SWOT Analysis: Central Banks Continue to Show Their Love for Gold

By Frank Holmes, US Funds / June 24, 2019 / news.goldseek.com / Article Link

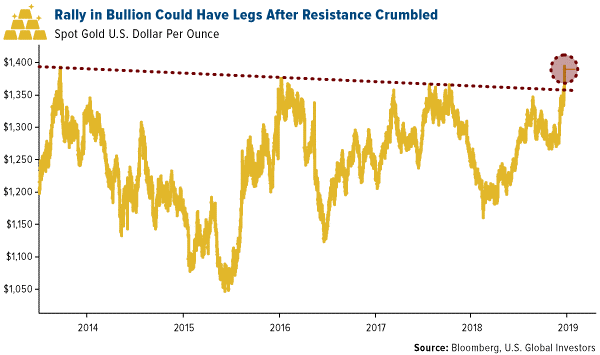

The best performing metal this week was gold, up 4.26 percent. Gold traders and analysts were surprisingly neutral on their price outlook for the yellow metal after it hit a five-year high this week and broke above $1,400 per ounce. Bullion got a huge boost after the Federal Reserve kept interest rates unchanged on Wednesday and signaled a readiness to cut rates due to increased economic uncertainties.Central banks continue to show their love for gold. Kazakhstan raised its gold holdings to 11.93 million ounces in May, up from 11.79 million ounces in April. Russia's climbed from 70.2 million ounces to 70.42 in May. Turkey was also up to 16.03 million ounces in May from 15.99 in April. Additionally, Turkey saw its gold reserves rise $167 million this week from the previous week to now total $21.7 million worth of reserves, according to central bank data.Illegal gold mining in Ghana is now being cracked down on. A veteran NASA engineer developed a software tool that is capable of identifying illegal mines from satellite photos, making it easier to find and shut down illegal operations. Refiners are also taking steps to reduce illegal mining. Reuters reports that Metalor, one of the world's largest gold refineries, said on Monday that it would only work with gold from large industrial mines in order to reduce the risk of illegality in its supply chain of the metal. Gold Fields Ltd. announced that its mine in Western Australian will become one of the nation's first mining operations to be predominantly powered by renewable energy.

Weaknesses

The worst performing metal this week was platinum, up just 0.51 percent as hedge funds boosted their new bearish positioning to a 9-month high. Fed Chairman Jerome Powell regularly receives attacks from President Donald Trump on interest rates and Fed policy. The President has now threated to remove Powell as chair. Even though many think the president cannot outright fire Powell, White House lawyers have put together a framework for the president to demote Powell and leave him as just a governor.Bloomberg reports that sentiment among U.S. homebuilders unexpectedly fell for the first time this year, suggesting that lower mortgage rates aren't giving housing a boost. The Empire State manufacturing index plunged in June by the most on record, which adds to signs that continued tariffs are hitting manufacturers and the broader economy.Barrick Gold continues its bid for Acacia Mining in what might not be the best deal in the space. Barrick was initially down 1.3 percent in the premarket on Wednesday after it said it is proposing to engage "intensively" with Acacia's minority shareholders.

Opportunities

President Trump might be starting a currency "war," in addition to the ongoing trade war. After the European Central Bank (ECB) announced it was prepared to cut interest rates further below zero, Trump published a series of tweets accusing the bank of unfair competition. Trump has spoken of reigning in the dollar, which would likely be positive for the price of gold, as the two have historically had an inverse relationship. Gold is heading for its best week in three years with it set to close near $1,400 per ounce - a level not seen since 2013. Citigroup says that "bullish gold fever [is] justified" after the Fed meeting. It also raised its 3-month price target to $1,450, up from $1,400 in January.Bloomberg's Eddie van der Walt writes that "with central banks around the world turning more dovish, the latest move may just be the start" in regards to gold breaking above its resistance level. Evercore ISI, which isn't usually a gold bull, released a recommendation this week on the yellow metal to "either way, buy gold."

Threats

Despite gold's recent price breakout, junior miners are still having a hard time finding sources of capital, as gold is down around 28 percent below its peak earlier this decade. Andrew Kaip, an equity analyst at BMO Capital Markets, said that "large banks aren't willing to lend debt to companies that don't have revenue." Small gold miners often don't have revenue and need to find capital for exploration and building out mines. However, if gold keeps moving higher it will be very positive for juniors seeking funding.A threat for consumers in general, politicians and analysts are waking up and noticing the negative effect that big tech has on everyday Americans. Representative David Cicilline of Rhode Island, who opened an investigation into competition in the tech industry, said that big tech companies like Facebook and Google have had "devastating effects" on everyday Americans due to them having much of users' private information and selling to the highest bidders. Should the government pursue antitrust to its logical conclusion that "Big Tech" gets turned into regulated utilities they would no longer be able to own their own platform and participate in it. New regulation is coming for the tech giants as the government realizes the monetization of your privacy is wrong.Tensions continue to rise in the Middle East after Iran shot down an American drone this week. President Trump ordered, and then called off, a limited airstrike that was intended to target three infrastructure sites related to the missile launch.

Recent News

Immediate trigger for crash was new Fed Chairman pick

February 02, 2026 / www.canadianminingreport.com

Gold stocks slump on metal price decline

February 02, 2026 / www.canadianminingreport.com

Is the gold market starting to turn 'irrationally exuberant'?

January 26, 2026 / www.canadianminingreport.com

Gold stocks explode up as equity markets languish

January 26, 2026 / www.canadianminingreport.com

Gold stocks outpace flat large caps

January 19, 2026 / www.canadianminingreport.com