SWOT Analysis: Sibanye Gold Announced Plans to Cut 5,270 Jobs

Strengths

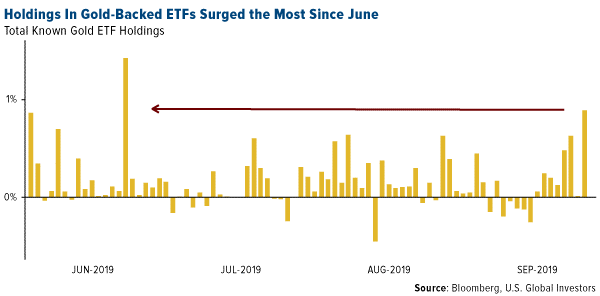

The best performing metal this week was palladium, up 2.57 percent as hedge funds increased their bullish positioning to an eight-week high. Gold traders and analysts were split between bullish and bearish on the yellow metal this week in the Bloomberg survey despite the metal's price swings. On Monday, ETFs added 498,162 troy ounces of gold to their holdings, the most in three months, according to Bloomberg data. Then on Thursday, ETFs added another 130,610 troy ounces of gold, marking the ninth straight day of inflows. Hedge funds boosted their bullish positions in gold to the most bullish on record with data going back to 2006.Turkey's central bank gold holdings rose $903 million from the previous week to bring total holdings to $25.9 billion. The nation's reserves are up a whopping 45 percent year over year.Even as gold prices had a very bad day on Wednesday, falling 1.8 percent, demand for gold-backed ETFs spiked. Holdings jumped the most since June. Bloomberg writes that this suggests some investors have been waiting for a pullback in order to buy the dip. Where is all this money coming from? Perhaps from divestment in the S&P 500. Bloomberg reports that the SPDR S&P 500 ETF Trust lost $8.7 billion to withdrawals last week and that the SPDR Gold Shares ETF saw $950 million in inflows, the most in three months.

Weaknesses

The worst performing metal this week was silver, down 2.61 percent as hedge funds cut their net-long position to a five-week low. In negative economic news, U.S. home price gains in 20 cities decelerated in July for a 16th straight month. The S&P CoreLogic Case-Shiller index of property values increased 2 percent from a year earlier, which is the slowest since August 2012. U.S. consumer confidence saw the biggest drop since the start of 2019, falling to 125.1. This demonstrates that expectations for the economy are worsening, which poses a risk to household spending.Sibanye Gold Ltd. announced that it plans to cut 5,270 jobs at its Marikana platinum mines in South Africa as deadlocked wage negotiations with workers brought a strike closer, reports Bloomberg. The company is restructuring operations that it acquired when purchasing Lonmin Plc earlier this year that made it the world's biggest platinum miner. Discounts on gold in India have widened significantly due to muted retail demand and higher unofficial imports, according to the World Gold Council Market Intelligence Group. The gold discount was $28 in July and then widened to $55 an ounce in August. Gold demand out of India, the world's second largest consumer, has weakened due to higher prices but could rise in the coming month as Diwali approaches.

Opportunities

? In a stock deal implying equity value of around C$338 million, Osisko Gold Royalties has entered into a definitive agreement to buy the remainder of Barkerville Gold Mines, reports Bloomberg. According to the article, the purchase is a premium of 26 percent over the Barkerville September 20 closing price. On the topic of gold names, Citigroup says that the latest signs are "strongly suggesting" that uptrends in precious metals are resuming after consolidating for the past few weeks. If you recall, earlier in the month the group said gold could rally to a record above $2,000 an ounce in the next two years. Similarly, Overseas China Banking Corp. agrees that gold should be supported in the short term, and could advance toward $1,600 an ounce.

? A deficit in palladium could widen amid a lack of mine investment, reports Bloomberg. That is according to MMC Norilsk Nickel, which controls around 40 percent of global palladium output. The Russian company explains that the supply shortfall for palladium will be 600,000 ounces this year due to tougher environmental regulations underpinning demand. Palladium set another record on Wednesday after gaining over 30 percent this year, Bloomberg continues.

? Conviction in gold's uptrend is strengthening, according to UBS's Global Precious Metals Comment for the week. As Joni Teves writes, as gold gains further upward momentum, UBS believes other areas in the market can become more active and support the next leg higher. "Participation out of China, the private wealth community, and retail investors has scope to pick up ahead, granted the supportive macro narrative remains intact," she continues. Bloomberg ads in another article this week, which due to insufficient exploration spending, gold reserves have depleted significantly. This alone looks to be enough supply-side impetus to perk up the yellow metal.

Threats

According to AGF Investments, investors should be more concerned about the increasing prospects of Elizabeth Warren as president of the U.S. than the Donald Trump-Ukraine phone call scandal. The firm says that the Ukraine controversy is unlikely to affect stock markets and that President Trump should instead be attacking Warren as the main competition. According to Jefferies LLC, a 2020 election that pits Trump against Warren could finally crack the U.S. dollar's multiyear rise by creating a massive spend fest, reports Bloomberg. Brad Bechtel, global head of foreign-exchange, says, "Warren and Trump's tone would be different but the end result would be the same, massive blowouts of the U.S. government budget." Bloomberg reports that the repo market could be heading for trouble on Monday even as the market calmed this week. Last week the overnight repo rate soared to a record high of 10 percent amid a funding crunch that drew scrutiny to the size of the Fed's balance sheet, writes Alexandra Harris. Thomas Cook collapsed this week, but not everyone was a loser. Hedge funds have been betting that some companies will fail by buying credit-default swaps. Bloomberg reports that more companies are set to follow Thomas Cook's path as Europe's economy slows and a growing number of companies are under stress.The Minerals Council of Australia (MCA) has warned that gold companies could face mine closures if the Victorian government moves ahead with a 2.75 percent royalty on gold production. Australia is one of the largest miners of the metal. The MCA says that the projected $16 million in revenue the government would see from the royalty pales in comparison to the $300 million spent by Victorian gold mines in 2018 on wages, goods and services, taxes and community grants, the Financial Times reports.