The Breakout That's REALLY Important for Gold / Commodities / Gold and Silver 2022

Since the gold market now showsparallels to 2008 and 2013, what can we expect if the correction has justended?

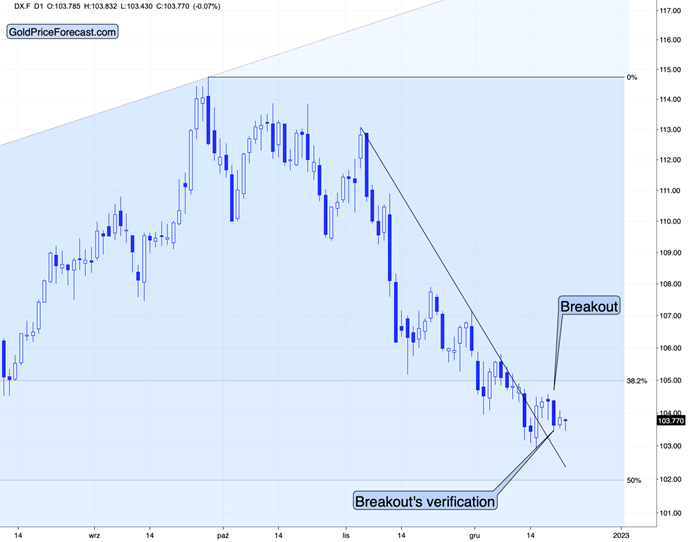

TheUSDX's Breakout

The changes that we saw on the chartsyesterday were not enough to change anything that I describedyesterday, so those comments remain up-to-date. Also, what I coveredduring yesterday’s live event (I combined the live market analysis with thepresentation about the top 3 gold tradingtechniques – youcan see the recording here) remains up-to-date at the moment ofwriting these words.

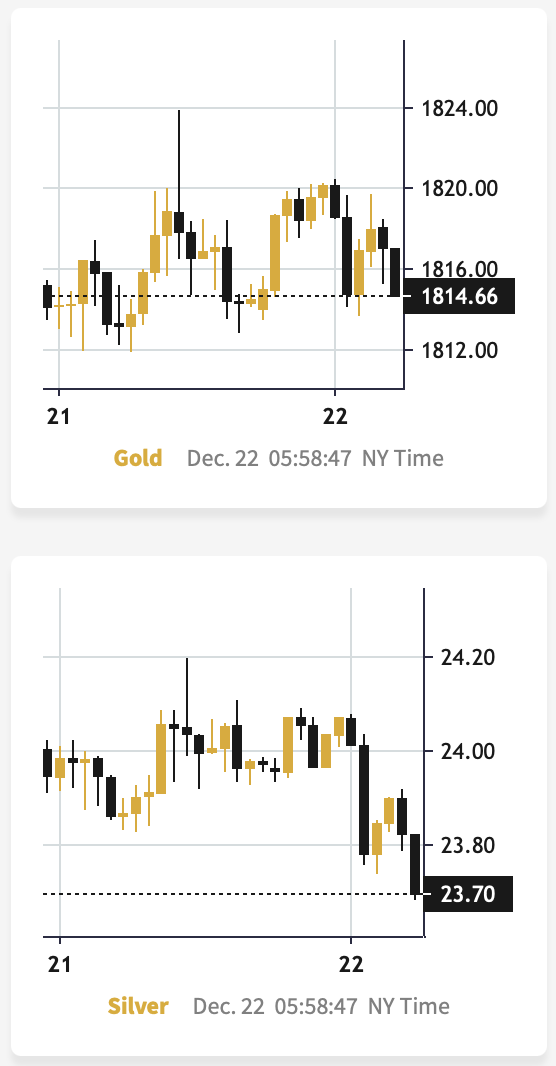

So far today, gold and silver have moveda bit lower, while the USD Index moved a bit higher (chart courtesy of https://goldpriceforecast.com).

After yesterday’s intraday reversal, bothprecious metals moved lower. The silver price once again failed to move above the $24 level.

And the USD Index?

At the moment of writing these words,it’s after an overnight reversal and after a confirmed breakout above its declining resistance line.

This means that it’s now likely to movehigher.

Please keep in mind that both markets,the USDX and the precious metals market, have been very strongly negativelycorrelated recently (with the exception of the very recent yen-relatedturmoil). Consequently, analyzing thegold price, USDX, and their correlation implies very bearishimplications for the PMs and miners.

From the long-term point of view, it’sclear that the long-term support remains intact. The relatively small movelower that we saw this week didn’t take the USDX to new short-term lows.

There was no breakdown below the 2016 and2020 highs in terms of the closing prices, which means that the odds for aturnaround and a rally are very high.

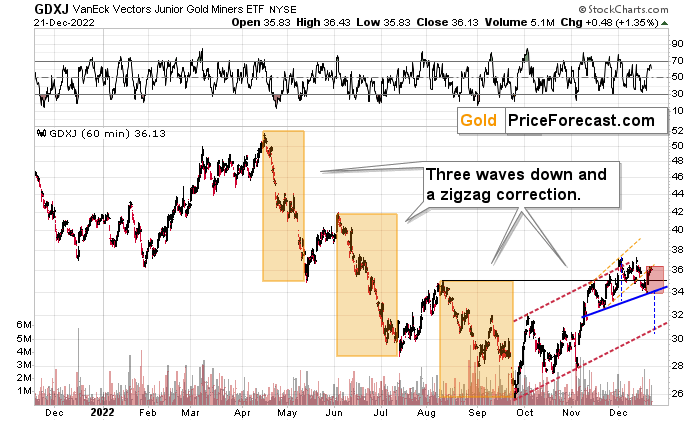

WhatCan Happen to Gold Miners?

Meanwhile, junior gold and silver mining stocks moved a bit higher yesterday,but they haven’t moved above the lower border of the accelerated trend channel(marked with orange). This means that this week’s upswing was likely just a verificationof the breakdown below it.

Interestingly, if we see a decline soon,which is likely, it could become the right shoulder of a potentialhead-and-shoulders pattern. I marked the theoretical right shoulder with a redrectangle and the neck level with a blue rectangle.

In short, when we see a confirmedbreakdown below $34 in the GDXJ, we’re likely to see a move even lower – to$30.5 or so. Then, I’d expect to see something similar to what we saw inAugust, earlier this year – a small correction that is followed by anotherdecline.

This time, however, I think that themedium-term decline will be much bigger than what we saw in the middle of theyear. This is based not just on the bullish medium-term outlook for the USDIndex but also on the analogies in gold price, silver price, and preciousmetals mining stocks: to 2013 and 2008. It seems that the history is rhyming,and the correction right before the biggest slide appears to be over or aboutto be over. I’ll discuss more details in tomorrow’s analysis.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.