Surging Tech Stock Could Squeeze Shorts

HRS options are attractively priced, too

HRS options are attractively priced, too

Harris Corporation (NYSE:HRS) is a defense contractor and tech name that doesn't get the publicity of bigger names like Lockheed Martin (LMT) and Raytheon (RTN), despite its merger with L3 Systems back in October. As far as the stock is concerned though, investors may want to take notice, as its flashing two bullish signals that could present intriguing buying opportunities.

Diving right in, Harris stock made the list of 25 best stocks to own the week of Fed policy meetings, according to Schaeffer's Senior Quantitative Analyst Rocky White. Looking at data since 2015 with at least 25 returns to be considered, HRS sports an average one-week return of 0.9% and was positive 71% of the time the week of Fed policy meetings. That's good for seventh best out of the 25 stocks profiled, and best in its sector of technology hardware and equipment.

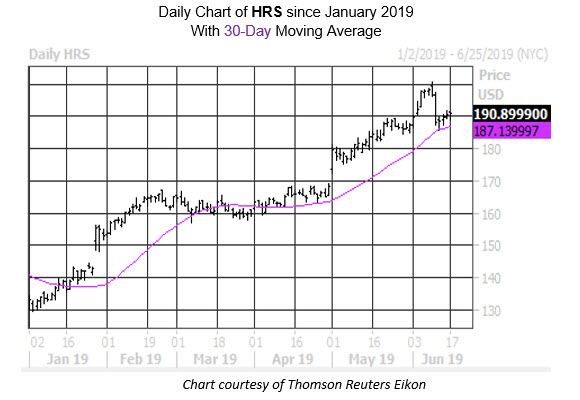

A 0.9% bump by Fridaywould mean a fourth straight daily win for HRS. Since a June 10 record of $200.77, the shares pulled back, shedding 3.8% last week, its worst weekly loss of the year so far. However, it quickly found support at its rising 30-day moving average, a trendline not breached on a closing basis since April 3.

That early June record high could be toppled via an exodus of short sellers. Short interest increased by 23% in the two most recent reporting periods to 12.39 million shares, the most since 2012. This accounts for a healthy 10.5% of HRS' total available float, and 13.4 times the average daily trading volume. That's a hefty amount of buying power that can enter the market and propel the shares higher.

Traders betting on the next leg higher should consider short-term options, which can be had for a bargain at the moment. The equity's Schaeffer's Volatility Index (SVI) of 20% is in the 17th percentile of its annual range, suggesting near-term options are pricing in relatively low volatility expectations for HRS shares.