The Best and Worst Days of the Week to Buy Stocks

Fridays have been especially awful for buyers of late

Fridays have been especially awful for buyers of late

Worries about the next Fed rate hike have already started! Or something. We get The Really Big News, rally a little, sell off a little, go to sleep, and then Wham. I'm old enough to remember when we declined hard because the dollar was too strong -- now we decline hard because it's too weak. Either that or it's not really related -- I totally lost track.

Here's one thing I did notice: Fridays just seem to act awful. It feels like we spend an inordinate amount of time worrying what could possibly go wrong over the weekend. On Aug. 21, those fears proved pretty founded. But most every other time, it's a non-event.

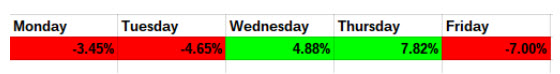

Anyway, I wanted to quantify it a bit. Are Fridays really that weak, or am I imagining it? Here's the average and median returns of each day of the week this year in the SPDR S&P 500 ETF (NYSEARCA:SPY). Prices are adjusted for the quarterly dividends.

Friday has indeed been the ugliest day of the week in 2015, but we're only talking an average return of negative 0.21%. Monday is negative 0.10%, but that's a bit skewed thanks to the Aug. 24 implosion. If we look at median, it's just negative 0.01%. SPY itself is down 3.75% this year, so it all goes into the context of that.

But how about a little fun with numbers? Let's say at the end of last year you started five separate Day-of-the-Week Funds. The fund buys the previous day's close, and sells that day's close. That is, the Monday Fund buys the Friday close, and then sells the Monday close; the Tuesday Fund buys the Monday close, and sells the Tuesday close; et. al. How did the Day-of-the-Week Funds do this year?

Ah, the wonders of compounding, both good and bad. Monday is pretty close to in line with overall market returns, Tuesday is a bit worse, and Friday... ugh. On the other hand, if you owned the Wednesday or Thursday Fund, you've had a terrific year.

Now, obviously these funds don't actually exist (well, as far as we know). But if you knew this in advance, you would simply go long on Tuesday's close and then close out on Thursday's close.

As a matter of fact, if you simply went long every Tuesday close and sold it back every Thursday close, you would be up 13.07% this year. Conversely, if you went long the Thursday close and sold back out on Tuesday's close, you would be down 13.37%.

Now, all of this is interesting from a trivia standpoint, but not necessarily all that tradeable going forward. There's no long-term history of any significant Day of Week bias. What's more, a lot of that outperformance is thanks to the timing of the late August drop.

From early January into mid-May, the two trades were very close to even. Perhaps in shaky markets there's something to be said for avoiding longs around weekends, while in better markets it's a lesser version of the reverse. Otherwise, though, it's an oddity that's worth paying attention to, but not something I'd go crazy about.

Disclaimer: Mr. Warner's opinions expressed above do not necessarily represent the views of Schaeffer's Investment Research.