The Biggest Energy Breakthrough Since Fracking / Commodities / Oil Companies

Acrossthe world’s big energy markets, the energy war rages on.

Acrossthe world’s big energy markets, the energy war rages on.

OPEC andU.S. producers have been competing for years, but it’s now clear who’s winning thisfight.

Americanproduction of crude oil rose to an all-timehigh, surpassing 10 million bpd. InFebruary, the International Energy Agency predicted that U.S. shale outputcould meet all new global demand, thanks to its “extraordinarygrowth.”

In thebattle for global market share, the U.S. is winning, as Saudi exports reach their lowestlevels since the 1980s.

As SaudiArabia is forced to maintain costly production cuts, the United States hasembraced an energy revolution.

OPEC cuts,led by the cartel’s leader Saudi Arabia, have propped up prices, but there’s no question how U.S. companies have come out on top.

Byembracing new technologies, innovations in upstream and downstream, andachieving maximum efficiency, American companies on the shale patch andelsewhere have unlocked American energy potential.

But whileshale has been the big story, it’s really just the beginning.

Onelittle company is preparing to take U.S. energy to the next stage: unlocking oiltrapped in U.S. oil sands for as little as $22/barrel and usingblockchain-based supply-chain management to improve efficiency and cut out themiddlemen.

Thecompany is Petroteq Energy Inc. (TSX:PQE.V; OTCQX:PQEFF), and it’s here to help take U.S. energy dominance to the next level.

Petroteq doesn’twant to just produce oil from oil sands much more cheaply—it intends to licenseadvanced technology globally, targeting not only the 1 trillion-plus barrels ofoil equivalent in sands in Utah, Colorado and Wyoming, but the trillions ofbarrels worth everywhere around the world.

Plus,Petroteq is harnessing the hotter-than-hot Blockchain sector to transformenergy market deals and data.

Now, withoil prices rising and predictions of future upwards movement and new techwinning the war for North America, here are 5 reasons to watch Petroteq (TSX:PQE.V; OTCQX:PQEFF) very closely:

1) 87 Million Barrels of Oil Equivalent

Oil sandsdon’t have the best reputation: people tend to think of oil sand extraction asdirty and expensive.

The tarsands of Canada, one of the biggest petroleum deposits on earth, were soexpensive to exploit that most majors had to divest from theirholdings there after the oil price crashed in 2014.

ButPetroteq is getting ready to change that, thanks to a phenomenal resource inUtah and an innovative new method for extracting oil sands crude.

The Stateof Utah is home to more thanhalf of all U.S. oil sands deposits, and the Uintah region has been producing oil since the 1950s. It’s got more than 32 billion barrels of oil equivalent in sands waiting to be extracted from 8 majordeposits. It’s also got fantastic infrastructure, with 5 major refiners withtruck routes to Salt Lake City.

And it’sright there—in Asphalt Ridge—that Petroteq has an estimated 87 million barrels of oil equivalent.

Evenbetter, this is heavy oil-producing oil sands that can be accessed directlyfrom the surface, so there’s no risk of running into a ‘dry well’.

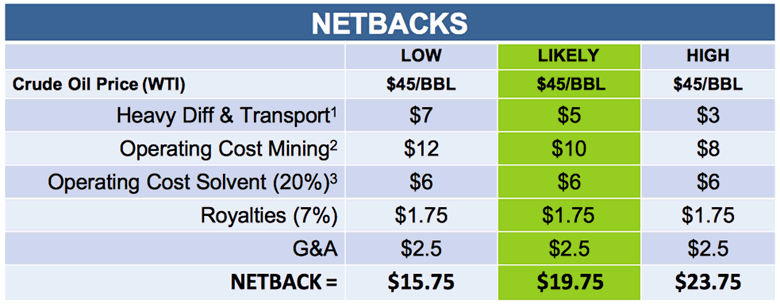

Costs toproduce are expected to come in at only $22 a barrel.

With oneplant, Petroteq says its potential is $10 million a year in profit with $25 perbarrel production costs at today’s oil prices.

Theyacquired Asphalt Ridge for $10 million, and they’ve already proved that theycan extract the oil from the sands and the shale. Permits to produce arealready in place, and 10,000 barrels were produced from the property in 2015.

By the end of March thecompany expects to produce 1,000 bpd. The plan is to reach 5,000 bpd by 2019 at a cost of production of as lowas $18 per barrel. And there’s potential, says Petroteq, to achieve 30,000 bpd with proven reserves.

Demand is expected to be voracious with oil that is produced in the U.S. cleanlyand efficiently. And that’s just the oil from a single plant: This story getsmuch bigger if you read on…

The projected netbacks are impressive…

Utah, Colorado and Wyominghold about 1.2 trillion boe in oil sands and shale,worth a combined $72 trillion at current market prices.

So, while oil sands in Canada are prohibitively expensive to produce intoday’s oil-price environment, Petroteq has found a way to produce in Utah for atargeted $22 per barrel.

And it’s doing it in a clean, safe and efficient way with proprietarytechnology …

2) War-winning Proprietary EOR Tech

Winning the oil war against OPEC, and helping the U.S. to become energyindependent is all about technology. And U.S. national interest right now isall about increasing domestic energy sources.

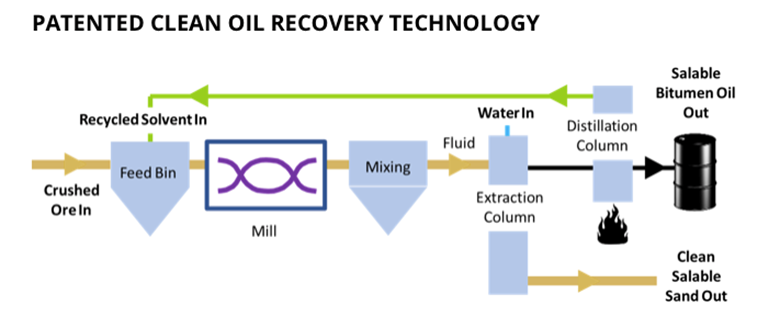

Technological advances such as Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) proprietary Liquid Extraction System will become a key focus for developingU.S. oil sands deposits—and not just in Utah.

Petroteq alreadyhas a significant claim to fame: Its patented oil extraction technology is thefirst ever to generate production from Utah’s massive heavy oil resource.

Existingoil sands extraction technologies use tons of water and leave toxic trailingponds. Petroteq’s system produces oil and leaves behind nothing but clean, drysand that can be resold as fracking sand or construction sand or simplyreturned to Mother Nature.

In teststo date, it extracts over 99 percent of all hydrocarbons in the sand, generateszero greenhouse gases and doesn’t require high temperatures or pressures.

ForUtah’s 32 billion barrels this tech could be the Holy Grail.

This is how it works:

The endresult? The extracted crude oil is free of sand and solvents and then pumpedout of the system into a storage tank.

“The wet tech kills theenvironment,” says Petroteq Chairman and CEO Aleksandr Blyumkin, “but we usegreen additives that allows the sand to be removed in a very clean manner. Noother company has what we have in this space.”

Technologylike Petroteq’s can help make American oil for Americans: full energyindependence.

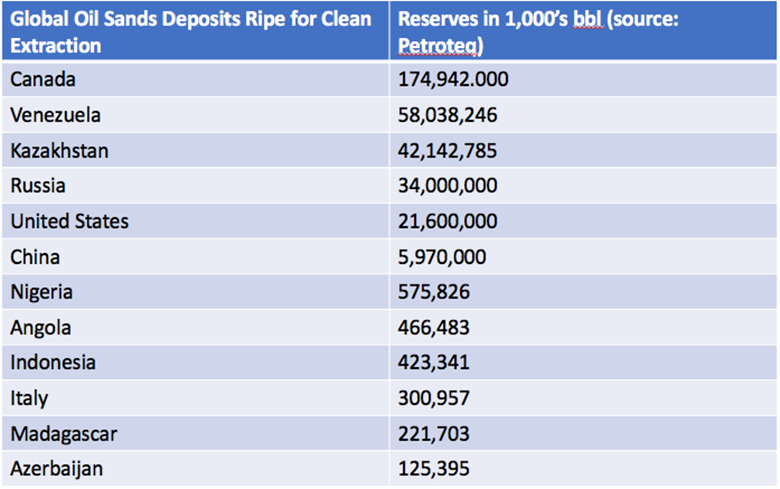

Thistechnology is aimed to be deployed to cleanly unlock oil resources representinghundreds of millions of barrels of oil around the world. Licensing is a revenuestream that can flow to Petroteq (TSX:PQE.V; OTCQX:PQEFF) with no associated capital expenditure. This tech is so good, it could sellitself.

Worldwide,the licensing opportunities are vast, with over 12 countries home to major oilsands deposits.

Fortunes can be built onlicensing fees, and Petroteq could have a big advantage in this market.

3) Blockchain-Based Solutions

Nothing could change oilindustry supply chain management more than blockchain.

Blockchain works to ensuresecure and verified transactions between parties without a lot of third-party involvement.Deals that take weeks instead take hours, or even minutes, to secure. Andthere’s no need for expensive middle-men.

And now, oil and gas isgetting in on the action.

Supermajors BP, Shell and Statoil are getting into blockchain because it’s like what computers were threedecades ago and it could make oil and gas trading a lot easier. They want tocreate a secure, real-time blockchain-based digitalplatform to manage energy transactions, without allthat fussy paperwork.

Every single industry theworld over will likely switch to blockchain because it’s efficient; it’stransparent; and it creates savings.

Deloitte released a report showing all the waysblockchain and crypto-currency technology could be applied to the oil and gasindustry. And Petroteq (TSX:PQE.V; OTCQX:PQEFF) wants to lead the charge withits new supply-chain management software, “Petrobloq.”

In January Petrobloq reached an agreement with Pemex, the Mexicanstate-owned oil company. Through its Petrobloq subsidiary, Petroteq isdeveloping a supply chain management system for Pemex that could radicallyimprove efficiency.

Petrobloq’s technology isbeing designed to function as a digital ledger for oil and gas transactions,one that could become widely-used throughout the energy industry.

Petrobloq has attractedattention: it was cited by Geoffrey Cann, director at Deloittespecializing in oil and gas, as a contender for best blockchain tech in theenergy sector.

This new tech puts Petroteqon the forefront of the blockchain revolution that could be about to sweepthrough the entire oil and gas industry.

4) Skin in the Game Expert Management Team

The Petroteq (TSX:PQE.V; OTCQX:PQEFF) management team is savvy andforward-thinking. That’s why it sees the opportunity not only in producing thefirst clean oil sands, but also in licensing its proprietary oil sands andblockchain tech worldwide.

This is where some of thebrightest minds in extraction tech, chemistry, and blockchain come together toform a dream team.

The Chairman and CEO ofPetroteq, Aleksandr Blyumkin, has championed this Company and technology withmillions of dollars, including an interest-free loan to expand the productioncapability at its Temple Mountain facility in Utah.

Founder and CTO Dr. VladimirPodlipskiy is a 23-year veteran in chemistry, R&D and manufacturing, and achemical scientist from UCLA. He’s the oil extraction tech genius with a line-up of patents for everything from oilextraction and mold remediation to fuel reformulators.

President Dr. R. Gerald Bailey is a former Exxon president of Arabian Gulfoperations, Dr. R Gerald Bailey. He believes in the technology and thecompany's ability to not only turn a profit, but also protect the environmentwhile doing so. He’s got more than 50 years of international experience at allspots along the oil and gas chain behind him, including as operations managerof Qatar General Petroleum Corp., Exxon Lago Oil in Aruba and Esso StandardLibya.

Chief Geologist Donald Clark,PhD, a widely published geologist and consultant, is the blockchain tech geniusin this group, responsible for providing input to financial models, analyzingcommodity price fluctuations and handling operational and transportation costsof oil and natural gas.

And the team supporting themwill be working towards licensing-Petroteq’s technology in as many countries asthey can.

5) Prices on the Rise, Heavy Oil DemandShifting Up

Now is the time to payattention to Petroteq (TSX:PQE.V; OTCQX:PQEFF) for two big reasons. Thefirst is the likely imminent spike in demand for heavy oil.

President Donald S. Trump has announced a $1.7 trillion infrastructure plan. Billionsof dollars will be deployed to rebuild U.S. infrastructure and it requiresexactly the kind of heavy oil that Petroteq can produce from oil sands.

U.S. production growth hasfocused on light oil, and heavy oil is in strong demand, particularly on the GulfCoast, where the billions of dollars put into heavy oil refineries means itneeds a lot of oil to feed them.

Heavy oil traditionallytrades at a discount, but as demand rises, the discount should start disappearing.

This is a story of extractingcosts of $22 per barrel of oil...in a $70 world.

Second, when Petroteq startslicensing out its blockchain and oil sands tech, the royalties it gets could bemassive. The U.S. has billions in trapped oil sands crude that Petroteq techmay be able to get at for costs of only $22 per barrel.

The Petrobloq tech could becomehighly-sought after, as energy firms embrace blockchain to cut costs andstreamline supply chain management and transactions.

While the Saudis fumble aboutin the dark, cutting production and losing market share, the U.S. is primed tobecome the world’s dominant energy producer. And it’s all thanks to innovationfrom companies like Petroteq (TSX:PQE.V; OTCQX:PQEFF).

By Ian Jenkins

**IMPORTANT!BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READCAREFULLY**

Forward-LookingStatements

Thisnews release contains forward-looking information which is subject to a varietyof risks and uncertainties and other factors that could cause actual events orresults to differ from those projected in the forward-looking statements. Forward looking statements in this releaseinclude that PETROTEQ will be able to produce oil as currently scheduled, atthe rates of production announced and at the targeted low prices from its Utahproperty; that PETROTEQ will successfully develop a blockchain supply chainsolution for the oil industry; that it will have customers and contracts forits supply chain technology; that oil will be as much in demand in future ascurrently expected; that PETROTEQ’s technology is protected by patents and thatit doesn’t infringe on intellectual property rights of others; that PETROTEQwill find licensees for its technology and that it can patent its technology inmany countries; that PETROTEQ’s technology will work as well as expected; thatblockchain technology will help PETROTEQ create a supply chain managementsystem which can handle all transactions; and that PETROTEQ will be able tocarry out its business plans. These forward-looking statements are subject to avariety of risks and uncertainties and other factors that could cause actualevents or results to differ materially from those projected in theforward-looking information. Risks that could change or prevent these statements from coming tofruition include that the Company’s patents and other technology protection arenot valid, patents may not be granted in countries where PETROTEQ wants tolicense its technology; production of oil may not be cost effective asexpected, technology development costs may be much higher than expected, theremay be construction delays and cost overruns at the production plants, PETROTEQmay not raise sufficient funds to carry out its plans, changing costs forextraction and processing; technological results based on current data that maychange with more detailed information or testing; blockchain technology may notbe developed to be as useful as expected and PETROTEQ may not achieve itsbusiness plans; competitors may offer better technology; and despite thecurrent expected viability of its projects, that the oil cannot be economicallyproduced with its technology. Currently, PETROTEQ has no revenues.

DISCLAIMERS

PAID ADVERTISEMENT. Thiscommunication is a paid advertisement and is not a recommendation to buy orsell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners,managers, employees, and assigns (collectively “the Company”) has been paid bythe profiled company to disseminate this communication. In this case theCompany has been paid by PETROTEQ seventy thousand US dollars for this articleand certain banner ads. This compensation is a major conflict with our abilityto be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purelybased on our communication. We have been compensated by PETROTEQ to conductinvestor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF.Therefore, this communication should be viewed as a commercial advertisementonly. We have not investigated the background of the company. Frequentlycompanies profiled in our alerts experience a large increase in volume andshare price during the course of investor awareness marketing, which often endas soon as the investor awareness marketing ceases.

The information in our communications and on our website has not beenindependently verified and is not guaranteed to be correct.

SHAREOWNERSHIP. The owner of Oilprice.comowns shares of this featured company and therefore has an additional incentiveto see the featured company’s stock perform well. The owner of Oilprice.comwill not notify the market when it decides to buy more or sell shares of thisissuer in the market. The owner of Oilprice.com will be buying and sellingshares of this issuer for its own profit. This is why we stress that youconduct extensive due diligence as well as seek the advice of your financialadvisor or a registered broker-dealer before investing in any securities.

NOTAN INVESTMENT ADVISOR. TheCompany is not registered or licensed by any governing body in any jurisdictionto give investing advice or provide investment recommendation. ALWAYS DO YOUROWN RESEARCH and consult with a licensed investment professional before makingan investment. This communication should not be used as a basis for making anyinvestment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading thiscommunication, you agree to the terms of this disclaimer, including, but notlimited to: releasing The Company, its affiliates, assigns and successors fromany and all liability, damages, and injury from the information contained inthis communication. You further warrant that you are solely responsible for anyfinancial outcome that may come from your investment decisions.

PASTPERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don'ttrade with money you can't afford to lose. This is neither a solicitation noran offer to Buy/Sell securities. No representation is being made that anyaccount will or is likely to achieve profits similar to those discussed.

OilPrice.com Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.