The Bombardier guessing game: Did they, or didn't they?

Overnight news that regulators in Quebec are reviewing some Bombardier (BBD.B) insider-related transactions shines a spotlight on a big shortcoming in disclosure in Canada. There is an obscure measure in a 2006 OSC staff notice that allows insiders to delay reporting trades for a year or possibly more if they are made under an Automatic Securities Disposition Plan (ASDP) and receive a regular reporting exemption.

First, some quick background. On August 15th, Bombardier issued a press release stating that certain executives had entered into an ASDP describing that it had been set up "in accordance with applicable Canadian provincial securities legislation". Essentially, that meant insiders who were part of the plan could sell certain shares in accordance with pre-arranged instructions even during blackout periods (such as before earnings news). Generally in such plans, instructions are not supposed to be drawn up if the insider is in possession of material non-public information.

The first problem for investors is uncertainty. That arises because when a plan has been set up "in accordance with applicable legislation," it leaves investors wondering as to what that exactly means. Does that mean insiders will be filing on SEDI regularly or did they get an exemption which allows for annual filings? Unless the press release explicitly states exemption or no exemption, investors are left guessing.

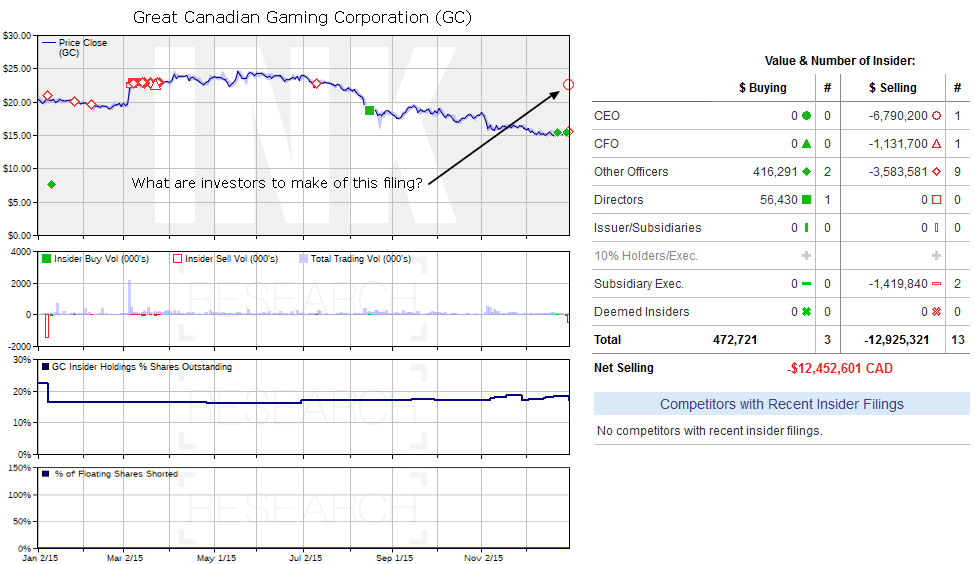

The second problem is the lack of transparency with all ASDPs that receive exemptions. As is the case in the United States, the details of these types of plans are not generally disclosed. However, in contrast to the United States where insiders are not given filing exemptions, investors in Canada may have to wait a year or potentially even longer to find out some information about the sales. That leads to situations like we had with Great Canadian Gaming for 2015 when some insider trades were summarized for the year and reported as of December 31st. It just so happened that the reported price was far above the close on that day. How is anyone but a very sophisticated investor supposed to figure out what happened?

The third issue is fairness. While these plans are supposed to be put into place without the benefit of material non-public information, studies in the United States have found trades in such plans can still beat the market.

So, have Bombardier insiders beat the market with their ASDP? We do not know. If one or more insiders in the plan did trade in the public market during September or October, those trades are not on SEDI. They are not on CanadianInsider.com, and they are not on INKResearch.com.

Like many investors, that leaves me guessing. Regulators must put a stop to that guessing game by eliminating ASDP insider filing exemptions. Until they do, issuers should not seek these filing exemptions because in INK's opinion, that is not consistent with best governance practices.