Stubborn Fed Is Keeping A Lid On Gold

The Fed is holding the line on rates, which is keeping the dollar strong.

This in turn is putting downward pressure on gold and silver prices.

New highs in dollar index mean investors should favor cash for now.

There are many factors that can be blamed for slumping precious metals prices in recent months. Yet one of the biggest factors has been none other than the Federal Reserve. The steadfastness of the U.S. central bank in holding interest rates steady has kept the dollar strong, which in turn has weighed on the gold price. As I'll explain in today's report, the strong dollar and the Fed's steady monetary policy will likely continue to keep a lid on the gold price in the coming weeks.

Gold prices have pulled back sharply this week, hitting a two-week low after the dollar strengthened ahead of the release of the minutes from the Federal Reserve's latest policy meeting. While gold bulls haven't capitulated yet in their recent efforts at reversing gold's 3-month decline, the metal remains perilously close to its recent pivotal low at the $1,267 level. Traders are understandably nervous right now since a decisive close below this level could result in another wave of liquidations among investors who still hold gold for safety reasons.

Meanwhile, the dollar is currently the safe haven du jour of the world's investors, many of whom are apprehensive over the latest developments concerning Huawei Technologies, the Chinese telecom equipment and electronics manufacturer recently banned from doing business with U.S. firms by a Trump administration executive order. While the U.S. Commerce Department announced Monday it would allow some U.S. companies to continue doing business with Huawei and its affiliates for 90 days, many investors remained skeptical.

There is still an enduring fear that the U.S.-China trade war could further intensify this year, thereby potentially inflicting damage to global financial markets. Gold could potentially benefit from an acceleration of the trade war as safe haven demand for the metal would likely increase. For now, though, gold's safety factor remains muted as there is just enough optimism in the stock market to undermine gold's appeal.

Another reason for gold's recent weakness is the increase in bets among speculators that the Fed won't cut interest rates this year, contrary to expectations. The growing belief by some traders that the Fed will stand pat on interest rates resulted in the dollar index hitting a new yearly high on Tuesday, which undermined gold's safety appeal.

Earlier this week, Fed Chair Jerome Powell suggested it was too early to diagnose the impact of increased tariffs on monetary policy. While it's still a minority view, there are some on Wall Street who believe the Fed will resist calls from some investors to lower rates.

Fed Chair Powell also acknowledged another concern of investors when he said on May 20 that business debt "has clearly reached a level that should give businesses and investors reason to pause and reflect."

Powell was referring to record levels of corporate borrowing of approximately 35 percent of corporate assets. However, this is likely one of the reasons why the Fed is trying to avoid cutting interest rates since lower rates could encourage business to contract even more debt. The implication behind a steady Fed policy is that the dollar will likely remain strong, in turn providing a continued headwind for gold.

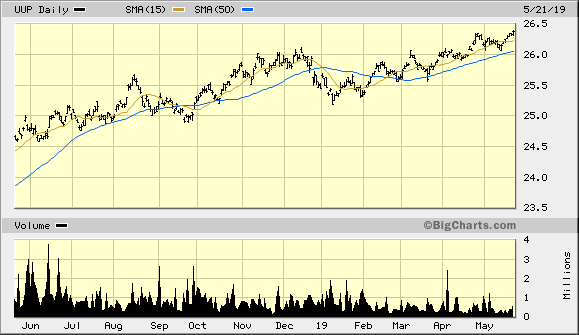

Shown here is the Invesco DB U.S. Dollar Index Bullish Fund (UUP), which hit a 52-week high on May 21. The prolonged rising trend in UUP reflects the continued strength of the dollar index, which has been a source of consternation for gold bulls since February. As I've emphasized in recent reports, as long as the dollar index and dollar ETF remain above the 15-day moving average on a weekly basis, the dominant immediate-term trend for the U.S. currency is considered to be up. Moreover, as long as UUP remains above the widely watched 50-day moving average (blue line) on a weekly closing basis, the intermediate-term (3-6 month) trend is considered to be up. A rising dollar makes it very difficult for gold to rally in a sustained fashion due to the dollar's outsize impact on the the metal's currency component.

Source: BigCharts

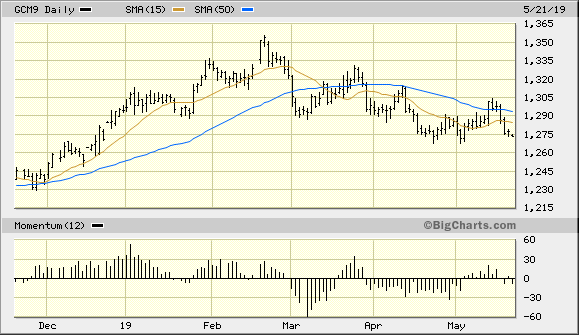

Despite the dollar's relentless strength, however, June gold has held up remarkably well in recent weeks. As you can see here, gold buyers have made a concerted effort to reverse the gold price twice in the past month with a third reversal attempt now underway. However, at no time in the last several weeks has gold managed to close above its important 50-day moving average on a weekly closing basis to reverse its intermediate-term downward trend. Until it does, participants should assume that the sellers remain in control of gold's dominant interim trend and avoid new purchases for now.

Source: BigCharts

There has also been another attempt this week by sellers at testing the $1,267 level. This level was the intraday low during gold's previous two short-term lows; the first low was Apr. 23 and the second was on May 2. A failure to hold above $1,267 this week would likely discourage the bulls, and as I intimated above it could also result in another wave of liquidations. The most likely catalyst for a gold price breakdown would be a continued rally in the U.S. dollar index, which at some point would almost certainly prove to be too much for the gold bulls to continue fighting.

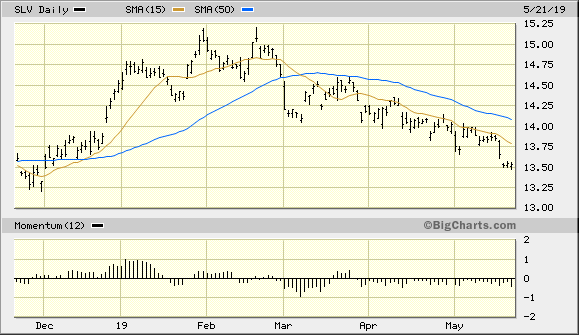

Another factor which is weighing against gold in the short-term is the silver price. Silver's relative weakness is a problem for gold, for it suggests that institutional investment demand for the precious metals in general is weak right now. Gold has always historically had its best performances when its strength has been confirmed by corresponding strength in the silver price. But as you can see in the graph of the iShares Silver Trust (SLV), silver is slumping due to diminished demand. Not even the recent trade war threat has been enough to reverse silver's decline. The implication here is that a combination of a strong dollar and weak safe-haven demand is a problem for both metals.

Source: BigCharts

The Federal Reserve has made clear that it has no intention of capitulating to Wall Street's demand for lower interest rates. This in turn is keeping a steady upward pressure on the dollar and will likely also keep the gold price from launching a sustained intermediate-term rally like the one we saw in late 2018/early 2019. While temporary short-covering rallies in the yellow metal will still periodically occur, until the dollar index weakens appreciably gold investors should be prepared to wait before adding to existing long-term gold positions.

However, when the dollar index finally reverses its rising trend and gold's sister metal, silver, reverses its decline we'll have another trading opportunity in gold. For now, a continued defensive stance is recommended due to the cross-currents still plaguing the precious metals sector. No new trading positions are therefore advised until we see the improvements discussed here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts