SWOT Analysis: $1,600 Gold in the Next Three Months?

Strengths

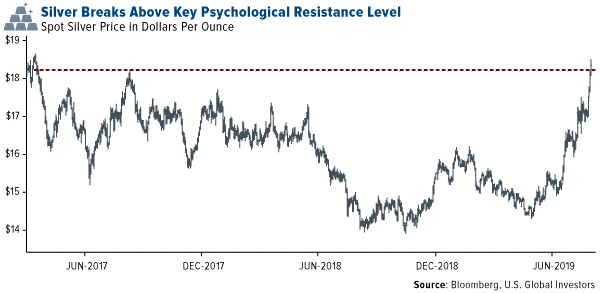

The best performing metal this week was platinum, up 8.86 percent. Platinum had its best week since 2011 as haven demand for gold expands to other precious metals. Gold rose to as much as $1,550 an ounce this week due to the escalated U.S.-China trade war. And silver is catching up. The gold/silver ratio was trading at its lowest level since April 17, which indicates that the silver price is starting to trade more like gold, but still has some room to go higher.Turkey's official gold reserves rose 4.3 tons month-over-month in July to a total of 466.3 tons. Last week was strong for commodity ETF inflows. Precious metals ETFs led the way and saw holdings grow by $815 million to total $1.59 billion.The Reserve Bank of India grew its gold holdings by 9.2 percent in the year ended June, which was its biggest purchase in almost a decade, reports Bloomberg. India's central bank purchased 51.93 tons of gold to raise its total holdings to 618.16 tons. ANZ estimates global central bank buying of gold will remain strong and above 650 tons annually in the coming years.

Weakness

The worst performing metal this week was gold, down only 0.43 percent. Reuters reports that a crisis has been quietly brewing in the gold market. In the past three years, gold bars worth at least $50 million were stamped with Swiss refinery logos, but were not actually produced there. At least 1,000 bars have been found. Richard Hayes, CEO of the Perth Mint, has not found any fraudulent branded Perth Mint bars, but did say he has little doubt the bars are circulating globally. "It's a wonderful way of laundering conflict gold. The gold is genuine, but it's not ethically sourced... They look completely genuine, they assay correctly, and they weight correctly as well."China's purchases of gold from Hong Kong fell to 8.3 tons in July, down from 14.7 in June, according to calculations by Bloomberg based on data from the Hong Kong Census and Statistics Department. This was the lowest level in more than eight years. However, this is not surprising given the current and longstanding protests in Hong Kong against Chinese intervention.Although some progress was made between the U.S. and China on the trade war front, it remains a threat to global economic stability. Gold has risen over 20 percent so far this year and some think it might be overbought. The 14-week relative strength gauge for gold has risen to overbought levels, which in the past as signaled short-term peaks, according to Bloomberg.

Opportunities

Negative real rates could pave the way for gold, and platinum's rally this year. As the growing list of negatives in the markets adds up, it strengthens the case for holding precious metals. Ranjeetha Pakiam of Bloomberg writes "with bond prices on the rise as investors seek havens, that means the yields they now pay are lower than the pace of consumer price gains. That's a tremendous boon for good, which doesn't pay interest." Silver has surged 13 percent this month and hit a two-year high on Wednesday, benefitting like gold is from the global economic outlook falling. The gold/silver ratio is also a bullish sign for the white metal. In July one ounce of gold was worth 93 ounces of silver and now that ratio is down to just under 84, but still above the 30-year average of 67 ounces.

Threats

? This month has been the busiest August for ETF traders in eight years, writes Bloomberg, as we are heading into week four following the first U.S. rate cut in more than a decade. According to data compiled by Bloomberg, nearly $2.2 trillion of ETF shares have changed hands this month. "Nowhere was this more evident than within the bond market, where ETF trading topped its record for the month," the article reads. In a separate note from Bloomberg this week, Janet Miu of Cazenove Capital says the group favors gold over bonds as an uncertainty hedge.

? According to Bloomberg, the current respite in the "relentless drop in yields" that has taken hold of the $16 trillion Treasury market isn't likely to last for very long. In fact, Tony Farren of Academy Securities sees a possibility of the five-year Treasury yield hitting 1 percent, the 10-year breaking its record low, and the 30-year falling to 1.70 percent to 1.75 percent, all by mid-October. Farren says the only thing that could alter the equation is a resolution to the U.S.-China trade tensions.

? One of the world's largest wealth managers, UBS, has turned bearish on equities for the first time since the eurozone crisis, reports Bloomberg. According to the article, President Trump's decision to increase tariffs last Friday on $250 billion of Chinese goods to 30 percent from 25 percent prompted the downgrade.