The Bull Market Is Still in Place

Barry Dawes of Martin Place Securities shares his thoughts on the gold market and gold stocks.

Barry Dawes of Martin Place Securities shares his thoughts on the gold market and gold stocks.

Gold's parabolic US$530 spike surge in April 2025 has absorbed vast energy, and unless gold surges again to new highs, it will have created a substantial overhang that will take months to overcome.

The Gold ETF GLD shows the gaps from movements out of U.S. hours, but these will still need to be filled, and US$ Gold should retreat to retest the parabola.

Gold has also exceeded the top channel rail line, so it could pull back to retest the parabola and maybe needs to retest the lower channel rail line.

Bull market is still in place, but over-enthusiasm says enough for now.

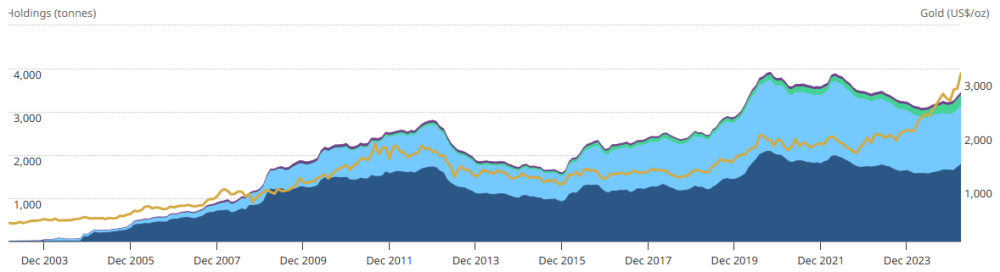

Gold ETFs are picking up in tonnages held but have not again reached the highs of 2020.

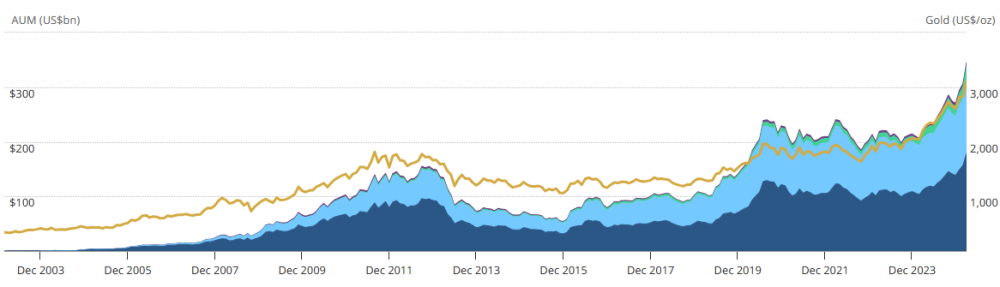

In contrast, they are now more than 50% higher in US$ value.

See below the gold ETF holdings in tonnes of gold.

Source: WGC

Source: WGCSee below the gold ETF holdings in U.S. dollars.

Source: WGC

Source: WGCGold Stocks

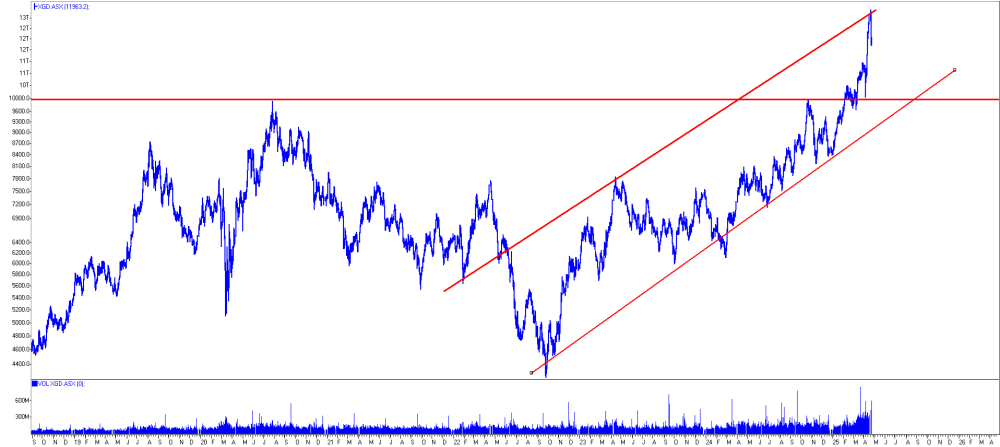

Gold stocks have broken the 2011 Downtrend but appear to be overextended for now.

This Index could retreat about 10% from here.

Keep in mind that gold peaked in 1980, but the ASX Gold index peaked in 1987, seven years later.

Note also that gold stocks versus gold is basing for a very large move over the next few years.

The GDX ETF had 400m shares outstanding a year ago at ~US$26 (= US$10bn) but now has only 307m -down 23% and market cap US$15 billion.

Despite good earnings reports, neither of these were able to exceed October 2024 highs.

But note some small caps.

The 'smaller cap' gold stocks in GDXJ Junior Gold Mining Stocks ETF are starting to turn up vs the largest gold mining companies.

ASX Gold Sector

A pull back to 10,000 is likely mostly in the big caps.

NST/DEG merger to be digested.

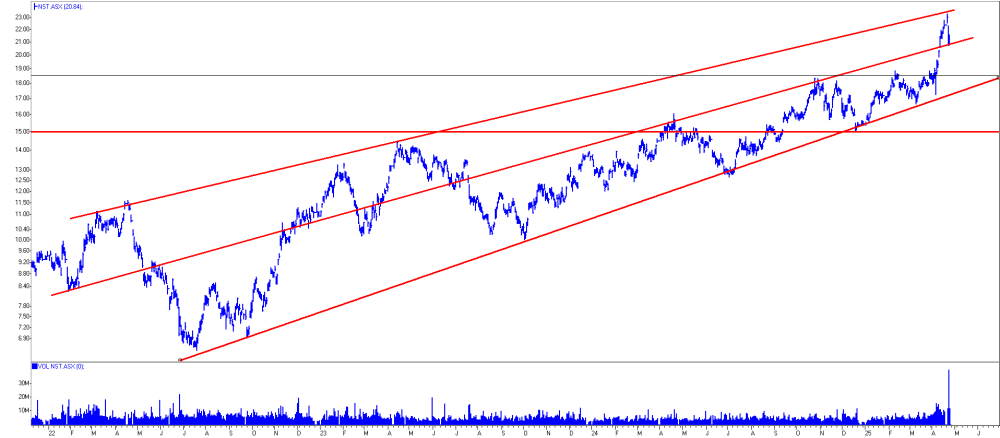

Most of these have hit the top channel rail line and are pulling back 15-20%

NST:

EVN:

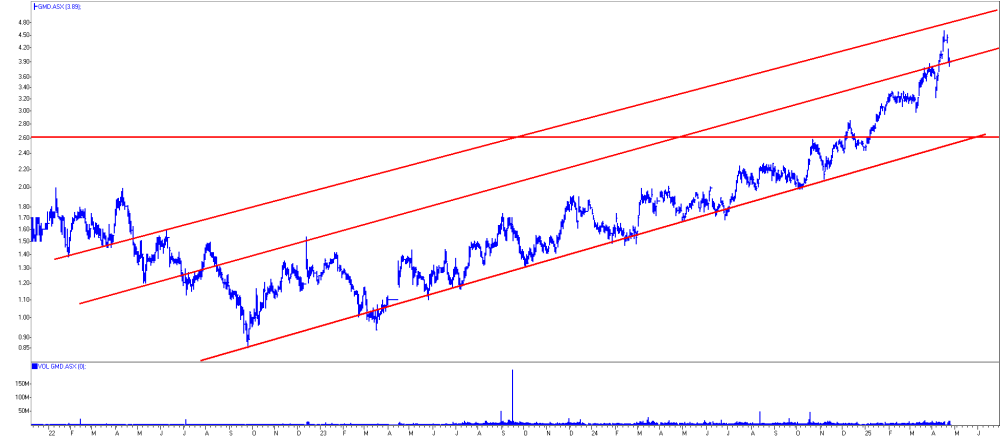

GMD:

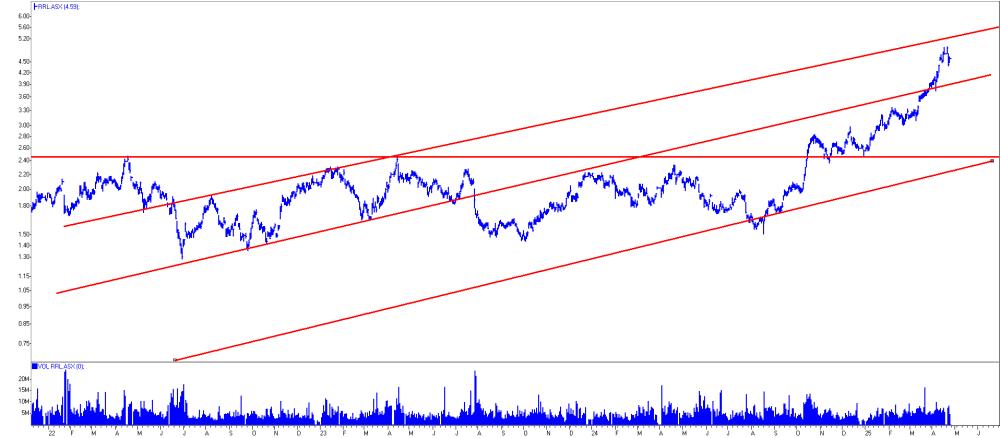

RRL:

Head the markets, not the commentators.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp.Barry Dawes: I, or members of my immediate household or family, own securities of: NST. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.