Target Stock Slides Ahead of Earnings

Taking a look at Target stock ahead of next week's earnings report

Taking a look at Target stock ahead of next week's earnings report

Target Corporation (NYSE:TGT) stock has been in sell-off mode since the broad-market pullback, now nearly 6% lower for the week. While stocks seem to be making a comeback, TGT is still inching lower, down 0.9% at $110.70 at last check. This comes just ahead of the retailer's fourth-quarter earnings report, which is due out before the open next Tuesday, March 3. Below, we'll dig into how Target has been faring ahead of its quarterly report, and what investors may be able to expect for the equity following its release.

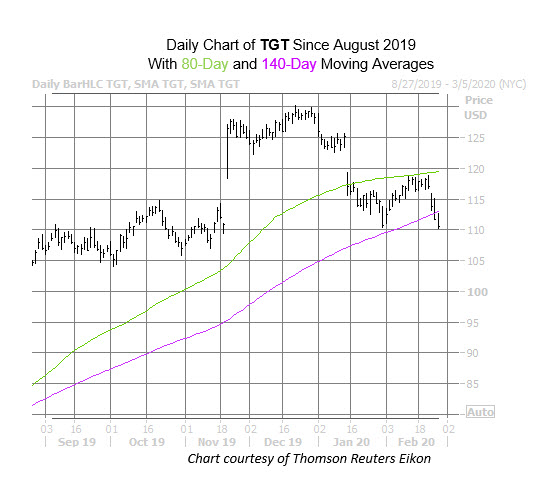

On the charts, TGT has been chopping lower since hitting an all-time high just above the $130 level back in December. Now the stock is consolidating under pressure at its 80-day moving average, and just breached former support at its 140-day moving average. Year-over-year, however, Target is still up 53.2%.

Despite this recent dip, most analysts are still optimistic on the equity, with 13 in coverage calling it a "strong buy," compared to seven who say "hold." Adding to this, the consensus 12-month target price of $135.14 is a 22.1% premium to current levels, and represents a region not yet touched by the equity.

The options pits have followed suit, as evidenced by TGT's 10-day call/put volume ratio of 3.96 at the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio sits higher than 96% of all other readings from the past 12 months, suggesting a much bigger appetite than usual for long calls of late.

Looking back, the stock has seen mostly positive returns following its earnings reports during the past two years. In fact, five out of eight of these next-day sessions were positive, including an impressive 20.4% pop back in August. The security averaged an 8.8% swing, regardless of direction, the day after its last eight reports, and this time around, the options pits are pricing in a similar, 9.9% shift, regardless of direction.