The 5 biggest private funds investing in mining

According to a new report by private capital tracker Preqin, overall fundraising for natural resources investment actually declined declined by a fifth in 2016 to the lowest since 2012 despite the turnaround in the industry experienced last year.

Coming off a record 2015, 74 funds raised a total of $60bn in 2016 for investment in natural resources, which includes metals and mining, water, timberland and energy. Private providers of capital include pension funds, sovereign wealth funds, endowments, family offices and others.

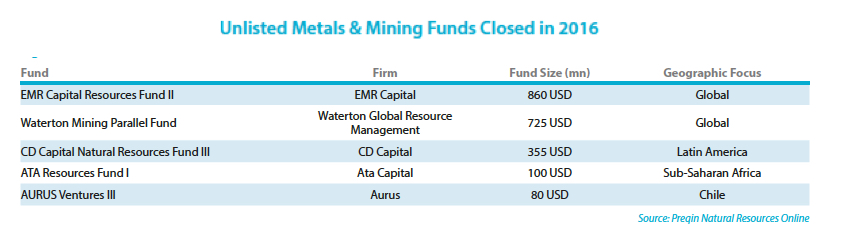

Money will also flow into mining from diversified funds with a combined war chest of $12.3 billion, but none of the energy-focused funds with $206 billion on call are looking to invest in coal assetsIn 2015 funds with a primary strategy of investing in mining and metals made up a small portion of funds raised with three funds closing on $1.1 billion in 2015. Last year five funds managed to raise $2.1 billion. 2012 was the peak year for mining-specific fundraising with $4.6 billion of capital commitments from investors.

So called dry powder - money already raised and ready to be invested - destined for mining totals around $5.5 billion while funds still have to exit $10.7 billion worth investments.

Some money will also flow into mining from diversified funds which have $12.3 billion ready to be injected into natural resources, but according to a recent Preqin survey none of the energy-focused funds which have $206 billion on call are looking to invest in coal assets.

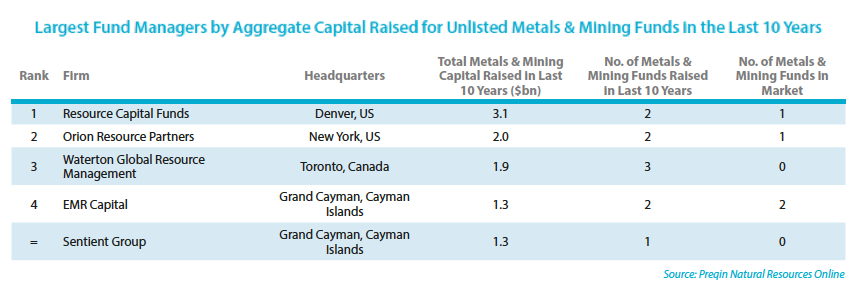

In 2017, across natural resources 252 funds are look to raise just around $105 billion. Of those only 13 are primarily focused on metals and mining and are hoping to raise $5.9bn.Electrum, launched in 2015 by prominent metals investor Thomas Kaplan invested in two junior mining companies based in the Yukon last yearThe biggest mining-focused fund currently in the market to raise funds is China's Power Capital. The Asia-focused fund is seeking $3 billion which should it be successful will place it at number two position. Diversified US-based Energy and Minerals Group is looking for $4 billion.

While much smaller, Preqin spotlights the Electrum Strategic Opportunities Fund with a target of raising around $250 million as one of the funds to watch this year thanks to its eye-watering net investment multiple of 2.05.

Electrum, launched in 2015 by prominent metals investor Thomas Kaplan invested in two junior mining companies based in the Yukon, Wellgreen Platinum and Victoria Gold, last year. Electrum also acquired a stake in Kaminak Gold, another Yukon explorer, prior to its sale to Goldcorp for C$520 million.