The Best Silver Developers Still Have Valuations That Are Lagging as the Silver Price Surges

Shad Marquitz of Excelsior Prosperity shares his views on the escalating silver market and goes over a few stocks he believes are worth keeping an eye on.

Shad Marquitz of Excelsior Prosperity shares his views on the escalating silver market and goes over a few stocks he believes are worth keeping an eye on.

Gold, silver, and the PM stocks have been crushing the performance seen in most other sectors all year long. With less than a month left for trading here in December, we can start to celebrate the record year across many fronts . . . because the precious metals charts keep posting record daily, weekly, monthly, quarterly, and annual prices.

However, despite all the sector optimism and solid chart performance, there does still seem to be a noticeable disconnect going on under the surface, with regard to where the gold and silver developers are being valued at current metals prices.

If we look at where developers are being valued on an ounce-in-the-ground basis, or on a price to net asset value ratio, then even the impressive spectacle of their big stock runups so far this year fades a bit in glory when contrasted with their fundamentals.

If history is our guide, and if we look at where these stocks are being valued compared to bull market runs in past cycles, then many are still way below those levels, even though their fundamentals are actually far more robust in the here and now.

Let's turn our attention now to the silver developers.

With the silver price blasting well into the low US$60's, we have seen buying pour into many silver equities in sympathy. However, investors are so enamored with how well some of these stock charts have done this year that some investors watching from the sidelines may feel like they've missed out on the whole run. The reality is that many analysts and investors are still undercutting where the true valuations of these companies should be.

Vizsla Silver Corp.

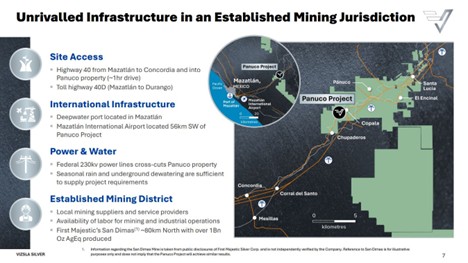

Vizsla Silver Corp. (VZLA:TSX.V; VZLA:NYSE) arguably has the best undeveloped silver deposit on the market in its Panucho Project, which is at the Feasibility Study level.

The company has raised a ton of capital this year, demonstrating its commitment and the market confidence in moving this project forward towards construction in 2026 and first production in 2027.

At first glance, with a stock chart ripping up and to the right and a market cap of US$1.75 billion, it's easy to assume that (VZLA) is fully valued at this point.

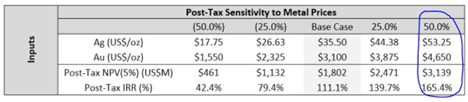

However, if one considers the metals sensitivities table on the Feasibility study, at US$53.25 silver (far lower than the current price) and US$4,650 gold (only about 7% higher than Thursday's close at $4,313), thenthe Net Present Value (NPV 5%) is US$3.14 billion with an Internal Rate of Return (IRR) of 165%.

Unfortunately, the metals sensitivity table does not show what US$62-US$64 silver price assumptions translate over to, but one could envision an NPV (5%) growing north towards a US$4 billion valuation. In that sense, the current valuation still has room to rerate quite a bit higher.

Also consider that Panucho boasts 361,073,000 ounces of silver equivalent in all categories (222,362 in M&I + 138,711 in Inferred). So, at the current market capitalization, they are being valued at US$4.84 per silver equivalent ounce in the ground.

Vizsla's Panucho is the best silver development project on the market, and yet it is being valued for less than US$5 a AgEq ounce in the ground, while silver has been up above US$62 an ounce in the ground most of this week. I'm not suggesting that it should be valued at over US$60 an AgEq ounce in the ground, but surely something closer to US$10 or possibly even US$15 a AgEq ounce in the ground would be a fairer valuation in light of the current strength in the underlying metals price.

As a result, my personal investing thesis is that Vizsla Silver could still double or triple from here, even if metals prices just hang somewhere in the neighborhood of where they've been here in Q4.

That valuation also assumes that they never find another ounce of silver on their property, which is absurd, because they have a massive land package that they've been adding to aggressively, that likely boasts millions more ounces of AgEq.

AbraSilver Resource Corp.

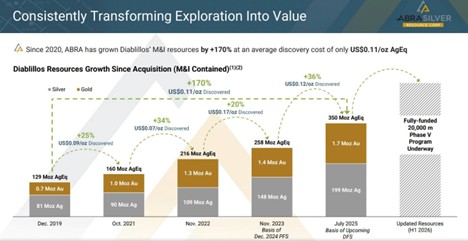

AbraSilver Resource Corp. (ABRA:TSX; ABBRF:OTCQX), also has roughly 350,000,000 ounces of AgEq [with 199M ounces of silver, and 1.7 million ounces of gold], which will be growing further in their updated resource estimate at their Diablillos Project which is due out in Q1, and will be the basis of their upcoming Definitive Feasibility Study, due out in 2026.

They have a market capitalization of US$1.61 billion, and have a chart that has been ripping up and to the right all year long.

Once again, many investors may consider this market cap already fully valued, and feel like they've already missed the full run in this stock, but consider this:

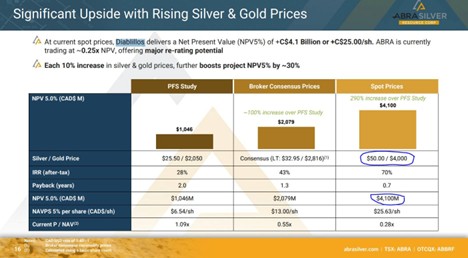

Just their Pre-Feasibility Study (which was based on a smaller resource than the upcoming DFS will be based on) has a Net Present Value of US$4.1 billion at price sensitivities of just US$50 silver and US$4,000 gold, along with an IRR of 70%. That number will likely be going up substantially with their DFS, especially if one factors in US$60 silver and US$4,250 gold price assumptions.

Based on their market cap of US$1.61 billion and roughly 350M ounces of AgEq, they are getting valued at around US$4.60 per AgEq ounce in the ground.

Again, I'm not suggesting that they should be worth US$62 an AgEq ounce in the ground, but surely a double or triple from their current valuation is still reasonable, even if metals prices just keep hovering around where they are at present, and if they never find another ounce of silver or gold on their Diablillos Project.

The company still has about a dozen drill holes to release from their Phase 5 exploration program from 2025, after just releasing their broadest gold mineralized drill hole of all time just this last week, and all of this drilling is not yet even factored into their resources. It's easy to see how all this ongoing value creation can keep propelling this stock to a higher valuation and market capitalization in the fullness of time.

BlackRock Silver Corp.

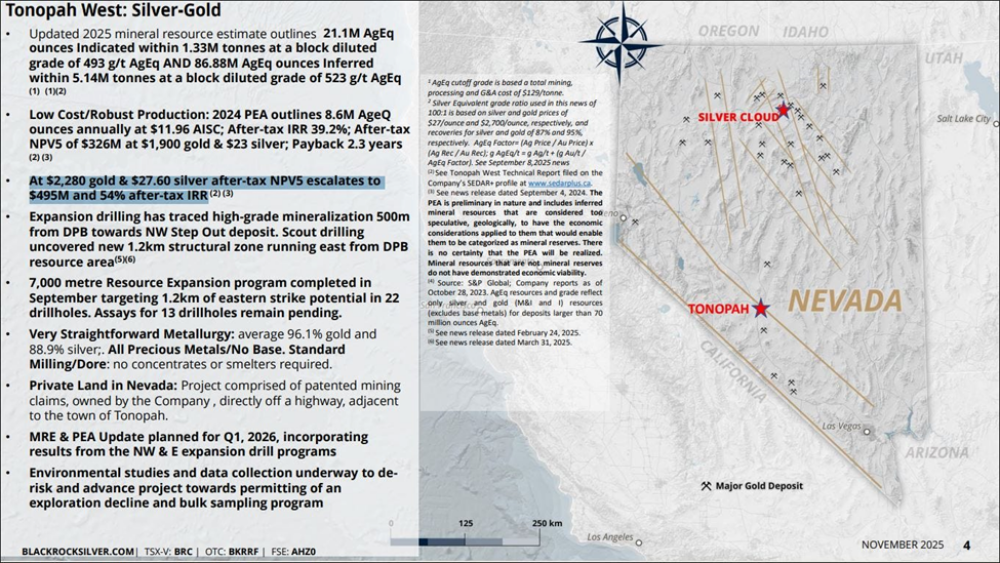

Blackrock Silver Corp. (BRC:TSX.V; BKRRF:OTCQX) is an advanced explorer and now earlier-stage silver-gold developer, derisking their Tonopah West project located in West-Central Nevada, United States.

This silver company is even more undervalued on an ounce-in-the-ground basis than the prior two examples, but some of that is based on its earlier stage of economic studies, in contrast.

Regardless, this appears to be yet another example of a large market disconnect with regard to its in-situ mineral valuation and robust economics.

They have roughly 108,000,000 ounces of silver equivalent ounces delineated at present, via their 21.1M AgEq ounces Indicated at a block diluted grade of 493 g/t AgEq, + 86.88M AgEq ounces Inferred at a block diluted grade of 523 g/t AgEq.

With a current market cap of US$206.6 million, that means they are being valued at around US$1.91 a silver equivalent ounce in the ground. These are some of the highest-grade ounces in a meaningful domestic silver development project, and that is a comical valuation in light of the recent US$62-US$64 silver price environment.

They are getting ready to put out an updated Mineral Resource Estimate in Q1 of 2026, which should show considerable expanded growth from all the expansion drilling from this year at both their NorthWest Step Out and Eastern Expansion areas. Despite all the juicy drill hits that will be incorporated into this upcoming resource estimate, the market is still asleep on this value creation.

There is a 2024 Preliminary Economic Assessment (PEA) in place that demonstrated that at US$2,280 gold and US$27.60 silver after-tax NPV5% escalates to US$495 million and 54% after-tax IRR.

I have no idea where the project will be valued on the upcoming larger resource, with a rising grade profile, and with gold and silver prices that are essentially double those metals assumptions, but let's just be conservative and say the NPV(5%) at spot prices is about double that old study. That puts the project worth somewhere around $1 billion at today's metals prices, and the company is trading for around a US$200M M.C.

With all of those factors resource growth not factored in, rising average grade profile, more robust economics on tap, and much higher underlying metals prices I could see this being a 3-bagger or 4-bagger from here, if they never find another ounce of metal on their property (which is quite unlikely).

Want to be the first to know about interestingSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. Subscribe

Important Disclosures:

Shad Marquitz: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.