The Big Boys Are on the Hunt

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and the recent news that BHP/Lundin big CA$4.1 billion for Filo Mining Corp. (FLMMF:OTCMKTS; FIL:TSX).

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and the recent news that BHP/Lundin big CA$4.1 billion for Filo Mining Corp. (FLMMF:OTCMKTS; FIL:TSX).

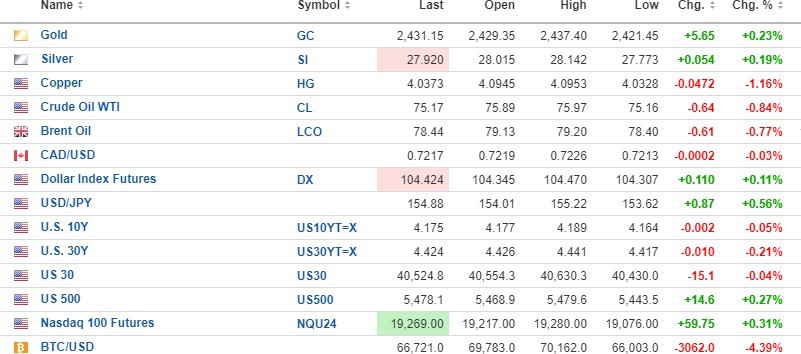

USD index futures are up slightly with 10-yr. and 30-yr. bond yields lower. Gold (+0.23%) and silver (+0.19%) are rallying slightly, while copper (-1.16%) and oil (-0.84%) are lower.

Stock index futures are mixed, with the DJIA (-0.04%) lower and the S&P 500 (+0.27%) and NASDAQ (+0.31%) higher.

Risk barometer Bitcoin is down sharply to $66,000, losing 4.39%.

GLD:NYSE

I was stopped out of the SPDR Gold Shares ETF (GLD:NYSE) August $222 puts yesterday morning right on the opening, after which they performed the "trader's nightmare;" they reversed on a dime with GLD at $221.55 and bolted straight to $4.19 before closing at $3.55 bid. I was traveling during the morning, so when I stopped at a light and checked the prices, the could be heard for miles. Normally, on a dull news week, I would attempt to buy these back, but this is not a "dull news week."

The problem right now is that we have the Fed rate decision coming tomorrow at 2:00 pm, followed by the Jobs Report on Friday at 8:30 am, both of which usually create extreme volatility for gold and stocks. I already own the GLD August $215 puts, so if gold gets smoked after we learn on Wednesday that there is no interest rate cut (as expected by many), I will pick up the drop by way of the $215. If, for some ungodly reason, the Fed panics and cuts by a quarter or a half, GLD will undoubtedly rocket higher, at least over the very near term.

Then, on Friday, we get the Employment Report, and if that comes in "hot," expectations for a rate cut will diminish. Now, since the Fed knows the jobs number on Wednesday, if they fail to cut, one might surmise that the jobs number is indeed "hot," so this is a bearish backdrop for gold (with the reverse scenario also true).

Ergo, the way to play this is to wait for the FOMC decision on Wednesday and be ready to buy back the $222 puts if the Fed stays put. The Friday report will probably be hostile to gold, and given the tendency for gold to get hammered on Friday sessions, the odds favor a rout.

Obviously, I will abort this plan if the Fed cuts.

Copper-Gold Juniors

Yesterday, BHP Minerals and Lundin Mining launched a combined bid for Filo Mining Corp. (FLMMF:OTCMKTS; FIL:TSX) for CA$33/share or CA$4.1 billion in order to acquire the monstrous "high sulphidation epithermal copper-gold-silver" Filo del Sol located on the Chile-Argentina border. The shares of FIL traded as low as CA$1.80 in 2020 and as low as CA$16 last November, demonstrating to me that the mergers and acquisitions ("M&A") cycle is only just beginning despite the current and ongoing correction in copper.

This underscores the significance of being fully invested in the names covered in this publication such as American Eagle Gold Corp. (AE:TSXV) where results from the NAK Project are scheduled to be released any day.

Of even greater importance and a certain "must-own" are the shares of Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) whose Caballos copper-gold prospect is starting to really shape up. The news release from yesterday highlighted how the surface outcrops of high-grade Cu-Au mineralization are creating a large footprint carrying potential scale and grade. They have now confirmed the emergence of the first bona fide drill target, and I expect that will be their primary focus at Caballos.

As exciting as are the new developments at Caballos, the project that could develop into a Filo del Sol-type of outcome is Buen Retiro. It is a developing IOCG (iron-oxide-copper-gold) deposit located 45 KM SW from the Candelaria Mine owned 100% by Lundin Mining Corp. the same company that is buying Filo del Sol along with BHP.

Since the new CEO/President (Merlin Marr-Johnson) was appointed, the moves by this management team has far exceeded my loftiest expectations and I am adding at every opportunity.

| Want to be the first to know about interestingGold,Silver,Critical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of American Eagle Gold Corp. and Fitzroy Minerals Inc. Michael Ballanger: I, or members of my immediate household or family, own securities of: American Eagle Gold Corp. and Fitzroy Minerals Inc. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.