SWOT Analysis: Venezuela Liquidated $400 Million in Gold Last Week

Strengths

The best performing metal this week was palladium, up 3.52 percent as CPM Group noted that the price could climb to $1,800 on supply constraints. Gold traders and analysts switched from bullish to mostly neutral or bearish on the yellow metal this week, according to the weekly Bloomberg survey.Turkey's gold reserves reversed this week by rising $227 million from the previous week. The central bank's holdings are now worth $20.9 billion as of April 12, according to official figures. Kazakhstan also increased its gold holdings to 11.63 million ounces in March, up from 11.46 million in February. Mexico, too, raised gold reserves by 3.86 million ounces last month.Bloomberg's Cormac Mullen writes that currency traders should get ready for a big move in the dollar, if past periods of low volatility are a guide. Over the last 25 years, there have been three previous troughs in the JPMorgan Global FX Volatility Index, and each time the U.S. Dollar Index has moved around 10 percent over the subsequent six months, according to Bloomberg data. A weaker U.S. dollar has historically been positive for the gold price as the two trade inversely.

Weaknesses

? The worst performing metal this week was gold, down 1.13 percent. The yellow metal tumbled to its lowest since January on Tuesday morning just as the market opened after someone dumped 11,000 gold futures contracts, worth around $1.5 billion, into the market. Traders were said to be using the F-word "fiduciary." Who recklessly dumps so many contracts unless their motive is to drive the price down?

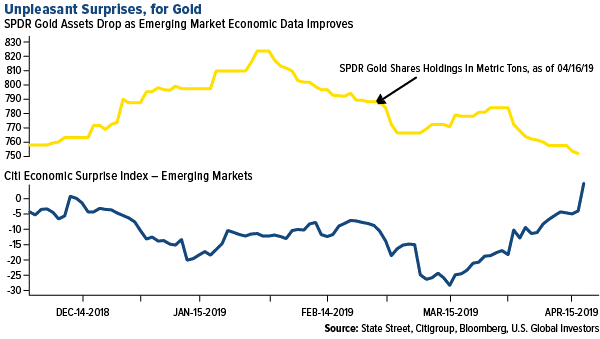

? Gold is headed for its fourth weekly drop - the longest run of weekly declines in eight months - amid speculation that the U.S. and China are nearing a trade deal. Bloomberg writes that better-than-expected first quarter growth and March industrial production for China weighed on gold prices. The data eased concerns about a slowdown in global growth that rattled investors.

? Holdings in the SPDR Gold Shares fund fell to its lowest since October on Tuesday, which also happens to be the same day that gold gave up all its 2019 gains. Unexpectedly strong data from emerging markets, and China in particular, helps explain gold's slip as investors are turning away from safe haven assets. Japan's largest bullion retailer, Tanaka Kikinzoku Kogyo K.K., said that first quarter sales of gold bars fell 33 percent year-over-year and platinum bars also fell 34 percent.

Opportunities

? Federal Reserve Chairman Jerome Powell has made an important shift in strategy for dealing with inflation, in a prelude to what could be a more radical change next year, writes Bloomberg's Rich Miller and Craig Torres. "The Fed is evolving to a 'white-of-the-eyes' approach in terms of inflation" under which it won't hike rates until price rises accelerate, said Stephen Stanley, chief economist at Amherst Pierpont Securities. Higher inflation is typically good for gold.

? Rio Tinto, the world's second biggest miner, released a statement last week saying that it will only work with groups aligned with its own climate principals and pledged to become a "greener" miner. Mining.com writes that "Rio Tinto has effectively put mining industry lobby groups on notice that they need to adapt to a world in which the challenge of climate change is recognized and that mining should be a positive force for change."

? According to a joint statement, ICBC and the World Gold Council are partnering to develop the Chinese gold market. The two groups will leverage online technology and ICBC's platform advantages to design and develop new gold products and services for millennials in particular.

Threats

Venezuela managed to sell as much as $400 million, or nearly 9 tons, in gold with sanctions in force, somehow skirting international sanctions. The sale not only means President Maduro has found a way to sidestep the economic blockage, but it also may have contributed to the drop in gold price this week, according to some analysts. "Of course [the sale] impacts the gold price," RBC Wealth Management managing director George Gero told Kitco News. "Anytime you have a large supply overhanging the market, it impacts trading. It did not help attract buyers."Gold demand has been supported lately by the idea that global output could begin to roll over on higher operating costs and the lack of large discoveries. However, it doesn't look as if "peak gold" has arrived just yet. Output is expected to rise to 109.6 million ounces this year, an increase of 2.1 percent more than in 2018, according to S&P Global Market Intelligence. This will be "the strongest growth in the past three years, debunking commentary calling for peak gold," analyst Christopher Galbraith told Bloomberg. Galbraith added that more than half of the increase "is projected to come from new mines that are expected to come on stream this year or have recently commissioned."For the past two decades, U.S. corporate profits have widened on average, but this is unlikely to last much longer. According to a note by Bridgewater Associates' Greg Jensen, "some of the forces that supported margins over the last 20 years are unlikely to provide a continued boost." This could lead to a major valuation problem, Jensen says, adding that incentives for offshore production have been reduced "as global labor costs have moved closed to equilibrium, with domestic costs and rising trade conflict increasing the risk of offshoring, while the potential tax rate arbitrage from moving abroad is now much smaller." As a result, it could be challenging for companies to maintain profitability levels over the next several years, let alone widen margins further.