The Climate Is Good For GAMCO Global Gold, Natural Resources & Income Trust

GAMCO Global Gold, Natural Resources & Income Trust is a closed-end fund that's designed to generate income by applying a buy-write strategy to more volatile sectors.

Gold and gold stocks are rising despite the strong dollar. Oil prices and energy stock performance is lagging.

The volatility of gold and energy stocks remains high and this will positively impact GGN's premium income and dividend payments.

After the strong performance in the first half of this year the fund is trading at a premium.

Produced by The Belgian Dentist for The Income Strategist

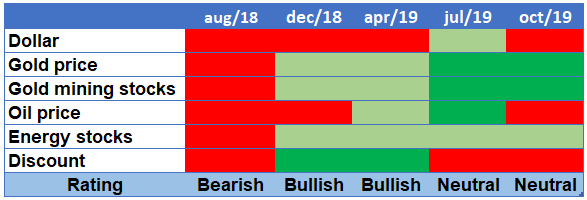

In December we told that the backdrop for investing in the GAMCO Global Gold, Natural Resources & Income Trust (GGN) had improved considerably. In July we became neutral because of the nice performance of the fund in the first half and due to the fact that the fund as a consequence was trading at a premium again.

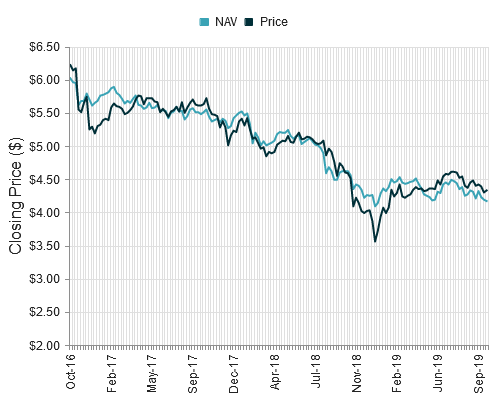

Exhibit 1: GAMCO Global Gold, Natural Resources & Income Trust

Source: CEFConnect

What is the current outlook for GGN?

Buy-write strategy

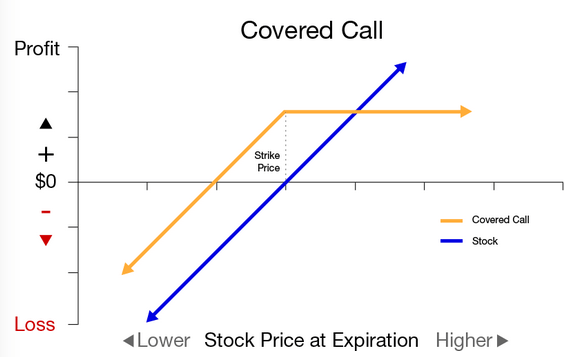

A "Buy-Write" strategy, also known as covered calls, generally is considered to be an investment strategy in which an investor buys a stock or a basket of stocks, and also writes covered call options that correspond to the stock or basket of stocks.

Buy-Write strategies provide option premium income that can help cushion downside moves in an equity portfolio, but Buy-Writes often underperform stocks in rising markets: Lower highs for higher lows.

Exhibit 2: Covered Call

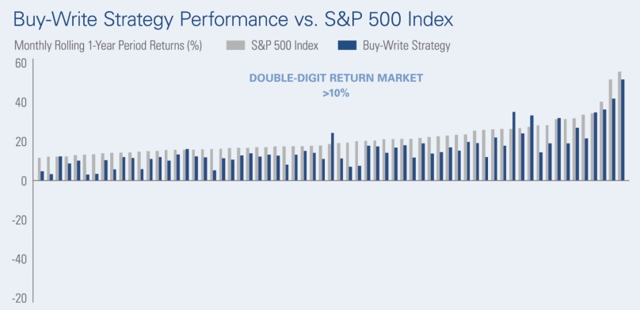

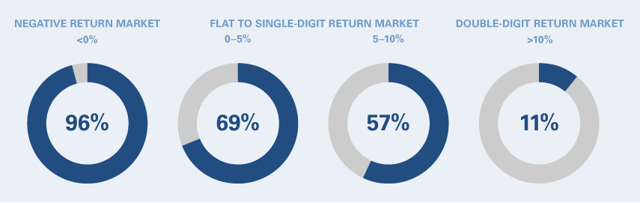

Historically, this strategy has trailed the S&P 500 in double-digit return markets, but has outperformed in lower return or negative markets.

Exhibit 3: Buy-Write strategy vs S&P 500 Index

Exhibit 4: Buy-Write strategy outperformance

GAMCO Global Gold, Natural Resources & Income Trust

The GAMCO Global Gold, Natural Resources & Income Trust is an income fund. It intends to generate current income from short-term gains primarily through its strategy of writing (selling) covered call options on the equity securities in its portfolio. Because of its primary strategy, GGN forgoes the opportunity to participate fully in the appreciation of the underlying equity security above the exercise price of the option. It also is subject to the risk of depreciation of the underlying equity security in excess of the premium received.

GGN is designed to generate income by investing in more volatile sectors of the market - commodities, specifically gold and energy. It's not a fund for investors who wish to participate directly in the returns from either the underlying commodities or the stocks of companies engaged in these sectors. But rising prices do have a positive impact on the NAV of the fund.

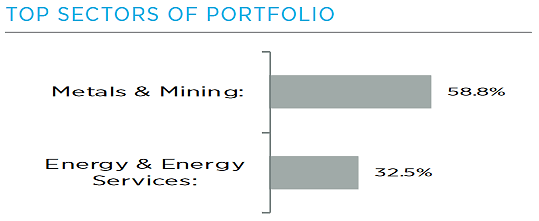

GGN's cash distributions are generated primarily through the execution of a covered call strategy on the majority of the portfolio's equity holdings. Gold stocks account for more than half of the portfolio holdings.

Exhibit 5: Sector allocation

Source: Gabelli

Because of the high level of implied volatility associated with these underlying equities, the manager generally chooses to write these options for terms of between two and six months, struck at price levels approximately 6% to 12% higher than the then-prevailing price. This allows GGN to potentially capture some of the upside of the underlying portfolio while simultaneously generating option premium income for its distribution.

GGN is not a fund for investors who wish to participate directly in the returns from either the underlying commodities or the stocks of companies engaged in these sectors. The focus is on income generation. GGN pays a monthly dividend of $0.05 per share which translates into a 14.25% yield.

When to buy GGN?

So preferably the underlying securities in the fund rise 6% to 12% and do this in a very volatile way such that the fund receives high premiums on the written call options.

Commodities in general and metals and energy prices are heavily influenced by the dollar because they are priced in dollars. So when the dollar gains, commodities drop and vice versa. So GGN benefits from a weakening dollar and certainly when the dollar does this in a very volatile way.

To sum up: In a Blue Sky scenario for investors in GGN we have simultaneously

A declining and volatile dollar that leads to Rising and volatile commodity prices and hence Rising and volatile gold and energy stocks.A final Blue Sky scenario-condition is the fund trading at a discount, preferably greater than the five-year average discount of 2.2%.

Current (volatility) environment

Let's start with the dollar.

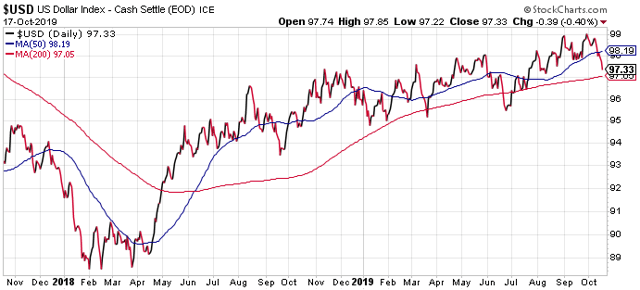

Exhibit 6: USD Index

Despite some recent weakness the dollar remains in a clear uptrend. A strong dollar is normally a headwind for gold and oil prices.

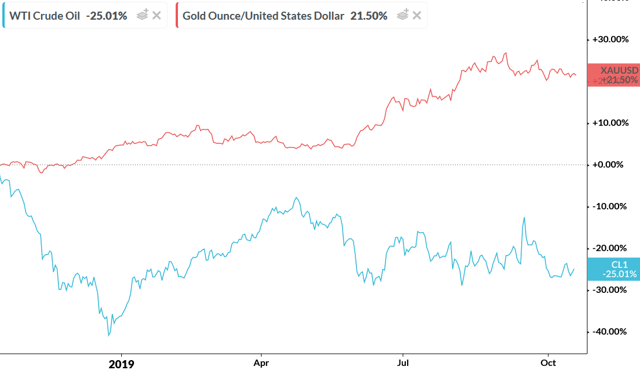

Nevertheless we see that gold is performing well while oil prices are also up year-to-date.

Exhibit 7: Gold and oil prices

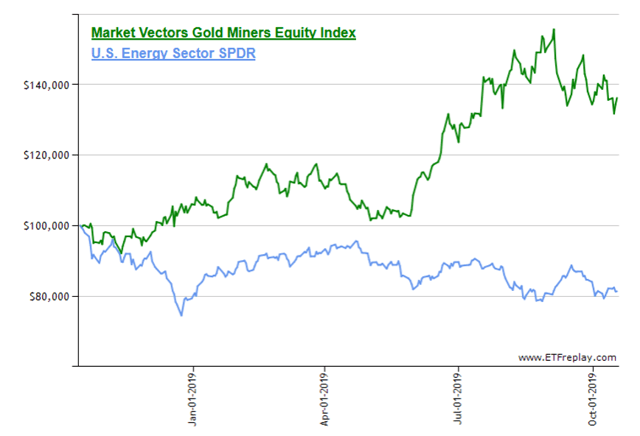

And we see a similar picture for gold and energy stocks, as you can see on the below graph of the VanEck Vectors Gold Miners ETF (GDX) and the Energy Select Sector SPDR ETF (XLE).

Exhibit 8: Gold and energy stocks total return YTD

Source: ETFreplay.com

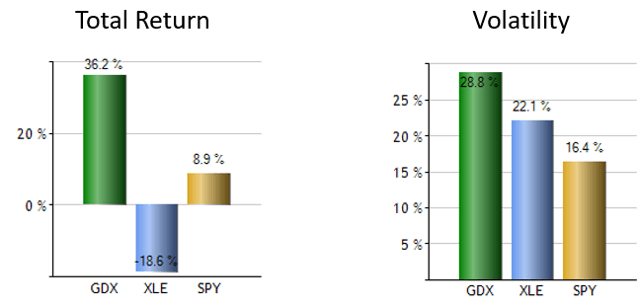

Exhibit 9: Total return and volatility

Source: ETFreplay.com

In the past twelve months, the volatility of gold and energy stocks was as usual higher than that of the stock market in general. But is this volatility of gold and energy stocks high and/or rising (as is preferably the case for GGN)?

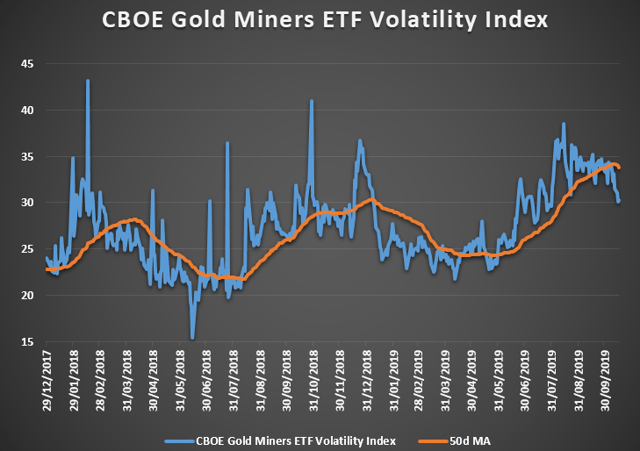

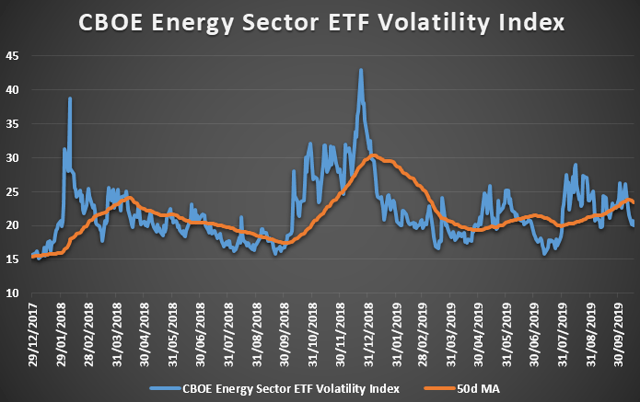

The CBOE Options Exchange now applies its proprietary CBOE Volatility Index (VIX) methodology to create indexes that reflect expected volatility for options on select exchange-traded funds.

CBOE calculates and disseminates the CBOE Energy Sector ETF Volatility Index, which reflects the implied volatility of Energy Select Sector SPDR ETF and the CBOE Gold Miners ETF Volatility Index, which reflects the implied volatility of the VanEck Vectors Gold Miners ETF.

Exhibit 10: CBOE Gold Miners ETF Volatility Index

Source: CBOE

Exhibit 11: CBOE Energy Sector ETF Volatility Index

Source: CBOE

The volatility of both gold and energy stocks has clearly been in an uptrend the past six months. This is positive for GGN's premium income and will allow GGN for the time being to maintain its monthly dividend of $0.05.

CEF discounts and premiums

The differences between the share price and the NAV create discounts and premiums. Shares are said to trade at a "discount" when the share price is lower than the NAV.

Efficient market hypothesis-believers have tried to explain discounts and premiums for years with myriad explanations. Most commonly, the reason a CEF trades at any given discount or premium is related to the fund's distribution rate, regardless of the source of the distribution.

Other typical reasons for premiums and discounts include:

Overall market volatility. Recent NAV and share price performance. Brand recognition of fund family. Name recognition (or lack thereof) of the fund manager. Recent changes in distribution policy. An asset class or investment strategy falling out of market favor. An asset class or investment strategy rising in the market's esteem.If we compare a CEF's discount to its average historic discount, this is what we refer to as a "relative discount." When considering valuation, it's important to look at relative discounts/premiums.

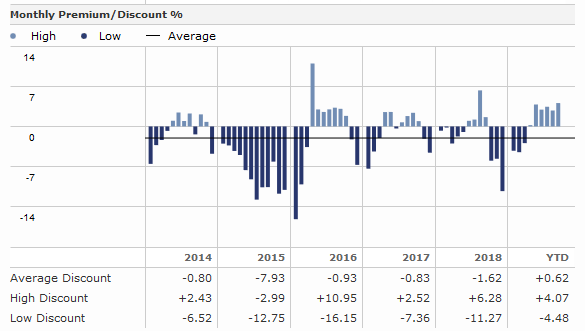

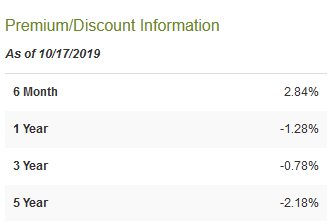

Exhibit 12: GGN premium/discount

GGN is authorized to repurchase the Fund's common shares in the open market from time to time when such shares are trading at a discount of 7.5% or more from NAV. When GGN is trading at a premium to NAV, it may issue shares pursuant to its shelf registration statement in "at the market" offerings. This helps to limit the extent of both premiums and discounts.

Currently the fund is trading at a premium of 3.2%, while on average the fund was trading at a discount of 2.2% the past five years.

Exhibit 13: GGN average premium/discount

Value drivers

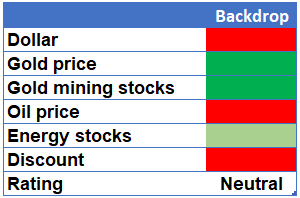

All in all, when we look at GGN's value drivers we see that the dollar's behavior is not really supporting.

Gold and gold stocks perform nevertheless well. The same cannot be said of oil prices and energy stocks.

The volatility of gold and energy stocks remains high and this will positively impact GGN's premium income and dividend payments. That's why we color the backdrop for the gold price and gold stocks "bright green."

Energy stocks are "light green" because of the negative return YTD.

GGN is no longer trading at a discount and this is a red flag.

Exhibit 14: GGN Value Drivers

The two main value drivers are volatile gold and energy stocks and trading at a discount. The volatility is OK, but the fund is currently trading at a premium.

Exhibit 15: GGN Value Drivers' History

Conclusion

A buy-write fund can generate high income. It makes perfect sense to target the more volatile sectors of the equity markets (like gold and energy stocks) in order to receive higher premiums. This is exactly what GGN does.

Despite a strong dollar, gold and gold stocks are moving higher. This is not the case for oil prices and energy stocks. The volatility of both gold and energy stocks remains quite high.

Gold stocks are rising and this bodes well for GGN's NAV evolution.

GGN is currently trading at a premium. That's why we remain neutral on GGN. We would await GGN to trade at a discount to become bullish again but the current environment is certainly ripe.

Generate Better Returns with my Five Income Strategies

Expand your income investing to include five unique strategies. Use them individually or combine them to generate the target returns you want.

Expand your income investing to include five unique strategies. Use them individually or combine them to generate the target returns you want.

Get access to our 5 Income Portfolios and research including

Stable Monthly Income Portfolio Dividend Growth PortfolioHigh Income PortfolioTax-Exempt Income PortfolioIncome Safety PortfolioIn addition, get investment strategies to navigate all phases of the macroeconomic cycle and advice from Arturo Neto, a Chartered Financial Analyst (CFA) and Certified Private Wealth Advisor (CPWA).

As a member, you will also get preferred pricing on Financial Planning and Portfolio Guidance services.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is meant to identify an idea for further research and analysis and should not be taken as a recommendation to invest. It does not provide individualized advice or recommendations for any specific reader. Also note that we may not cover all relevant risks related to the ideas presented in this article. Readers should conduct their own due diligence and carefully consider their own investment objectives, risk tolerance, time horizon, tax situation, liquidity needs, and concentration levels, or contact their advisor to determine if any ideas presented here are appropriate for their unique circumstances. Furthermore, none of the ideas presented here are necessarily related to NFG Wealth Advisors or any portfolio managed by NFG.

Follow Arturo Neto, CFA and get email alerts