The Bearish Combination of Soaring Silver and Lagging GDX Miners / Commodities / Gold & Silver 2020

Silver is moving up quite shortly today, whichsounds bullish, until one realizes that silver tends to be particularly strongright before the precious metals market tops. And you know what’s the otherthing that quite often happens at the tops, in addition to silver’s temporarystrength? Miners tend to underperform. What did goldminers do on the last trading day of the previous week?

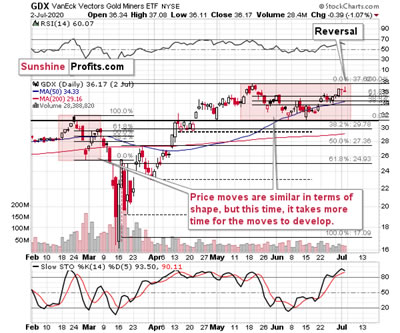

Miners reversed and ended the day over 1% lower,even though the GLD ETF ended the day slightly higher. Consequently, this piece of the puzzle seems tobe in.

Remember when we wrote that the situation right nowis similar to what happened in March, but this time it takes longer foreverything to develop due to the change in market’s perception of risk? To makea long story short, the March coronavirus panic was because the entire world was dealing with the unknown, whichexacerbated the fear. Right now, the situation is worse, and it goes worsealmost on a daily basis, but people are not as afraid. The economicimplications don’t appear so dire either. And it’s definitely nothingunknown – we more or less know what to expect.

This means that we’re likely to see a repeat ofwhat we saw in March, we’re likely to see it in “slow motion”, at least forsome time. Please note that even slow-motion mode of the mid-March plunge wouldstill be very volatile.

The areas that we marked with red rectangles aresimilar in terms of shape, but the current one is about 4x longer. The previouspattern was characterized by a decline and a correction that took more or lessthe same time to complete. If we’re about to see something similar also thistime, then we can expect the top to be formed this week.

If the March decline took 5 trading days and theprice moves are taking 4x as long this time, then perhaps we would see amonthly decline to the final lows instead of a weekly one. This would serve asa perfect “handle” for the massive, long-term “cup and handle” patternin gold.

Today’s relatively weak performance of the miningstocks seems to confirm the above. The implications for the next 1-6weeks are bearish.

Thank you for reading today’s free analysis. Pleasenote that it’s just a small fraction of today’s full Gold & Silver TradingAlert. The latter includes multiple details, but most importantly, it includesthe clear discussion of what will be the sign telling one that gold’s movelower is almost certainly completely over. That’s the detail, we think youmight enjoy, want, and need right now.

If you’d like to read those premium details, wehave good news. As soon as you sign up for our free gold newsletter, you’ll get7 access of no-obligation trial of our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.