SWOT Analysis: Chinese Gold Company on the Hunt for a $2 Billion Deal

By Frank Holmes, US Funds / September 23, 2019 / news.goldseek.com / Article Link

Strengths

The best performing metal this week was silver, up 3.16 percent, as gold rebounded this week. As gold was set for a small weekly gain for the first week in four, traders were mostly bullish or neutral on bullion's trajectory in the weekly Bloomberg survey. Palladium, however, rallied as much as 1.8 percent to a record $1,648.65 an ounce for its best run since 2012 with seven weeks of gains. The precious metal is gaining from tighter supplies. Although car sales are down slightly, stricter environmental standards are creating a need for more palladium loading in auto catalysts, which are used to reduce pollution from vehicles.The yellow metal bounced back above $1,500 per ounce, recovering from a fall Wednesday, after the Federal Reserve announced a 25 basis point rate cut. Carsten Menke, head of research at Julius Baer, says he expects gold to move higher to $1,575 an ounce in the next three months due to further rate cuts. Swiss gold exports rose to the highest level since 2016 in August due to increased demand from the U.K. offsetting lower demand in Asia, according to customs data.Investors now appear to be shifting money down market to smaller capitalization names as confidence grows in duration of the coming gold cycle. On Tuesday, investors poured $193 million into the VanEck Junior Gold Miners ETF (GDXJ), the largest ETF that invests in junior gold miners. The fund attracted the most money in more than two years on growing optimism that companies will perform strongly alongside higher gold prices, reports Bloomberg.

Weaknesses

The worst performing metal this week was platinum, down 0.27 percent, as hedge funds cut net bullish platinum positions. As mentioned above, gold took a tumble on Wednesday after Fed policymakers were spilt over the need for additional rate cuts after the one announced this week. Bob Haberkorn, senior market strategist at RJ O'Brien & Associates LLC, said in a phone interview with Bloomberg that "if you're a gold trader right now, you're a little confused." Turkey's central bank gold holdings fell $615 million from the previous week, but reserves are still up 34 percent year-over-year.It's rare for the Department of Justice to bring criminal Racketeer Influenced and Corrupt Organizations Act (RICO) charges, but it just did. Bloomberg reports that two current and one former JPMorgan Chase & Co. metals traders were charged with RICO criminal violations for rigging precious metal futures markets over the course of a decade. The three individuals are accused of engaging in "a massive, multiyear scheme to manipulate the market for precious metals futures contracts and defraud market participants."Negative rates just got more negative for a record group of bank clients in Denmark. Jyske Bank A/S is offering the first 10-year mortgage at negative coupons and said that it has no choice but to drag more retail depositors into its negative-rates after the country's central bank lowered its policy rate to minus 0.75 percent, writes Bloomberg. CEO Anders Dam said in a statement: "Due to the rate reduction last week, we are losing even more money. And we need to share that bill with some of our clients."

Opportunities

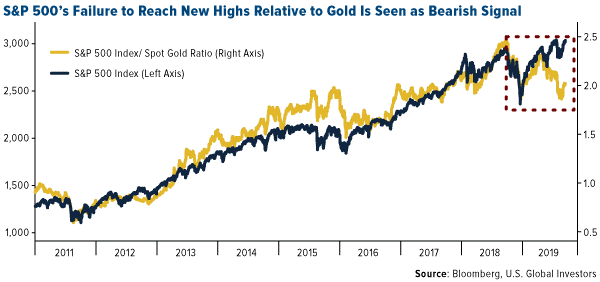

At the Denver Gold Forum earlier in the week, China Gold International Resources Corp. said it is on the hunt for M&A deals worth as much as $2 billion. Executive Vice President Jerry Xie said in an interview that they need more pipeline in gold production and are looking for acquisition opportunities "quite aggressively." And there could be big opportunity for deals as many mining companies could use some lowering of general and administrative (G&A) costs, according to Shareholders' Gold Council. In a recent report, the group writes that $2.5 billion of profits generated by 47 gold companies goes to pay the salaries and costs of head office management and boards, while financial markets discount the value of these companies by approximately $21 billion. M&A generally helps lower G&A costs for the company that got taken out.RBC writes that by 2025 it sees the gold sector in better shape. It forecasts that margins will improve and that output will be broadly flat due to the inability to stop the decline of reserves. "To deliver improved margins and sustain mine life, companies will need to stay active in both M&A deal and exploration, making strategic direction on these fronts critical, in our view." Output will also continue to fall due to a lack of new technological developments on how to extract the metal from the ground.HSBC wrote in a note this week that global mining capex is now two years into a more sustainable and product-driven cycle and is unlikely to return to levels last seen in 2012 during the China commodity boom due to better capital discipline. According to Mike Wilson, chief U.S. equity strategist at Morgan Stanley, the S&P 500's instability to reach new highs relative to gold "raises questions about the quality of this month's rally" in stocks, reports Bloomberg. As seen in the chart below, the S&P 500 divided by the price of gold has fallen in 2019, indicating gold is beginning to outpace the broader markets.

Threats

Bloomberg's Liz Capo McCormick writes that there is not enough cash on hand at major Wall Street firms to meet the funding demands of a market trying to absorb record Treasury bond sales needed to cover U.S. budget deficits. She adds that there isn't enough liquidity and that there are deep structural problems in the money markets. The big catalyst causing the squeeze in repo liquidity is the big swath of new Treasury debt that settled into the marketplace just as cash left due to quarterly tax payments to the government. The liquidity issue as discussed above could get worse. Bloomberg's Stephen Spratt reports that the dollar-funding squeeze, which rocked short-term interest rate markets this week, may deepen further due to the upcoming quarter end when banks usually start their pattern of cutting back on providing liquidity. Another round of Treasury auctions next week could leave markets short of another $45 billion in cash. Spratt writes that those two factors could explain why stress is showing up in bill sales and currency markets even after the Fed took measures to ease a liquidity shortage.The Organization for Economic Cooperation and Development (OECD) cut almost all economic forecasts it made just four months ago as intensifying trade conflicts have sent global growth momentum tumbling. The organization forecasts world growth at 2.9 percent this year, a level not seen since the last financial crisis.Recent News

Immediate trigger for crash was new Fed Chairman pick

February 02, 2026 / www.canadianminingreport.com

Gold stocks slump on metal price decline

February 02, 2026 / www.canadianminingreport.com

Is the gold market starting to turn 'irrationally exuberant'?

January 26, 2026 / www.canadianminingreport.com

Gold stocks explode up as equity markets languish

January 26, 2026 / www.canadianminingreport.com

Gold stocks outpace flat large caps

January 19, 2026 / www.canadianminingreport.com