The Canadian Dollar in Freefall

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and reviews how Trump's tariff plan could impact the Canadian dollar.

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and reviews how Trump's tariff plan could impact the Canadian dollar.

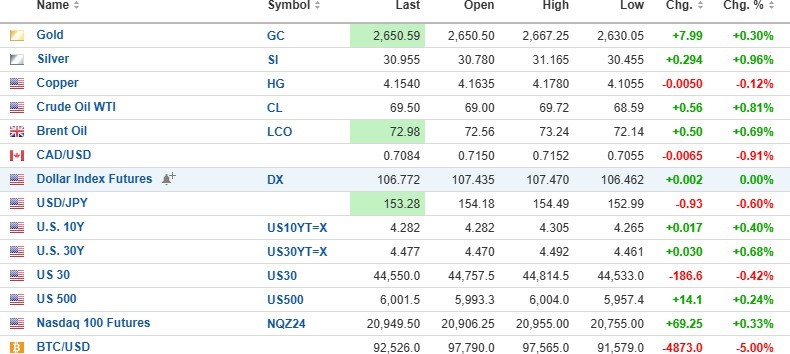

USD Index futures are flat at 106.772 this morning, with the 10-yr. yield (+0.40%) rising to 4.282%, and the 30-yr. yield (+0.68%) also rising to 4.477%.

Gold (+0.30%) and silver (+0.96%) are both rebounding up $7.99 and $0.294, respectively, as is oil (+0.81%). Copper (-0.12%) is off $0.005 to $415.40/lb.

The DJIA futures (-0.42%) are down 186 points, while the S&P (+0.24%) and NASDAQ (+0.33%) are advancing. Risk barometer Bitcoin is down a whopping $4,873(5.00%) to $92,52,6, which might be a precursor to a pending shift to "risk-off" equities next week.

Gold and Silver

Yesterday, the gold and silver markets got bombed on the same day options expired, which seems to be a bit of a habit as the underlying gold contracts for the in-the-money calls got sold rather than rolled over to a distant month, causing intense pressure on a market that had enjoyed five consecutive advances heading into last weekend.

The gap created in the $250-252 area for the SPDR Gold Shares ETF (GLD:NYSE) turned out to be the ceiling for the advance, but yesterday's crash of $7.36 (2.95%) (one of the biggest drops ever) now sets up a possible test of the 100-dma at $236.68. While gold and silver are bouncing hard this morning, I will continue to avoid the long side for either GLD, iShares Silver Trust (ETF) (SLV:NYSE), or the senior or junior gold miners ETF's VanEck Gold Miners ETF (GDX:NYSEARCA) / VanEck Gold Miners ETF (GDX:NYSEARCA).

I must confess that the enormous red candle on the gold chart from yesterday and the dismal action in silver and the mining shares have me sorely tempted to open a position in the GLD December $245 put options, especially into this morning's bounce,e but I suspect I will simply wait for this correction to run its course and open a long position around the 100-dma level.

Trump's Tariffs and Canadian Currency

President-elect Trump dealt his two North American neighbors a nasty blow overnight with the announcement of 25% tariffs on exports coming in from Canada (and Mexico), which has taken the loonie down to levels approaching the 2020 pandemic lows where it bottomed after briefly trading below CA$0.70.

This is going to create a world of hurt for the Bank of Canada in its attempt to rescue the Canadian housing market, which is reportedly off as much as 20% in certain parts of the nation but still grossly overpriced relative to average household income levels. If they move to slash rates again by 50 basis points, it is going to further stoke the inflationary fires that are most certainly being fed and fanned by a declining loonie.

Imported goods from abroad are not getting any cheaper, although this most certainly helps the energy and mining companies with operations in Canada, where their extracted liquids and ores are priced in U.S. dollars.

The historical low for the loonie was in 2002 when it hit CA$0.626 but with deficits in the U.S. having expanded far more on a relative basis than Canada, I see the loonie finding strong support at around CA$0.68-0.70, especially with hawkish hard money advocate Conservative Party leader Pierre Poilievre leading by a rather wide margin ahead of the October 25 Federal Election.

| Want to be the first to know about interestingSilver andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.