Teranga Gold Finishes 2018 On A Strong Note

Teranga finishes 2018 with record production and $112 million EBITDA.

Wahgnion construction is on time and budget and commercial production could start earlier than planned.

Golden Hill initial resource tops one million ounces of gold.

The first quarter of 2019 should be the strongest quarter of the year, which could provide a boost for the share price once results are released.

Introduction

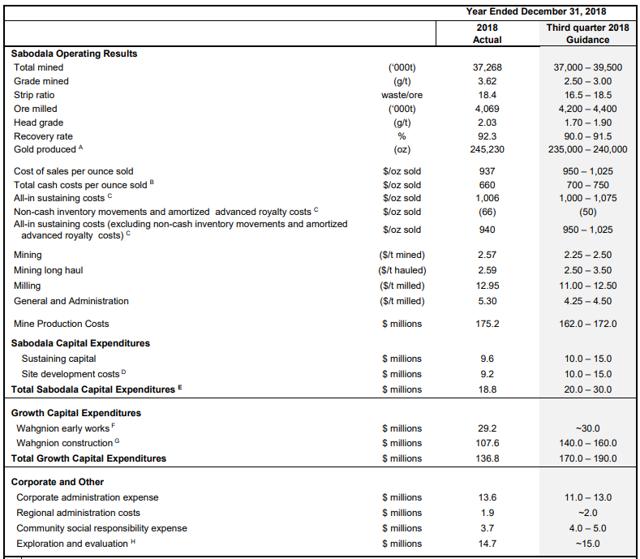

On 22 February, Teranga Gold (OTCQX:TGCDF) released its results for 2018, and they were strong. Production rose to 245,230 ounces of gold, exceeding the high end of the company's increased production guidance range of 235,000 to 240,000 ounces and representing the third consecutive year of record production. Total cash costs per ounce for the year were also below the lower end of the 2018 guidance:

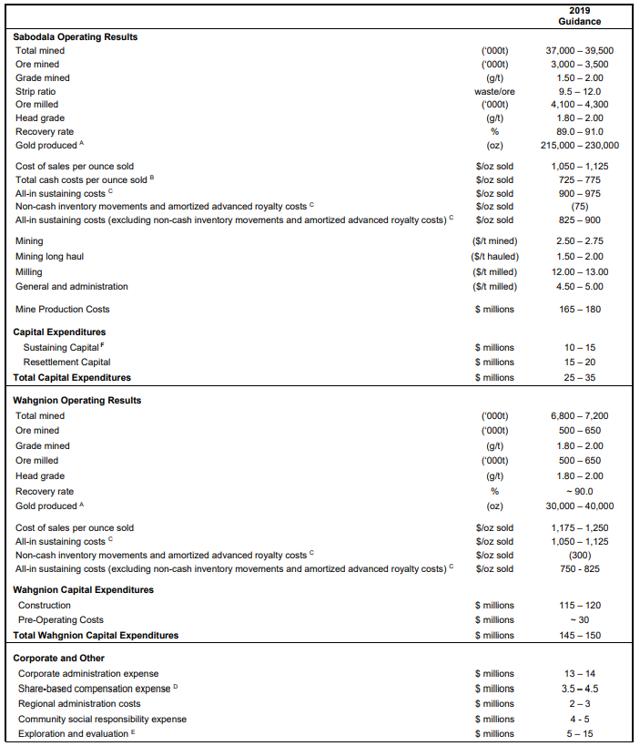

Teranga also put out a guidance for 2019, and the numbers are pretty much in line with the ones from 2018. A pleasant surprise in the earnings release was that construction of Wahgnion is going well and that the management is preparing a new mine plan for 2019 to mine more material than planned in last year's technical report to accommodate an earlier than planned commissioning of the plant.

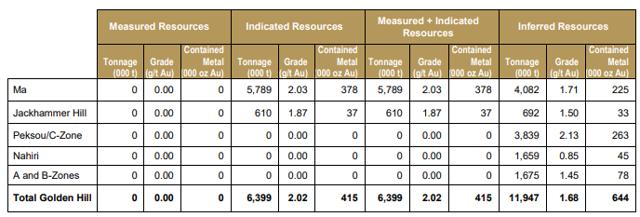

On 21 February, Teranga also released an early-stage initial resource for the Golden Hill project which included indicated mineral resources of 6.40 Mt averaging 2.02 g/t gold for 415,000 ounces and inferred mineral resources of 11.95Mt averaging 1.68 g/t gold for 644,000 ounces. I think this is a solid start for this project.

The 2018 results and 2019 guidance

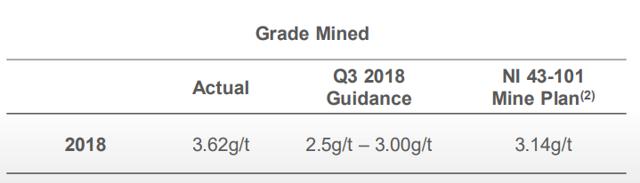

Teranga's financial performance for the year was pretty much in line with the guidance and the record production and lower costs can be attributed to the conservative reserve model for Sabodala. Over the past 18 months, Teranga recorded a 26% increase in ounces mined against reserves models thanks to better grades and more tonnes:

Plant production overall was down 4% for the year due to repairs of the crushing circuit and a higher proportion of harder high-grade ore in the mill feed.

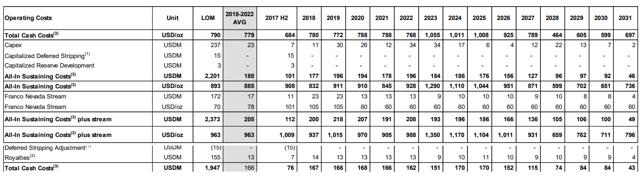

The 2019 guidance is very similar to 2018 with a slightly lower production being compensated by lower costs:

Source: Teranga Gold

In 2019, the company expects to benefit from lower fuel costs, relatively favorable foreign exchange rates and decreased long-haul contracting costs. Also, production during the first quarter of the year should be slightly higher compared to the remaining quarters. Teranga also has hedges remaining for 81,500 ounces at an average price of $1,347 per ounce, which is slightly higher compared to the current spot price of gold.

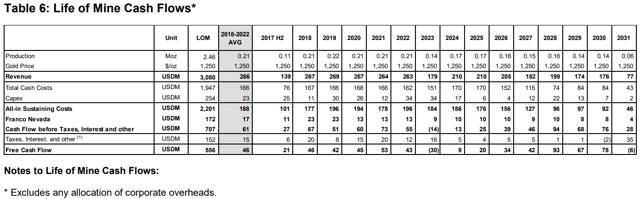

In view of Sabodala's performance in 2018 and the 2019 guidance, I'm pleased to see that the numbers are very close to those presented in the updated mine plan from August 2017 as this gives it credibility:

This makes me confident that Sabodala can indeed generate over $180 million in free cash flow between 2019 and 2022 (using $1,250 per ounce of gold) before it has to invest in underground development.

Wahgnion progress

Exploration expenses for 2019 will be lower compared to 2018, which is due to the effort of Teranga to conserve cash during the construction phase for Wahgnion. Speaking of the latter, I was surprised to hear that the company plans to release a mine plan involving earlier production considering that spending on the construction in 2018 was lower by $30-$50 million compared to the guidance. I was beginning to think that commercial production at Wahgnion was going to be delayed because of this and Teranga came out and said construction is on time and budget. The company has spent to date around $132 million on the construction of Wahgnion, which is around 63% of the total committed value of $209 million.

Early stage initial resource estimate for Golden Hill

I wasn't expecting a large initial resource for the project considering that the estimate covers only the most advanced prospects, which include Ma Main, Ma North, Jackhammer Hill, Peksou/C-Zone, Nahiri, A-Zone and B-Zone. It was a disappointment for me that Jackhammer Hill was smaller than expected but I think that it's still incredible that Teranga has developed Golden Hill in a project with more than a million ounces of gold in just a year and a half. I posted an SA article covering Wahgnion and Golden Hill in September 2018 and in it I mentioned that Teranga was aiming for an initial resource estimate of around 1-1.5 million ounces of gold at an average grade of in the 1.5 g/t-2 g/t range, probably something like 1.8 g/t. Well, the company now has 1.06 million ounces with grades in that range:

Source: Teranga Gold

I tuned in for the Q4 2018 earnings call to ask about the potential Teranga sees for Golden Hill and the company seems very optimistic. The management thinks they are just scratching the surface at the moment and that there is a potential for a 50 to 60-kilometer mineralized belt. The plan for the next 12 months is to apply for a mine license and come to a construction decision in the second half of 2020. Given that gold mining projects often need more than a decade for development, Golden Hill is moving along really fast and Teranga has already secured $25 million in debt financing to advance it through to feasibility. The company has been drilling Golden Hill for just 18 months and I think it has the potential to become Teranga's third gold mine.

Conclusion

Sabodala had another record year in 2018 and Teranga generated EBITDA of around $112 million. Most figures were in line with the updated guidance and the mine plan for Sabodala and the over-performance was due to the conservative reserve model of the company. Over the past 18 months, Teranga recorded a 26% increase in ounces mined against reserves models thanks to better grades and more tonnes.

The guidance for Sabodala in 2019 looks good with a slightly lower production offset by lower costs per ounce and is pretty much in line with the mine plan, which gives me confidence that the mine will be able to generate just above $180 million of free cash flow between 2019 and 2022 using a gold price of $1,250 per ounce.

Construction of Wahgnion is on time and budget and the project could even start production earlier than anticipated, which I think goes to show how good the execution is.

The initial resource estimate at Golden Hill was fine and although a million ounces of measured, indicated and inferred resources doesn't sound that impressive, I believe that Teranga is still scratching the surface and the project can grow significantly before becoming the company's third operating mine.

Overall, I think that Teranga is undervalued and its share price could see a boost after the release of the results for the first quarter of 2019 considering that this is expected to be the company's strongest quarter of the year in terms of production.

If you like this article, consider joining The Gold Commonwealth.

There's a two-week free trial and the service will focus on long ideas, takeover targets, turnarounds, exploration stories and under-followed gems in the mining space, particularly gold. Omnis Quis Coruscat Est Or!

Disclosure: I am/we are long TGCDF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow Gold Panda and get email alerts