The Biggest Gold Story Of 2020 / Commodities / Gold and Silver Stocks 2019

The second biggest gold mine in Europecould be about to make investors rich.

It’s a story that began over 2,000 years ago whenthe Romans dug up $16.8 billion in gold in Romania... Using only hammers andbuckets.

But now, a little company with a big dreamis coming to unearth the rest.

Using modern technology, they’re hoping to capitalize on anestimated $13.3 billion find.

Smart investors are watching this once in alifetime discovery like hawks.

GMP research says this little company couldrealize $550 per ounce profit...

And the mine is so exciting, Barrick Goldinvested $20 million to develop it.

And the mine is so exciting, Barrick Goldinvested $20 million to develop it.

The company’s stock, according to CantorFitzgerald, “is inexpensive by any and all metrics.”

It’s a steal because few people -- yet --have heard the extraordinary story of EuroSun Mining Inc. (TSE: ESM, OTCPK:CPNFF).

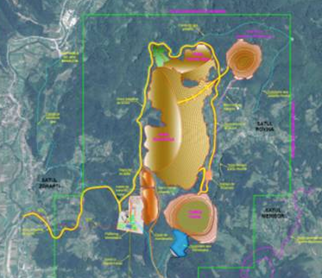

Based at their mine in Rovina, Romania,Euro Sun has 400 million tons of ore, with billions of dollars’ worth of goldand copper locked inside.

CantorFitz thinks they are undervalued by 500% and GMP Research predicts a671% gain.

With such a huge discovery ready for thetaking, this could be the gold story of 2019.

Plus, any small move on the gold marketcould turbo-charge the company’s growth… from 5x to 10x to even 30x its currentmarket cap.

Here are five reasons investors should notmiss out on the biggest gold story of 2019:

#1 Julius Caesar’s $13 Billion GoldStash Re-Discovered

Euro Sun has secured an asset of colossalvalue: a Romanian gold mine that was first proven to contain a massive payday onehundred years ago.

The Ancient Romans excavated $16.8 billionin gold from this area of Romania, minting coins that were dispersed across anempire 11 million square miles in size.

The problem? Permits are labor-intensiveand sometimes impossible, thanks to EU regulation.

Back when permits were available, BarrickGold (NYSE:ABX), the world’s most valuable gold miner, got in on the action: the company pumped in $20 million todevelop Rovina.

Now Rovina is owned by Euro Sun… and EuroSun has done the impossible... it just got the green light from the Romaniangovernment.

The Rovina mine has been classified as a“highly scalable” asset, with an unprecedented growth potential, according toCantor Fitzgerald.

Mines like Rovina are hard to come by, eventhough the area is rich in ore.

And Euro Sun (TSE: ESM, OTCPK:CPNFF) has flown over the biggest hurdle –acquiring the licenses it needs to start developing Rovina’s full potential.

The mining license from the Romaniangovernment was approved in November 2018 – the first license to have been given out in over 15 years.

A resourcestatement from 2012 offers a view of the potential riches: 400 million tonsof ore in three bodies, roughly 7.1 million ounces of gold and a billion and ahalf pounds of copper, or 10.1 million ounces of gold equivalent.

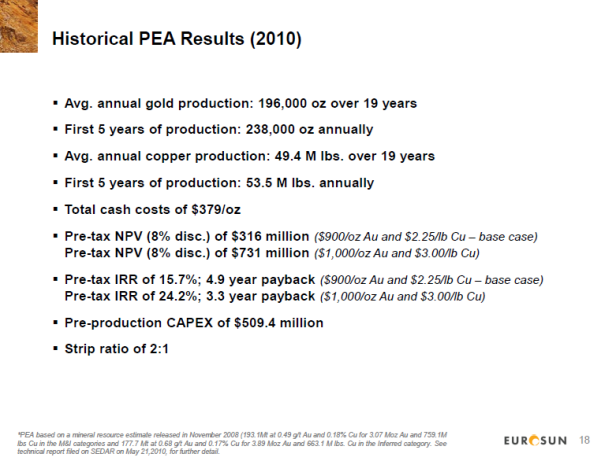

In February 2019, Euro Sun completed itsPreliminary Economic Assessment (PEA) for Rovina. The mine looks ready toproduce an average gold equivalent of 139,000 ounces and 1.6 million overtwelve years.

All told, the company is looking at $9.3billion in gold and $4 billion in copper… a total haul of $13.3 billion.

Better yet, the mine is perfectly situatednear a Romanian mining town, with a population of 13,000. Road and rail transportationis close at hand, ready to carry the mine’s product to market.

Based on the company’s current market cap,the upside potential here is insane.

And even just a tiny move in gold will sendit even higher.

#2 SmallClimbs In Gold Mean Massive Gains For Gold Miners

Analysts are optimistic that prices are set to climb even high, potentially exceeding $2,000/ounce, dueto wavering markets and shaky geopolitical conditions.

Right now, goldstocks are trading for pennies on the dollar, asthey have been since January.

But one thing that investors and speculators often forget, is how explosivegold-stock upside is when gold moves higher.

And, when goldgoes up, gold companies tend to do very, very well.

Every 1% move ingold can send a small miner up 10% or more... And a 10% move can send a smallminer up 100% or more.

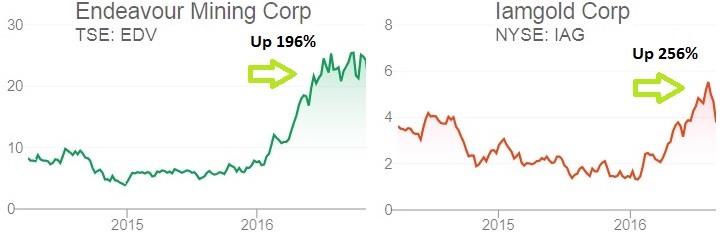

Back in 2016,gold prices jumped 26% in 6 months… and gold miner returns were stellar:

Mid cap miners such as Endeavour Mining Corp gained 196% in 6 months, while itsOntario based competitor IAMGold gained 256% in that same timeframe.

…but some of thereal winners were the shareholders of small cap miners.

Argonault Gold’s shareprice jumped 298% in 6 months,and its peer Great PantherMining saw its share price even jump by a whopping 340% in no more than 4 months after it reported a 19% in goldproduction.

Companies likeEuro Sun (TSE: ESM, OTCPK:CPNFF) could start selling at a premium…forinvestors who don’t snatch them up now.

And when goldgoes up, little companies like Euro Sun fly.

But that’s notthe end of this story. There’s a bigger-- nearby -- catalyst.

#3 China Just Spent $1.4 Billion On ASmall Mine Just Down The Street

With this incredible find, it’s no wonderthat analysts are starting to speculate about Euro Sun…

Could the company be snatched up soon,delivering a huge windfall to early investors?

It’s certainly a strong possibility.

Analysts in the mining sector are already hinting that Euro Sun could be acquired.

And we think China might have a part toplay because they just spent $1.4 billion to acquire a mine right down thestreet from Euro Sun.

China is making a big global investmentpush, as part of its $900 billion “Beltand Silk Road” initiative.

Chinese investment along the road issurging, covering68 countries.

China wants to acquire assets along theSilk Road route—gold, silver, copper, you name it—and that route runs rightthrough Romania.

And the Chinesehave just paid $1.4billion to acquire another mining asset…which sits right down the streetfrom Euro Sun...

China’s nearby acquisition could also takeyears to fully license.

And Euro Sun (TSE: ESM, OTCPK:CPNFF), on a site with ZERO ancient ruins iseven better positioned for a multi-billion dollar payday.

The Rovina mine is fully licensed. It’spoised to become one of the biggest gold and copper mine in Europe.

It’s right next to a major Romanian miningtown of Brad, which has already excavated $17 billion in gold in the last 100years.

In fact, Brad’s coat of arms prominentlyfeatures a mining cart. There’s ampleaccess to talent, transportation and infrastructure... as well as a nearby seaport.

Soon, this story will hit the shores ofAmerica.

#4 “Undervalued by 500%” -- CantorFitzgerald “671% Gain” -- GMPResearch

In 2016, GMP declared Euro Sun the “newold kid on the block,” declaring the company had 10 MILLION OUNCES in goldequivalent waiting to be dug up.

And the numbers look even better now thanthey did two years ago.

At currentprices, Euro Sun could realize $550 in profit per ounce… resulting in totalrevenue of $5.5 billion from Rovina alone.

At currentprices, Euro Sun could realize $550 in profit per ounce… resulting in totalrevenue of $5.5 billion from Rovina alone.

It’s no wonder that GMP noted Rovina has “robust economics andupside…If another ounce is never found, Euro Sun already owns a potentiallyextremely robust project.”

GMP’s estimate has been upheld by CantorFitzgerald, which completed its own estimate in early 2019.

The deposit at Rovina “carries strong economics on a standalone basis.” The only thingholding Euro Sun back is the fact this is happening in a small company... faraway from the lights of Wall Street.

But as we already explained, that couldchange in a flash…once this story gets out.

The management at EuroSun (TSE: ESM, OTCPK:CPNFF) knows what it’s doing. The company isled by CEO and President G. Scott Moore, a business executive with twenty-fiveyears’ experience in the resource sector, and the former EVP of Sulliden Goldand Director of Avion Gold.

Moore and his team have cultivatedexcellent political conditions in Romania, evidenced by their successfulacquisition of a license for the Rovina mine.

And now all they need is the capital totake Rovina to the next level…and turn it into one of the largest gold mines inEurope.

CantorFitz thinks they are undervalued by 500% and GMP Research predicts a671% gain.

#5 Europe’sSecond Biggest Gold Mine Could Be Worth 30x More

And it could go much higher...

When gold moves a little, miners like EuroSun can move A LOT.

And the company has already gotten positiveattention.

Barrick, the world’s largest gold miner,once invested $20 million into the Rovina mine. The asset has been developedand has fallen into Euro Sun’s lap. Now all it needs to do is exploit it.

GMP puts Euro Sun’s short-term target at$2.10. That’s a 500% increase from itscurrent price.

And Cantor Fitz goeseven further: they reckon Euro Sun is worth $2.70, an increase of 671%.

This is a company with a phenomenal upside.

It’s got a fully-licensed gold mine inRomania, the only one of its kind, that could be the biggest gold mine inEurope… an asset potentially worth $10.1 billion.

It’s got a fully-licensed gold mine inRomania, the only one of its kind, that could be the biggest gold mine inEurope… an asset potentially worth $10.1 billion.

And that’s only if prices stay where theyare! If gold edges above $1400/ounce, profits from Rovina could be even higher.

If China comes calling, Euro Sun (TSE: ESM, OTCPK:CPNFF) stock could be worth 5x or 6x what it isnow...

As it becomes the #1 gold mine in Europe.

And if its billions in profits are one dayrealized, that 5x could turn into 30x… A company to rival Barrick in size and value.

But the time to fully investigate Euro Sun (TSE: ESM, OTCPK:CPNFF) isnow...By. Charles Kennedy

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. Thiscommunication is a paid advertisement. Oilprice.com, Advanced Media SolutionsLtd, and their owners, managers, employees, and assigns (collectively “thePublisher”) is often paid by one or more of the profiled companies or a thirdparty to disseminate these types of communications. In this case, the Publisherhas been compensated by Euro Sun Mining, Inc. to conduct investor awarenessadvertising and marketing. Euro Sun Mining paid the Publisher fifty thousand USdollars to produce and disseminate this and other similar articles and certainbanner ads. Euro Sun Mining also paid the Publisher additional sums ascompensation for other marketing services earlier this year. This compensation should be viewed as a majorconflict with our ability to be unbiased.

Readers shouldbeware that third parties, profiled companies, and/or their affiliates mayliquidate shares of the profiled companies at any time, including at or nearthe time you receive this communication, which has the potential to hurt shareprices. Frequently companies profiled in our articles experience a largeincrease in volume and share price during the course of investor awarenessmarketing, which often ends as soon as the investor awareness marketing ceases.The investor awareness marketing may be as brief as one day, after which alarge decrease in volume and share price may likely occur.

Thiscommunication is not, and should not be construed to be, an offer to sell or asolicitation of an offer to buy any security. Neither this communication northe Publisher purport to provide a complete analysis of any company or itsfinancial position. The Publisher is not, and does not purport to be, abroker-dealer or registered investment adviser. This communication is not, andshould not be construed to be, personalized investment advice directed to orappropriate for any particular investor. Any investment should be made onlyafter consulting a professional investment advisor and only after reviewing thefinancial statements and other pertinent corporate information about thecompany. Further, readers are advised to read and carefully consider the RiskFactors identified and discussed in the advertised company’s SEC, SEDAR and/orother government filings. Investing in securities, particularly microcapsecurities, is speculative and carries a high degree of risk. Past performancedoes not guarantee future results. This communication is based on informationgenerally available to the public and on an interview conducted with thecompany’s CEO, and does not contain any material, non-public information. Theinformation on which it is based is believed to be reliable. Nevertheless, thePublisher cannot guarantee the accuracy or completeness of the information.

FORWARD LOOKING STATEMENTS. Thispublication contains forward-looking statements, including statements regardingexpected continual growth of the featured companies and/or industry. ThePublisher notes that statements contained herein that look forward in time,which include everything other than historical information, involve risks anduncertainties that may affect the companies’ actual results of operations.Factors that could cause actual results to differ include, but are not limitedto, the success of the company’s exploration operations, the size and growth ofthe market for the companies’ products and services, the companies’ ability tofund its capital requirements in the near term and long term, pricingpressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading thiscommunication, you acknowledge that you have read and understand thisdisclaimer, and further that to the greatest extent permitted under law, yourelease the Publisher, its affiliates, assigns and successors from any and allliability, damages, and injury from this communication. You further warrantthat you are solely responsible for any financial outcome that may come fromyour investment decisions.

TERMS OF USE. By reading thiscommunication you agree that you have reviewed and fully agree to the Terms ofUse found here http://oilprice.com/terms-and-conditions If you do not agree tothe Terms of Use http://oilprice.com/terms-and-conditions, please contactOilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com isthe Publisher’s trademark. All other trademarks used in this communication arethe property of their respective trademark holders. The Publisher is not affiliated, connected,or associated with, and is not sponsored, approved, or originated by, the trademarkholders unless otherwise stated. No claim is made by the Publisher to anyrights in any third-party trademarks.

OilPrice.com Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.