SWOT Analysis: Agnico Eagle Mines Is Forecasting Record Gold Output

Strengths

The best performing metal this week was palladium, up 2.05 percent on a strong market outlook. Gold traders and analysts were split between bullish and bearish this week as gold struggles to get back up to highs seen in January, according to the weekly Bloomberg survey. However, the yellow metal remarkably gained this week even as both the U.S. dollar and equities rose on the news that U.S.-China trade talks would resume next week. Despite local prices in India trading near the highest levels in more than five years, gold imports to the world's second largest consumer of gold rose in January, reports Bloomberg. Inbound shipments rose 64 percent last month from a year earlier to 46 tons. Gold futures 60-day volatility is at its lowest since 1997 as investors await the results of trade negotiations. Low volatility has historically been a sign of steady buying in the metal.China, the number one consumer of gold, added to its gold reserves for the second month in a row after a two-year dry spell. The People's Bank of China increased its holdings to 59.94 million ounces in January, up from 59.56 in December. Russia's gold output in 2018 rose 2.5 percent year-over-year to 314.42 tons, while silver production grew 7.2 percent to 1,119.95 tons. Russia is also taking steps to make gold investing accessible to more people. According to Bloomberg, the government is considering opening the precious metals market participation by allowing retail investors to buy bullion for their individual investment accounts.Agnico Eagle Mines Ltd. is forecasting record gold output as it brings two major projects in Canada into production, reports Bloomberg. CEO Sean Boyd said on Thursday in an interview that they will announce a 14 percent dividend hike, which could be even higher even if gold prices stay flat. Evolution Mining's executive chairman Jake Klein says that the gold sector is ready for more consolidation. Klein said "we believe that the mid-tier space is the space that delivers the best return." Harmony Gold Mining Co. Ltd's metal output rose by 34 percent due to a new mine in Papua New Guinea and a South African project, reports Bloomberg. The company's output rose to 751,008 in the six months to December and its free cash flow generation rose 100 percent to 1.1 billion rand.

Weaknesses

? The worst performing metal this week was silver, down 0.32 percent as new hedge funds cut bullish positions in late January. Turkey's gold reserves fell $119 million from the previous week, according to official weekly figures from the central bank in Ankara. In Italy, the country's populists have called on lawmakers to pass legislation allowing the government to take control over the central bank's gold reserves, reports Bloomberg. Luckily the market has seemed to shrug off any speculation of reserve sales to fund the country's budget. "My bill only aims at making clear that the gold belongs to the state, not to the government," euro-skeptic lawmaker Claudio Borghi of the League said in a phone interview.

? Amid financial turmoil and the government shutdown, U.S. retail sales unexpectedly fell in December, reports Bloomberg, posting the worst drop in nine years. The value of overall sales fell 1.2 percent, missing all economist estimates in a Bloomberg survey that called for a 0.1 percent gain. This sign of slowing economic momentum boosted the haven demand for gold, sending the yellow metal higher after the announcement. Concerns from gold bulls that the Federal Reserve may hike U.S. interest rates this year were eased on the news.

? The U.S. solar job market lost around 8,000 jobs in 2018 as uncertainty surrounding President Trump's tariffs took a toll on planned projects, reports Bloomberg. This likely lowered the demand for solar panels which contain silver. The good news is the Solar Foundation does expect project employment growth to resume in 2019, with the number of jobs increasing by 7 percent, the article continues.

Opportunities

? According to the leading maker of auto catalysts, Johnson Matthey, the palladium deficit is set to widen "dramatically" in 2019. The company wrote in a report that "our figures suggest that the market moved closer to balance, but the underlying structural deficit continues to grow." Platinum holdings in ETFs rose to the highest level since 2015 as investors bet on better performance of the precious metal. After prices fell 19 percent in the past year, many analysts believe platinum to be undervalued relative to other precious metals.

? The investment case for copper, the red metal, is on the rise due to supply shortage. Morgan Stanley writes that after significant outperformance last year, supply disruption has returned to several mines and years of low capital expenditure means a dearth of new production is entering the market this year. However, demand has only continued to rise, largely in part due to China's push for electric vehicles, and a big deficit could emerge.

? Newcrest Mining Co. is on the watch for smaller, tier-two assets to add to its portfolio. CEO Sandeep Biswas said in an interview with Bloomberg TV that the company is "scanning the market all the time" and that "a lot of tier-two assets, once you get in there, can be turned into tier-one assets." Newcrest, Australia's largest producer, wishes to have exposure to between two and four tier-two assets within the next 10 years. Pure Gold Mining Inc. announced the results of a feasibility study at its Madsen Gold Projects in the Red Lake mining district of Ontario. One highlight of the study is that it has a low initial capital requirement of $95 million including a 9 percent contingency. Paradigm Capital published a report noting that Freegold Ventures Ltd. is the most overlooked developer or explorer with remarkable exploration and torque.

Threats

? Barrick Gold Corp. said this week that its costs to produce gold will be at least 7.9 percent higher this year following its mega-merger with Randgold Resources Ltd. The company reported an all-in sustaining costs forecast of $870 to $920 per ounce, which is much higher than its forecast of $806 per ounce in 2018 pre-merger. Bloomberg writes that the company's main project, the Veladero project in Argentina, isn't performing like a tier-one asset. Barrick's CEO did say that there is "plenty of interest" from other players in the space to buy some of their assets. Jefferies gave a recommendation of hold for the stock while TD Securities and Deutsche Bank downgraded it to hold from a buy.

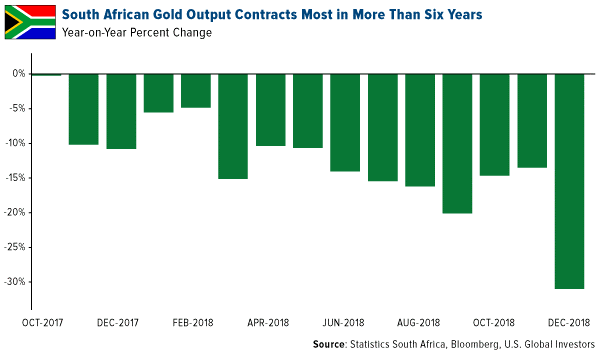

? South African gold output fell the most in six years, with production declining 31 percent from a year earlier, according to Statistics South Africa. The drop in December marks the 15th straight month of declines. Don't forget - the nation used to be the world's top miner of the yellow metal by a wide margin. Sibanye Gold Ltd., one of the top miners in the South Africa, said this week that it was considering shutting down unprofitable shafts and cutting jobs at its local operations. This could lead to more than 6,000 job losses.

? New Gold's adjusted loss per share for the fourth quarter came in wider than expected. The share price fell almost 27 percent for the week. Renaud Adams, the new CEO of New Gold, joined the company last year and had positive initial news to report at the start of the year, sending the share price up around 50 percent. Sustaining those gains, however, was going to be difficult. Mr. Adams is highly respected from his prior leadership at Richmont Mines which was taken over by Alamos Gold. However New Gold gets sorted out, whether by fixing the asset or selling it, Mr. Adams will surely walk away much richer as the board at New Gold was dealing from a weak position.