SWOT Analysis: Brent Crude Prices Diverge From Gold And Copper

Strengths

? The best performing metal this week was platinum, up 1.50 percent on expected Chinese demand for the metal, where demand for heavy-duty emission legislation will come into play by 2020. Bloomberg's weekly survey showed that gold traders and analysts are divided on their outlook for bullion prices for next week. The yellow metal rose higher this week amid mounting geopolitical tensions and talks of tariffs on automobile imports.

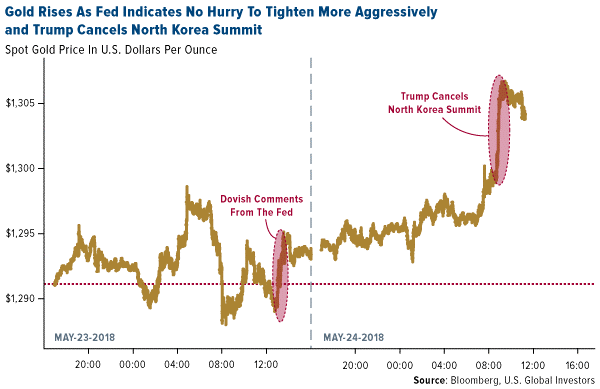

? Gold prices rose higher on Wednesday after the Federal Reserve minutes pushed the Treasury yield down, which is a bullish signal for gold. Bullion was also up 1 percent Thursday morning after President Trump announced that the summit with North Korea would no longer be happening. Gold has historically performed well during periods of geopolitical instability, as investors often view it as a "safe haven" asset.

? National home values increased 8.7 percent since last April to a median value of $215,600 and the pace of appreciation is the fastest since June 2006, reports Bloomberg. This is a sign of rising inflation. Gold demand in Turkey remains strong and the nation has imported 118 metric tons in the first four months of this year. Suki Cooper, precious metal analyst at Standard Chartered Bank in New York, said in a report this week that in Turkey "local consumers have turned to gold as a store of value amid rising inflation, heightened political and economic tensions, and currency weakness."

Weaknesses

? The worst performing metal this week silver, up 0.43 percent, but slightly trailing gold. Due to disappointing results at its flagship gold mine in Egypt, Centamin Plc cut its production forecast, reports Bloomberg. The move sent the stock down as much as 18 percent, the biggest fall in five years. "Underground gold output at Sukari has declined 10 percent so far this year, and production is likely to total 505,000 ounces to 515,000 ounces," the company wrote in a statement.

? Commerce Secretary Wilbur Ross praised tariffs on steel and aluminum imports, reports Bloomberg, as his agency considers whether similar measures would boost the nation's auto manufacturers. Should such a tariff be implemented the U.S. auto industry could raise car prices to consumers. Across the sea, China warned this week of a Canadian investment chill following the rejection of the Aecon Group takeover. "Prime Minister Justin Trudeau's government on Wednesday killed a proposed Chinese takeover of the Toronto-based construction firm," the article continues. Finally, back in the U.S., a nonprofit research center that analyzes government data found that the number of white-collar prosecutions is on track to hit a 20-year low under President Donald Trump.

? According to Bloomberg, the strong U.S. dollar is too much of a headwind for gold. As the yellow metal fell below $1,300 an ounce for the first time this year, hedge funds and other large speculators pared bullish bets on bullion to the lowest in more than two years, the article reads. This spurred the biggest weekly decline since December.

Opportunities

? The U.S. central bank released minutes of its policy meeting at the start of the month that could signal rising inflation. Bloomberg writes that by inserting the word "symmetric" a second time in the minutes "policy makers seemed to signal a relaxed view over the prospects of inflation moving above target in the coming months." Joseph Song, senior U.S. economist at Bank of America Corp. said that "we've heard a lot of Fed officials say they were comfortable with an overshoot of inflation" above the central bank's 2 percent target. Capital Economics writes that a rise in business inflation expectations has been more pronounced recently and that market-based measures of breakeven inflation compensation have also been rising significantly.

? Bloomberg reports that the temporary calm between the United States and China ended this week after President Trump announced a push for tariffs on imported cars and trucks, which would shake up the global auto industry. Japanese Trade Minister Hiroshige Seko said on Thursday that "imposing broad, comprehensive restrictions on such a large industry could cause confusion in world markets, and could lead to the breakdown of the multilateral trade system based on WTO rules."

? Due to heightened geopolitical tensions and the renewal of U.S. sanctions on Iran, OPEC's third-largest producer, the price of Brent crude has diverged from gold and copper, reports Bloomberg. Oil and gold generally move in the same direction due to their inflationary link. An ounce of gold currently buys the fewest barrels of oil since November 2014, perhaps indicating that some investors don't expect inflation to rise and the noise in oil prices are only temporary. However, with such a divergence between the N.Y. Fed's Underlying Inflation Gauge Full Data Set Measure, compounding at 13.21 percent trailing five years, and its Underlying Inflation Gauge Prices Only Measure only compounding at 1.94 percent over the same period, it might be better to bet on the full data set measure of future inflation.

Threats

? Emerging market companies and governments are struggling to deal with the rising cost of borrowing in dollars as a record slew of bonds become due, with some $249 billion needing to be repaid or refinanced through next year, reports Bloomberg. Mark Mobius, who is usually bullish on emerging markets, said that there is danger of contagion from the deteriorating situation in Turkey, plus Argentina and Brazil are not going well and may signal higher rates to come.

? Collateralized loan obligations (CLOs), or repackaged corporate loans are growing hugely in demand, with the biggest bond grader for CLOs, Moody's Investors Service, unable keep up with demand for rating securities. Strong demand allows managers to sell CLOs with weaker protections and it makes the leveraged loans that get bundled into the securities riskier too, writes Bloomberg. Michael Temple, Amundi Pioneer's direction of U.S. credit research, says that this "means a lot of CLOs have been stuffed with weaker credits" and that in a downturn "if and when that happens, will uncover these weaknesses." Lu Wang of Bloomberg reports that signs are showing many U.S. stock investors are ill-prepared to deal with a margin call. The deficit of net cash in equity brokerage accounts just reached the widest ever of $317 billion, according to New York Stock Exchange data.

? European insurers' standpoint is that U.S. Treasuries are cheap, but not cheap enough even with yields near multi-year highs. Bloomberg writes that AXA SA, the eurozone's second biggest insurer, is spurning Treasuries in favor of bonds cheaper to hedge, such as those from Switzerland and Japan. Nicole Montoya, head of fixed income in Asia and the U.K. at AXA, said that "remaining exposed to FX volatility is more costly under Solvency II." Solvency II is a European directive that came into effect in January 2016 stipulating that European insurers must have a capital requirement that protects foreign assets from a 25 percent price swing in the exchange rate. Investors have been piling into CCC rated bonds, some of weakest junk-rated companies, just two notches above default rating, and they have been returning 330 basis points in total this year, according to Bloomberg data. Premiums have fallen to their smallest since July 2014 on CCC bonds as investors are starving for income.