The Best Way To Play The Coming Gold Boom / Commodities / Gold and Silver Stocks 2019

It's no secret that a small move up in goldprices...

Converts -- directly -- in to a huge move injunior gold miners.

For every 1% move in gold... a small goldminer can rise 20%... 40% or more.

And right now, the smartest investors --insiders at TD, Merrill, Citi and more -- are calling for gold to rise 33%.

Gold could surpass its all-time highs and shoot up over $2,000 per ounce.

This could send gold miners into thestratosphere.

Back in 2016, gold prices jumped 26% in 6 months… andgold miner returns were stellar:

Mid cap miners such as Endeavour Mining Corp gained 196% in 6 months, while its Ontario based competitor IAMGold gained 256% in that same timeframe.

…but the real winners were small-cap miners.

Argonaut Gold’s share price jumped 298% in 6 months, and its peer Great Panther Mining saw its share price even jump bya whopping 340% in no more than 4 months after it reported a 19% in gold production.

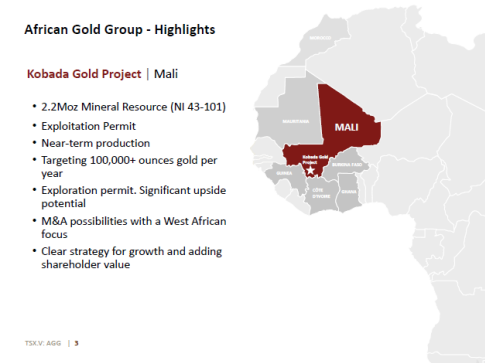

And one company positioned to ride the cominggold rush than anyone else is African Gold Group Inc. (TSX:AGG.V, OTCMKTS:AGGFF).

AGG has a mine in one of the biggest mineralbelts on earth, in a part of West Africa that has just become the capital ofthe global gold industry,

where mining firms are spending hundreds of millions ofdollarson new acquisitions.

where mining firms are spending hundreds of millions ofdollarson new acquisitions.

And AGG hopes to strike it rich in the next biggold boom.

Its mine already has resources of more than 2.2million ounces.

A project that is planned to comeon-line soon, with a total resource base of 2.2 million ounces of gold worthbillions of dollars.

And management team of dedicated veterans …led by a titan of the mining world who has turned tiny firms intomulti-hundred million dollar powerhouses.

Here are five reasons to get excited aboutAfrican Gold Group (TSX:AGG.V, OTCMKTS:AGGFF):

##1 The Kobada Mine…$140 million

The Kobada Gold Project is in southern Mali—andinvestors should take note of the difference.

While Northern Mali has had some trouble, southern Mali is stable, safe, and extremely favorable to mining.

Mali is Africa’s third-largest goldproducer, and the southern belt near the borders withCote d’Ivoire and Guinea is one of the most prolific gold belts in the world.

The belt stretches more than 25km throughout the whole Kobadaconcession and is entirely owned by AGG.

Studies have suggested a current resource base of 2.2 million ounces.

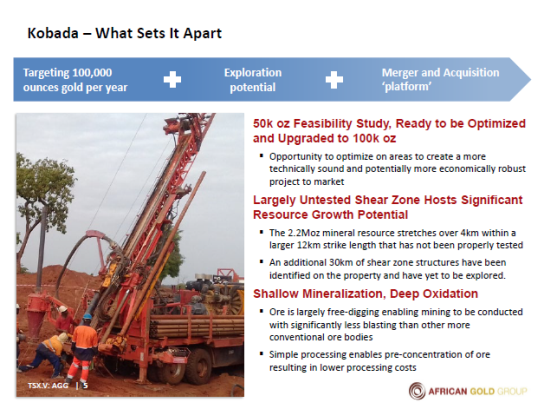

Thecompany thinks it can hit 50,000 ounces a year and build upwards to 100,000ounces a year in a short time frame. Thecompletion date of December 12 is in sight, with another feasibility studycoming up in April 2020.

At current prices, that would be $140 millionin gross revenue a year... for a tiny small-cap firm.

Mineralization is evident at shallow depths,which means miners won’t have to sink big pits or blast away too much rock toget at the ore deposits.

Total costs look like they’ll come in under$50 million, with the gold close to the surface—the company has only had to dig300 meters so far.

In Mali alone, there are at least twentydifferent mining companies are investing.

And the regulatory environment couldn’t bemore ideal—the Malian government has embraced mining, Mali’s biggest GDPcontributor, and has streamlined the permit process.

>Where in North America permitting cantake as long as 5-7 years, in Mali companies can have permits in hand in amatter of months.

ForKobada, licenses acquired from the Malian government expire in 2045 and coveran area of more than 200 square km

The area around AGG’s (TSX:AGG.V, OTCMKTS:AGGFF)operation at Kobada is turning into gold’s newest hot-spot.

Accordingto Mining Intelligence, 61 newassets are in production or construction stages, with 24 assets undergoingeconomic assessments. And there’s a huge number of assets in the explorationphase—more than 360 in total.

In fact, West Africa seems poised to become a new centerfor global gold mining—thanks to vast, untapped deposits,low costs and a favorable political and regulatory environment.

Guinea, Mali and Burkina Faso already produce twice asmuch gold as South Africa…and things may only getbetter from here.

#2 The Billion Dollar Gold Belt

Kobada is part of a massive belt runningacross a huge swath of West Africa.

Mining here has been very lucrative, withResolute and Barrick realizing big gains.

It’s called the Birimian Greenstone Belt. Andit’s already made a splash.

Take the Morila mine, in southern Mali, justeast of Kobada. Operated by gold giant Barrick, the mine has been in operationsince 2000.

Or Tongon in Cote d’Ivoire, also run by Barrick, where 230,000 oz was dug up…worth $322million.

Or the Syama Mine, in Mali,operated by Resolute, which estimates it will produce 300,000 oz of gold peryear.

At current prices, that’s $420 million.

Kobada sits squarely in a belt of mines thathave brought in big gains for investors.

And West Africa is only now growing into a newglobal gold hub…it’s only now popping up on investors’ radar. That means thingswill only get better from here.

Just this year, Ghana outpaced South Africa asAfrica’s biggest gold producer.

Mali, in third place, isn’t too far behind.

There are potentiallyhundreds of new assets that lie untapped, ready forexploitation by companies looking to make big gains, fast.

And AGG (TSX:AGG.V, OTCMKTS:AGGFF)could be even bigger than investors realize.

#3 From Millions to Billions…Just Like That

There are real reasons to expect big thingsfrom AGG and the Kobada Mine.

First, take the company’s projectedhaul—50,000 oz a year.

Valued at the current rate of $1400 per oz,that’s revenue of $70 million. Not too shabby for a little company.

The company estimates the total haul for theKobada property to be 2.2 million ounces, which at gold’s current prices couldbe worth as much as $3.1 billion in revenue.

The company is racing ahead of itsschedule—accommodation for staff is 95% complete, holes are being drilled at arate of one every three days, and a new feasibility study is set for April2020, past the December 12 drilling completion date.

Despite recent news, including the decision bythe Fed to cutinterest rates, consolidation in the gold marketmeans we can expect the $1400/oz rate to hold steady, or to trend upwards.

With China`s gold buying spree ramping up andincreasing international trade tensions, industry experts expect theprices to go up to $2000.

That means the estimated gold at the Kobadaproperty could be soon worth more than $4 billion.

That’s huge news…and it’s probably only thebeginning, considering the massive value trapped in the Birmian belt.

And AGG (TSX:AGG.V, OTCMKTS:AGGFF)has a team that knows what it’s doing. They know how to execute on bigprojects.

#4 A Firm Hand at the Wheel

The team at AGG is a superb group of industryprofessionals and financial whiz-kids who have spun iron ore into gold fordecades.

And this group is ready to do it again.

Two directors, Sir Sam Jonah and BruceHumphrey, have a hundred years of combined experience working the finances formining operations.

Working the heavy machinery is miner DannyCallow. Callow served as the head for Glencore’s African Copperdivision. ForGlencore, he built numerous large-scale copper and cobalt projects, including acopper and cobalt operation in Africa from green fields to a 210,000-ton copperproducer and the largest cobalt mine in the world.

But the real news here is Stan Bharti, thecompany’s new CEO.

With thirty years of experience and ajaw-dropping resume, Bharti could lead AGG into a golden age.

Just a few of his victories:

Started and founded Desert Sunin 2002 at $0.40 a share sold 2006 $750 millionor $7.50 a share (TSE: DSM)Started and founded ConsolidatedThompson 2004 at $0.25 a share sold in 2011 for $4.9billion or $17.50 a share (TSE: CLM)Started Avion Gold 2008at $0.40 a share and sold in 2012 for $400 million or $0.88 a share (TSE: AVR)Started Sulliden 2009 at $0.40a share and sold in 2014 for merged value of $464 million or $1.47 (TSE: SUE)Companies under Stan’s leadership haveuncovered 20 million ounces of gold, more than 3 billion ounces of iron ore and1.5 billion ounces of potash.

He’s amassed more than $3 billion ininvestment capital for his companies and brought in billions to hisshareholders.

Bharti correctly predicted that gold priceswould bounce back in the mid-1990s and again between 2003 and 2015. He’s got aknack for working the gold market—a skill that should be useful as gold surgesin 2020.

He already pulled off one miracle. In themiddle of the biggest financial crisis in history back in 2008, Bharti turnedAvion around and sold it off for $500 million four years later.

That’s a 20x growth rate.

And now Bharti wants to repeat the feat withAGG.

“It feels like we are in 2003 again,” Bhartisaid, “at the cusp of a great run in gold and goldstocks.”

“I have always bought or acquired undervaluedassets in emerging markets. This gives our shareholders the best potential forHUGE returns. AGG (TSX:AGG.V, OTCMKTS:AGGFF)fits in that category very well.”

“The team is now complete,” hedeclared, “and we are ready to take this asset to thenext level in one of the most bullish environments I have seen in my 30 yearcareer in mining “

#5 A New Gold Rush

It’s all happening again: the second big goldrush.

Talk of a return to the gold standard isspiking…and gold prices are climbing.

There’s a good chance interest rates couldfall even further…into negative territory. And that will make gold irresistiblefor investors.

The VanEck Vectors Junior Gold Miners ETF, one of the most popular small-capmining ETF’s, has gone up 50% in the last 2 months.

Mining expert and financial geniusStan Bharti, the new chief of AGG, thinks gold will reach $2000/oz.

This little $30 million market cap company with its billion dollar mine in Mali could see a colossal surge of investorinterest.

You don’t need to invest much in a small-capminer…say $1000 or $2000 or so…to realize huge gains.

And as big companies snap up small firms, thechance for a major pay-day grows—just look at what Bharti was able toaccomplish last time, taking a small company and growing it 20x.

This is the new gold rush.

And it pays to get in first.

By. Meredith Taylor

IMPORTANT NOTICE ANDDISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Oilprice.com, AdvancedMedia Solutions Ltd, and their owners, managers, employees, and assigns(collectively “the Publisher”) is often paid by one or more of the profiledcompanies or a third party to disseminate these types of communications. Inthis case, the Publisher has been compensated by 2227929 Ontario Inc. toconduct investor awareness advertising and marketing concerning African GoldGroup. Inc.2227929 Ontario Inc. paid the Publisher fifty thousand US dollars toproduce and disseminate this and other similar articles and certain banner ads.This compensation should be viewed as a major conflict with our ability to beunbiased.

Readers should beware that third parties,profiled companies, and/or their affiliates may liquidate shares of theprofiled companies at any time, including at or near the time you receive thiscommunication, which has the potential to hurt share prices. Frequentlycompanies profiled in our articles experience a large increase in volume andshare price during the course of investor awareness marketing, which often endsas soon as the investor awareness marketing ceases. The investor awarenessmarketing may be as brief as one day, after which a large decrease in volumeand share price may likely occur.

This communication is not, and should notbe construed to be, an offer to sell or a solicitation of an offer to buy anysecurity. Neither this communication nor the Publisher purport to provide acomplete analysis of any company or its financial position. The Publisher isnot, and does not purport to be, a broker-dealer or registered investmentadviser. This communication is not, and should not be construed to be,personalized investment advice directed to or appropriate for any particularinvestor. Any investment should be made only after consulting a professionalinvestment advisor and only after reviewing the financial statements and otherpertinent corporate information about the company. Further, readers are advisedto read and carefully consider the Risk Factors identified and discussed in theadvertised company’s SEC, SEDAR and/or other government filings. Investing insecurities, particularly microcap securities, is speculative and carries a highdegree of risk. Past performance does not guarantee future results. Thiscommunication is based on information generally available to the public, anddoes not contain any material, non-public information. The information on whichit is based is believed to be reliable. Nevertheless, the Publisher cannotguarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.comowns shares and/or stock options of the featured companies and therefore has anadditional incentive to see the featured companies’ stock perform well. Theowner of Oilprice.com has no present intention to sell any of the issuer’ssecurities in the near future but does not undertake any obligation to notifythe market when it decides to buy or sell shares of the issuer in the market.The owner of Oilprice.com will be buying and selling shares of the featuredcompany for its own profit. This is why we stress that you conduct extensivedue diligence as well as seek the advice of your financial advisor or aregistered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. Thispublication contains forward-looking statements, including statements regardingexpected continual growth of the featured companies and/or industry. ThePublisher notes that statements contained herein that look forward in time,which include everything other than historical information, involve risks anduncertainties that may affect the companies’ actual results of operations.Factors that could cause actual results to differ include, but are not limitedto, changing governmental laws and policies, the success of the company’s goldexploration and extraction activities, the size and growth of the market forthe companies’ products and services, the companies’ ability to fund itscapital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. Byreading this communication, you acknowledge that you have read and understandthis disclaimer, and further that to the greatest extent permitted under law,you release the Publisher, its affiliates, assigns and successors from any andall liability, damages, and injury from this communication. You further warrantthat you are solely responsible for any financial outcome that may come fromyour investment decisions.

TERMS OF USE. By reading this communicationyou agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditionsIf you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions,please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is thePublisher’s trademark. All other trademarks used in this communication are theproperty of their respective trademark holders. The Publisher is notaffiliated, connected, or associated with, and is not sponsored, approved, ororiginated by, the trademark holders unless otherwise stated. No claim is madeby the Publisher to any rights in any third-party trademarks.

OilPrice.com Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.