The $126 Billion Gold Opportunity in Australia / Commodities / Gold and Silver Stocks 2020

The biggest banks in the world areeyeing gold prices of around $3,000 in just over a year. Former Citigroup billionaireThomas Kaplan predicts $5,000gold . And even without those predictions, the gold rush is on …

Miners are stampeding this single gold rush territory …

That’s already produced over 40 million ounces of gold …

And still has an estimated 68 million+ ounces in theground, ripe for the taking.

Three miners have already descendedon the territory, and their success has by now reduced the upside.

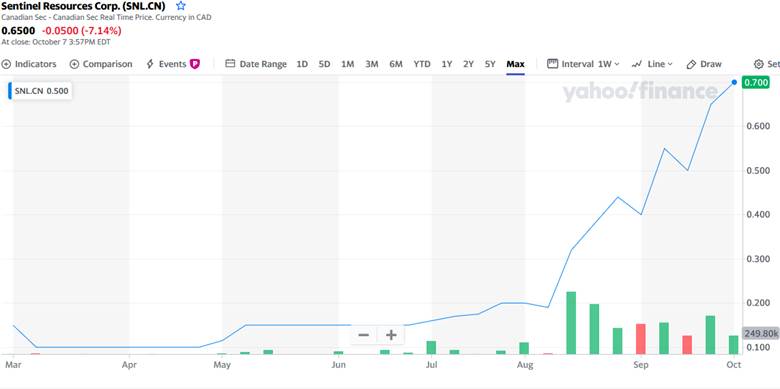

But the fourth miner in the stampedehas seen its shares surge 600%, perhaps because it's surrounded by majorsuccess stories, and there’s a ton of potential upside left as it gets ready todrill in the world’s No. 1 gold venue.

Source: https://ca.finance.yahoo.com/quote/SNL.CN/holders/

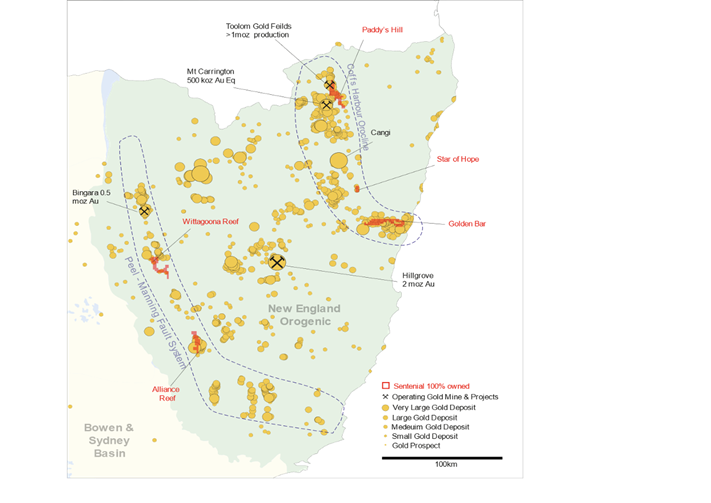

The 2020 gold rush scramble is goingdown in New South Wales (NSW) in southeast Australia, where the past-producingnumbers are mouthwatering, and the untapped potential is even more so.

And the company that’s surged 600% is Sentinel ResourcesCorp. a new Canadian-based explorer that’s been hot on the acquisitiontrail, with one of the biggest names in junior mining behind it.

Here are 5 reasons why youshould keep Sentinel Resources Corp. (CSE:SNL,OTC:SNLRF) on your radar:

#1 68 Million+ In Untapped Gold

New South Wales is a gold miner’sunderexplored dream. Past and present.

And the region’s Victoria golddistrict is its shining star.

The first gold was found in NSW in1823, and the first gold rush started in earnest in 1851.

Those explorers had pickaxes and shovels.

Source: https://www.sl.nsw.gov.au/stories/eureka-rush-gold

Since then, NSW has produced 40million ounces of gold.

Today’s explorers have advancedtechnology on their side.

And thepotential is for nearly double 40 million ounces of gold because it’s still wildly underexplored.

This is exactly where Sentinel hasparked itself--in the heart of gold rush territory.

Sentinel’s geography is as stunningas one would expect in this gold-rush region:

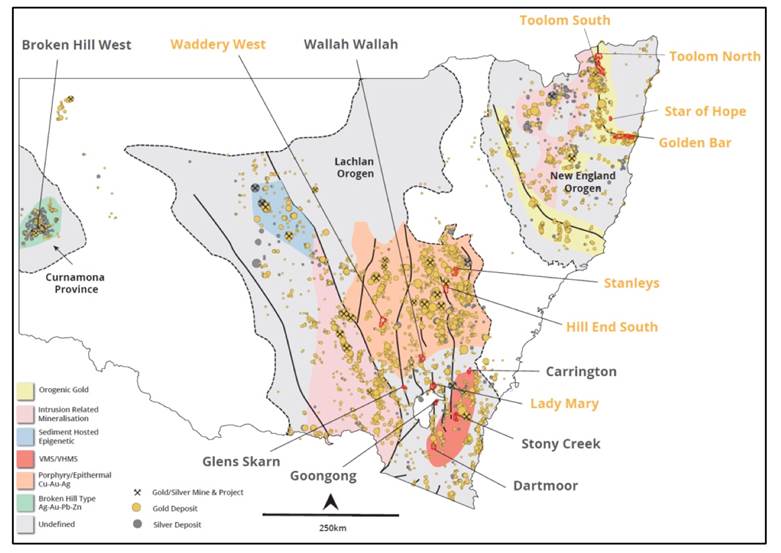

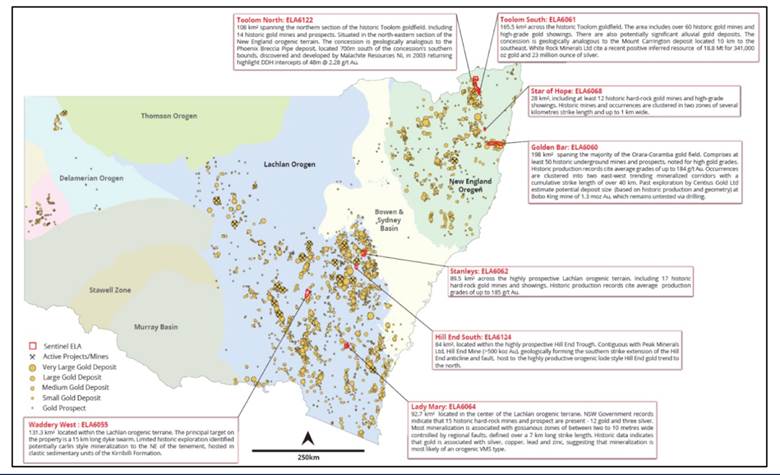

And thecompany has 8 gold exploration projects in this district, covering a massive94,500 hectares:

The brilliant geography alone doesn’teven tell half the story here: Almost 200 historicalgold mines are spread across Sentinel’s 8 gold projects.

And Sentinel’s exploration licenses for all of these projects arestrategically located in the best of the best geographies: The prolificallymineralized Lachlan, and the New England orogenic.

But that’s just the gold.

Sentinelalso has 7 silverexploration projects in the same area, covering 38,600 hectares. And once again, it’sspread across past-producing territory with at least 23 historic silver and3 historic gold mines and exploration prospects.

The Broken Hill Mine, which has produced 60 million ounces ofsilver, is right next door to Sentinel’s assets.

And this is just one of many goldbonanzas in the area, including more than 7 million ounces from Mount Morganand more than 3 million ounces from Queensland--just for starters. Significantgold resources have also recently been discovered at Gympie, Cracow, Tooloomand Mount Rawdon.

But again, geography--whilebreathtaking--is only part of this story …

Present-day “closeology” hits thepoint home:

#2 Surrounded by High-Grade Gold

Everyone’s congregating in New SouthWales, and the news flow has never been more exciting …

FosterSouth Exploration Limited (TSX.V:FSX)just announced multiple high-grade gold assays from its core drilling program at its Golden Mountainproject.

KirklandLake Gold (TSX:KL) recently announced high-gradeintersections at its Fosterville Swan Zone, a new exploration area of itsFosterville mine, the largest gold producer in the Australian state ofVictoria.

Newcrest Mining (TSX:NCM) just set inmotion the “execution” phase of its Cadia Mine Expansion project, one of thelargest in Australia. This is one of the largest, lowest cost, long-life goldmines in the entire world.

Andthey’re all flanking Sentinel’s assets, potentially setting this junior company up for a huge win witheach new discovery, each new high-grade assay and each new expansiondevelopment.

The number of gold deposits in thearea is astounding ...

And Sentinel (CSE:SNL,OTC:SNLRF) is right in the middle of it all.

That’s gold with a retail value of nearly $2 billion atcurrent gold prices of $1,915 per ounce.

And that’s only one of 8 gold projects.

#3 One of the Biggest Names on theJunior Mining Scene

There’s one name that helps de-risk this all: Dr. Chris Wilson, ahigh-success-rate explorer with as much experience in precious metals mining asit’s possible to have.

Wilson has been a key force behind the exploration success of FosterSouth Exploration Limited.

Now, he’s got his radar trained on Sentinel.

Dr. Wilson is a name connected with almost every major gold-miningsuccess story you’ve heard in the past three decades--and particularly on thejunior mining scene.

Among many others, Ivanhoe Mines should ring a bell. Dr. Wilsonserved as the head of exploration for this company for a decade, leading thecompany’s Mongolia mining exploration covering a massive 11 millionhectares.

He’s viewed by some as the go-to expert for area selection,prospect generation and target generation, and his track record in largeresource drilling is unparalleled.

He’s worked on major projects in over 75 countries--and now he’s jumping in on Sentinel’s NSW exploration in ahuge vote of confidence for investors.

Then, it will select the top 50% of those targets for Phase 2exploration.

The remaining 50% will be considered for joint venture or otherdevelopment.

In other words, Sentinel de-risks its projects by having aneclectic mix that diversifies its portfolio and minimizes risk, and with Wilsonbehind the target definition wheel, that de-risking spreads even further.

#4 The Gold Boost of the Century

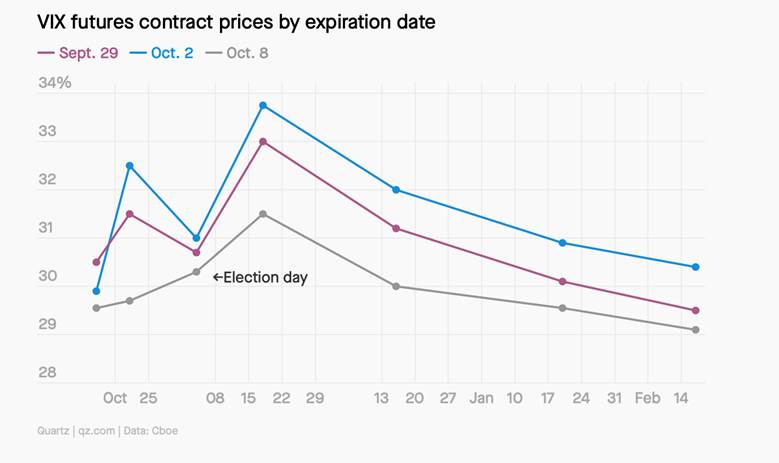

This is the perfect moment for gold.An unprecedented pandemic-induced economic meltdown, a weakening dollar and the cobra effect of massive government stimulus has sent financial markets into a tailspin.

The fear index is at an all-time high.

Themarkets are frightened at the prospect of a potentially turbulent outcome to USpresidential elections.

Source: https://qz.com/1910348/vix-index-shows-traders-expect-contested-us-presidential-election/

Gold isone of the only real safe havens.

That’s why gold prices and mining stocks have gained 25%-35% inthe ongoing maelstrom…

Bank of America Merrill Lynch says itexpects gold to hit$3,000 by early 2022.

BillionaireThomas Kaplan, founder of New York-based asset management firm Electrum Group,believes that $5,000 is in the crosshairs.

Indeed, the current gold setup looks very much like the one of the1970s that triggered the biggest gold rally in history.

But this one might have an even more potent catalyst: A globalpandemic and a Fed that has just handed gold investors the biggest gift ever. It’s a “FAIT” accompli--a new monetaryframework in process dubbed the “flexible average inflation targeting”strategy. In other words, when inflation undershoots its target in one period,the Fed will try to push inflation above the target in the next period tocompensate for the previous shortfalls.

This means interest rates are likely to remain close to zero forlonger, which gold investors absolutely love because gold is a hedge againstinflation.

The biggest beneficiaries are the junior gold miners--the onlyplace to bet on gold where investors can see real, millionaire-mintingupside.

And junior miners could now be ready to outperform the market.Even short-sellers seem to be withdrawing.

Sentinel (CSE:SNL,OTC:SNLRF), sitting on so much prime gold acreage in the middle of a goldrush, could be well positioned to gain the most.

#5 Wildly Undervalued in the Middle of a Gold Rush

You getdiscount gold when you buy gold that’s still in the ground in the form of aninvestment in a company that is sitting on potential gold worth multiple timesits market cap. That discount grows even bigger when the price of gold soars.

Even after the mad rally, Sentinel has a market cap of approximately $15M.

That’s absurd considering theincredible reserves they are potentially sitting on.

Thiscompany has purchased over 60 historic gold mines--all at once. They’vepackaged it all together in 8 major projects covering nearly 95,000 hectares. It’s an unfathomable amount of acreage.

These 8 projects could be sitting onbillions of dollars in gold. A thousand multiples above their market cap.

And if so, that’s when you really getdiscount gold … When you don’t even have to get the gold out of the ground. Youget discount gold when you jump on a junior that could be about to make bigheadlines.

It’s the equivalent of buying anentire gold rush in an area rich in gold that’s only been explored with apickaxe.

Right now, Sentinel (CSE:SNL,OTC:SNLRF) is identifying targets with new imaging technology and one ofthe biggest names in precious metals exploration.

The stock is already up 600% … and itonly listed on the CSE in March 2020, right when the COVID-19 pandemic struck.

If only one of their historical mineshits… it could be front page financial news for this stock to explode manytimes over.

The New South Wales Gold Rush tookplace over 120 years ago… and was largely forgotten until this year. Now, it’son the cusp of making history again. This time, with high-tech explorationtools that might make the previous bonanza look like fool’s gold.

`By. Nikki Olusha

IMPORTANT NOTICE ANDDISCLAIMER

PAIDADVERTISEMENT. This article is a paidadvertisement. GlobalInvestmentDaily.com and its owners, managers, employees,and assigns (collectively “the Publisher”) is often paid by one or more of theprofiled companies or a third party to disseminate these types of communications.In this case, the Publisher has been compensated by Sentinel Resources Corp. toconduct investor awareness advertising and marketing. Sentinel paid thePublisher to produce and disseminate five similar articles and additionalbanner ads at a rate of seventy thousand US dollars per article. Thiscompensation should be viewed as a major conflict with our ability to beunbiased.

Readers shouldbeware that third parties, profiled companies, and/or their affiliates mayliquidate shares of the profiled companies at any time, including at or nearthe time you receive this communication, which has the potential to hurt shareprices. Frequently companies profiled in our articles experience a largeincrease in volume and share price during the course of investor awarenessmarketing, which often ends as soon as the investor awareness marketing ceases.The investor awareness marketing may be as brief as one day, after which alarge decrease in volume and share price may likely occur.

Thiscommunication is not, and should not be construed to be, an offer to sell or asolicitation of an offer to buy any security. Neither this communication northe Publisher purport to provide a complete analysis of any company or itsfinancial position. The Publisher is not, and does not purport to be, abroker-dealer or registered investment adviser. This communication is not, andshould not be construed to be, personalized investment advice directed to orappropriate for any particular investor. Any investment should be made onlyafter consulting a professional investment advisor and only after reviewing thefinancial statements and other pertinent corporate information about thecompany. Further, readers are advised to read and carefully consider the RiskFactors identified and discussed in the advertised company’s SEC, SEDAR and/orother government filings. Investing in securities, particularly microcapsecurities, is speculative and carries a high degree of risk. Past performancedoes not guarantee future results. This communication is based on informationgenerally available to the public and on interviews with company management,and does not contain any material, non-public information. The information onwhich it is based is believed to be reliable. Nevertheless, the Publishercannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. ThePublisher owns shares and/or stock options of the featured companies andtherefore has an additional incentive to see the featured companies’ stockperform well. The Publisher has no present intention to sell any of theissuer’s securities in the near future but does not undertake any obligation tonotify the market when it decides to buy or sell shares of the issuer in themarket. The Publisher will be buying and selling shares of the featured companyfor its own profit. This is why we stress that you conduct extensive duediligence as well as seek the advice of your financial advisor or a registeredbroker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS.This publication contains forward-looking statements, including statementsregarding expected continual growth of the featured companies and/or industry.The Publisher notes that statements contained herein that look forward in time,which include everything other than historical information, involve risks anduncertainties that may affect the companies’ actual results of operations.Factors that could cause actual results to differ include, but are not limitedto, changing governmental laws and policies impacting the company’s business,the degree of success of identifying mineral-rich areas to explore, the degreeof success of drilling excursions, geopolitical issues in the various parts ofthe world in which the company operates, the size and growth of the market forthe companies’ products and services, the ability of management to execute itsbusiness plan, the companies’ ability to fund its capital requirements in thenear term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have readand understand this disclaimer, and further that to the greatest extentpermitted under law, you release the Publisher, its affiliates, assigns andsuccessors from any and all liability, damages, and injury from thiscommunication. You further warrant that you are solely responsible for anyfinancial outcome that may come from your investment decisions.

TERMS OF USE. By readingthis communication you agree that you have reviewed and fully agree to theTerms of Use found here http://GlobalInvestmentDaily.com/terms-of-use. If youdo not agree to the Terms of Use http://GlobalInvestmentDaily.com/terms-of-use,please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY.GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarksused in this communication are the property of their respective trademarkholders. The Publisher is notaffiliated, connected, or associated with, and is not sponsored, approved, ororiginated by, the trademark holders unless otherwise stated. No claim is madeby the Publisher to any rights in any third-party trademarks.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.