The Best Place To Find Gold Is in the Shadow of a Head Frame

John Newell explains how the best place to find gold is in the shadow of a headframe, and shares one company that checks that box, a company he believes to be a compelling junior exploration stock.

Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) stands out in the junior exploration market, particularly for investors seeking exposure to high-potential gold projects in historically rich mining regions.

The company's flagship asset, the Quesnelle Gold Quartz Mine Property, located near Hixon, British Columbia, has been generating significant interest due to its strategic location, promising drill results, and the experienced management team behind it.

You can read more about Golden Cariboo here.

A Historic Property with Modern Potential

What's old is new again.

The Quesnelle Gold Quartz Mine Property spans 3,814 hectares in one of Canada's most storied gold belts the Barkerville Gold Belt. This region has been known for gold exploration since the 1860s and continues to yield significant discoveries. Golden Cariboo's property is nearly encircled by Osisko Development Corp., a major player in the area, further highlighting the strategic importance of this asset.

Historically, the Quesnelle Gold Quartz Mine has shown impressive grades, with a historic mine grade of 3.14 grams per tonne gold (g/t Au) and 4.18 g/t silver (Ag) (BC Minfile, 2021).

The company's recent drilling efforts have confirmed the presence of gold-bearing sericite phyllite and carbonate-altered siltstone, with assays yielding up to 5.08 g/t Au. These results indicate the potential for a substantial and economically viable gold deposit.

Proven Management Team

One of Golden Cariboo's strongest assets is its management team, which has a proven track record of success in the mining industry. The team, led by the always enthusiastic and unflappable Frank Callahan, has already developed two mines and sold one to Osisko Development for $330 million. Their experience includes the development of Osisko's Cariboo Gold Project and the Bonanza Ledge Mine, both of which share geological similarities with the QGQ Mine Property.

This management expertise significantly de-risks the exploration process, as they have the knowledge and experience to navigate the challenges of bringing a project from discovery to production. Their involvement also signals confidence in the project, with insiders holding approximately 20% of the company's shares.

Active Exploration with Promising Results

Golden Cariboo is actively exploring its Quesnelle Gold Quartz Mine Property, with Phase 1 drilling completed and Phase 2 well underway. The company is drilling approximately 100 meters per day, focusing on expanding the discovery of "Bonanza Ledge Mine" style mineralization a type of high-grade gold mineralization that has proven to be highly profitable in the past.

Recent drill results have been encouraging, with broad intercepts of replacement gold mineralization, including 1.35 g/t Au over 41.0 meters and higher-grade zones of 4.65 g/t Au over 7.15 meters.

These results suggest that the property hosts a large and potentially lucrative gold system.

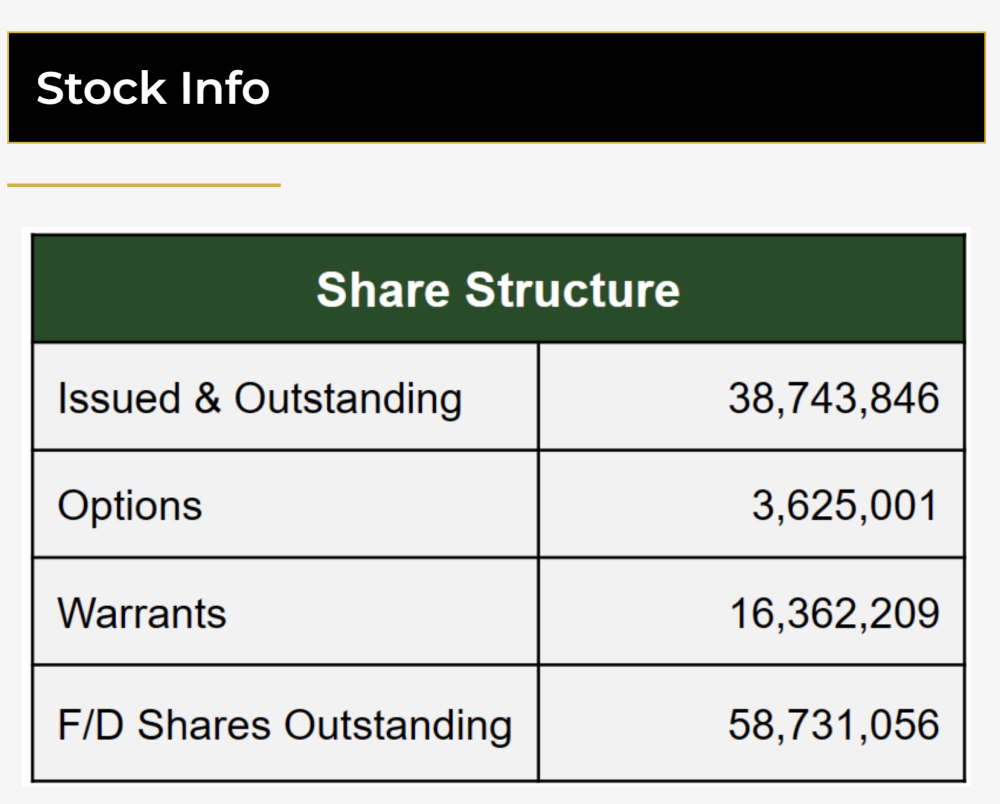

Strategic Financing and Tight Share Structure

Golden Cariboo recently announced a $2.5 million financing to expand its ongoing exploration efforts. This financing is critical for the company to continue drilling and advance its projects toward defining a resource.

The company's recent 3-for-1 share consolidation has resulted in a very tight share structure, with only 58.7 million shares fully diluted. This tight structure, combined with the recent financing, positions the company well for potential share price appreciation as exploration results continue to be released.

Takeover Potential

Given the strategic location of the Quesnelle Gold Quartz Mine Property, nearly surrounded by Osisko Development Corp., and the proven success of the management team, Golden Cariboo is a prime candidate for a takeover. Junior exploration companies with promising assets in prolific mining districts are often targeted by larger companies looking to expand their resource base.

The combination of a high-potential asset and a low market cap (currently around $7.5 million) makes Golden Cariboo an attractive acquisition target if they can prove up a resource that could further advance a surrounding miner.

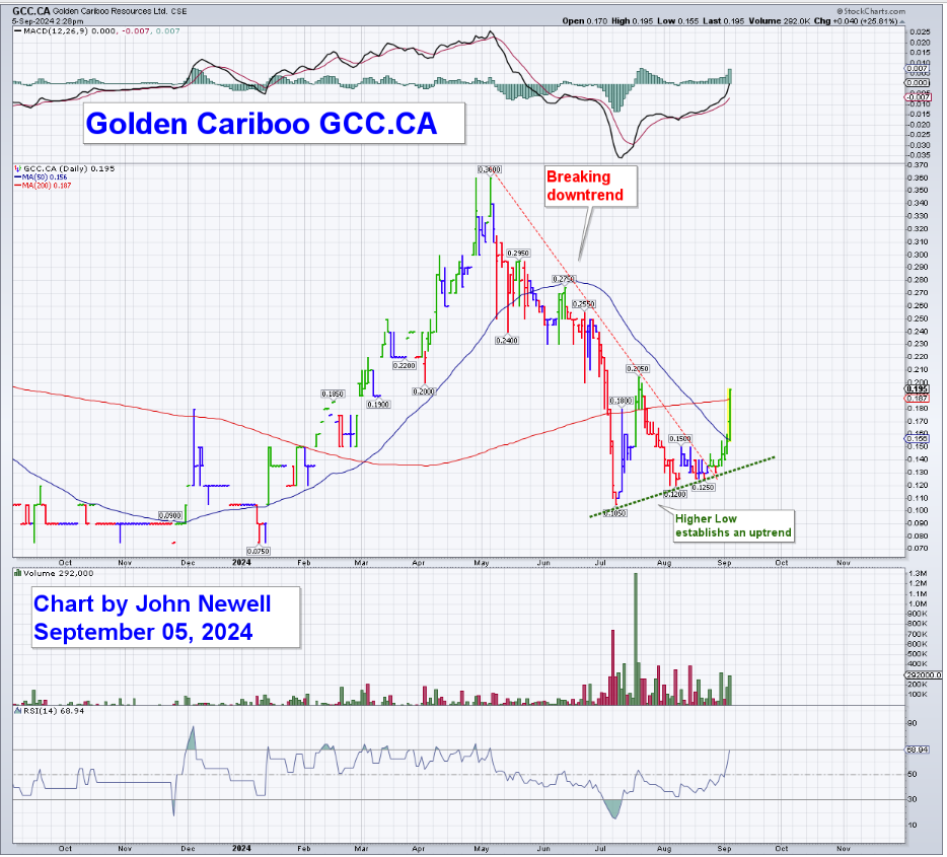

Technicals

The Shares have corrected, largely we believe because of a recent financing, however they have formed a higher low or established a small uptrend, broken the downtrend line, and have formed higher technical targets at ever higher prices. Given the steep correction and a new uptrend, Golden Cariboo shares are a buy at current levels of ~$0.19 cents per share.

Conclusion

Golden Cariboo Resources Ltd. offers junior exploration investors a compelling opportunity to gain exposure to a high-potential gold project in a historically rich mining district. With a proven management team, promising drill results, and strategic financing in place, the company is well-positioned to deliver significant value to its shareholders.

As exploration progresses and more results are released, Golden Cariboo could see substantial upside, making it a stock to watch closely in the junior exploration space.

Therefore, Golden Cariboo Resources Ltd. is a Buy.

Golden Cariboo's website.

Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) closed for trading at CA$0.195, US$0.1464 on September 5, 2024.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$2,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Cariboo Resources Ltd.Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell is an experienced money manager who holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.