Tech Leads Trade-Fueled Stock Rally

Oil prices couldn't hold their gains, though

Oil prices couldn't hold their gains, though

Stocks rose today thanks to comments from President Donald Trump, who said China wants to keep negotiating on trade -- though some in the Chinese media suggested the two nations didn't speak as the President described. Still, tech stocks led a broad rally, with trade-sensitive names like Apple (AAPL) enjoying the most upside. As such, the Dow, S&P, and Nasdaq all notched solid wins, recovering some of the losses from Friday's huge sell-off.

Continue reading for more on today's market, including:

Raymond James clashes with shorts with DISH upgrade.Solar stock's options could offer huge upside. The red-hot biotech that soared on a C-suite change. Plus, drugmaker flashes "sell"; chipmaker prepares for earnings; and 2 reasons Qualcomm was in focus.

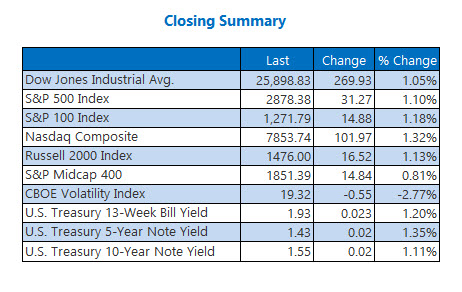

The Dow Jones Industrial Average (DJI - 25,898.83) closed up 269.9 points, or 1.1%, with all 30 blue chip closing in positive territory. Nike's (NKE) 2.3% gain was the best of the bunch.

The S&P 500 Index (SPX - 2,878.38) added 31.3 points, or 1.1%, while the Nasdaq Composite (IXIC - 7,853.74) closed up 102 points, or 1.3%.

The Cboe Volatility Index (VIX - 19.32) dipped 0.6 point, or 2.8%.

5 Items on our Radar Today

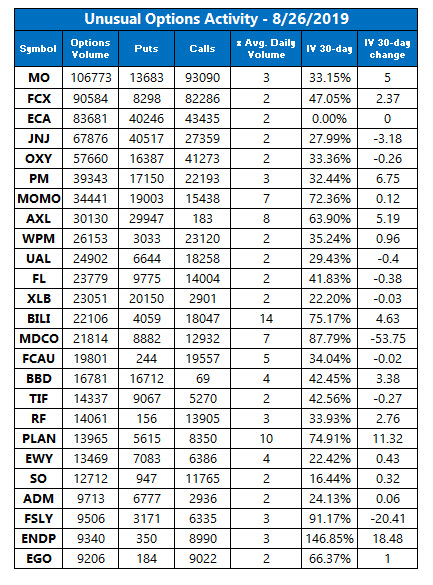

It's that time of year for investors to start paying attention to extreme weather conditions, particularly hurricanes. Right now, Tropical Storm Dorian is heading for the Caribbean islands, and could bring hurricane conditions. (USA Today)Senior officials say the U.S. government is focused on creating a program to protect voter registration databases from hacking ahead of the 2020 election. These systems were compromised by Russian hackers in 2016. (Reuters)Sell signal flashes on Mylan stock. A chip stock to consider before earnings. 2 reasons Qualcomm was in focus today.Data courtesy of Trade-Alert

Oil Gives Up Gains

Oil prices were trading higher for much of the session, but ultimately moved lower on the day. By the close, October crude futures were down 53 cents, or 1%, to end at $53.64 per barrel.

Gold also moved lower on the day, pulling back from last week's multi-year high. Gold futures dated for delivery in December fell 40 cents, or 0.03%, to $1,537.20 an ounce.