The Coming Copper Crunch / Commodities / Copper

Copperhad one of it best years ever in 2017, rising 27% on the back of supplydisruptions and steady demand from China, by far the largest copper consumer.

Copperhad one of it best years ever in 2017, rising 27% on the back of supplydisruptions and steady demand from China, by far the largest copper consumer.

Commoditiesanalysts are usually wrong about copper supply, always predicting a glut in themarket for the ubiquitous metal used in everything from piping for plumbing to wiringin houses, to components of electric vehicles. What they fail to account for isthe inevitable stoppages at the major copper mines due mostly to strikes andweather problems.

In2017 however they were right. In January last year a collection of analysts -BMI, Goldman Sachs, Citigroup and TD - were all bullish on copper, saying thatafter a terrible 2015 and 2016, it would be the strongest performing metal of2017 with predictions of up to $6,200 a tonne come mid-year. By the end of 2017copper futures trading on the London Metal Exchange (LME) were at their highestin four years, $7,236.50 a tonne or $3.28 apound. Copper wasn’t the best performing metal of 2017 (that would be cobalt) but it was third behindpalladium.

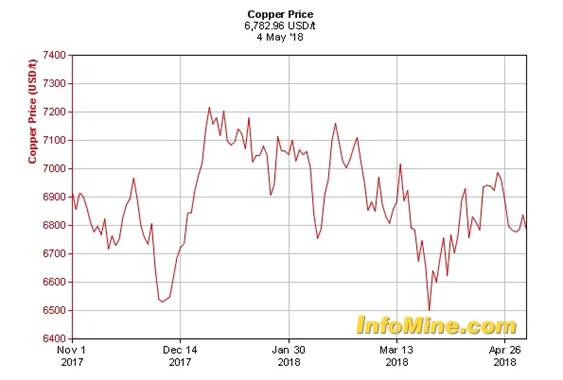

Sohow has copper done so far in 2018? The base metal is showing a V-shaped curve,with LME copper starting the year at $7,200 a tonne, bottoming out at $6,499 onMarch 26, and currently trades at $6,721. Spot copper follows the same pattern.It started 2018 at just under $7,200 and was at $6,782 ($3.08) as of May 4.Copper has traded up sharply since the end of March but has pulled back sincethe end of April.

Sowhat’s happening with the copper market and what are the prospects for juniorcopper companies wanting to find the next big discovery to be gobbled up by amajor? This article will take a look at the copper market in detail, includinguses, the supply-demand trends, and pricing. The overall conclusion is thatcopper is heading for a major shortfall, which can only mean one thing: higherprices.

Copper uses

Copperis one of the few metals that occur naturally in the earth’s crust as opposedto needing to be extracted from ore. For that reason, copper was the firstmetal ever used by early humans, from around 8,000 BC. Three thousand yearslater homo sapiens figured out how to smelt copper from its ore, and around3,500 BC, to alloy it with tin to create bronze. Bronze was useful for toolsand weapons, making it one of the most important inventions in the history of civilization.Copper was later used in roofing, and still is, for its strength and oxidizedgreen look, as well as in works of art. Copper, or Cu, is also known to be essentialfor all living organisms. In humans trace elements of copper arefound in the liver, muscle and bone. The body contains between 1.4 and 2.1 mgof copper per kilogram.

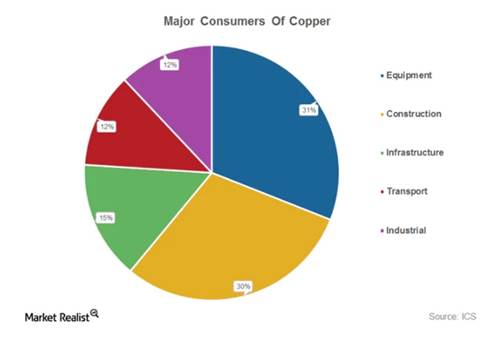

The Copper DevelopmentAssociation divides modern-day uses of copper into four categories:electrical, construction, transport and other. By far the largest sector forcopper usage is electrical, at 65%, followed by construction at 25%.

Copperis useful for electrical applications because it is an excellent conductor ofelectricity. That, combined with its corrosion resistance, ductility,malleability, and ability to work in a range of electrical networks, makes itideal for wiring. Among electrical devices that use copper, are computers,televisions, circuit boards, semiconductors, microwaves and fire preventionsprinkler systems.

Intelecommunications, copper is used in wiring for local area networks (LAN),modems and routers. The construction industry would not exist without copper;as mentioned it is essential for wiring in residential and commercialconstruction. The red metal is also used for potable water and heating systemsdue to its ability to resist the growth of water-borne organisms, as well asits resistance to heat corrosion.

Lastly,the transportation industry is reliant on copper for core components ofairplanes, trains, cars, trucks and boats. A commercial airliner has up to 190 kilometers of copperwiring, while high-speed trains use up to 10 tonnes of copper perkilometer of track.

Automobileshave used copper and brass radiators and oil coolers since the 1970s. Morerecent applications including on-board navigation, anti-lock braking systems,heated seats, defrosting wires embedded in windows, hydraulic lines, and wiringfor window and mirror controls.

Inelectric vehicles (EVs), copper is a major component used in the electricmotor, batteries, inverters, wiring and in charging stations.

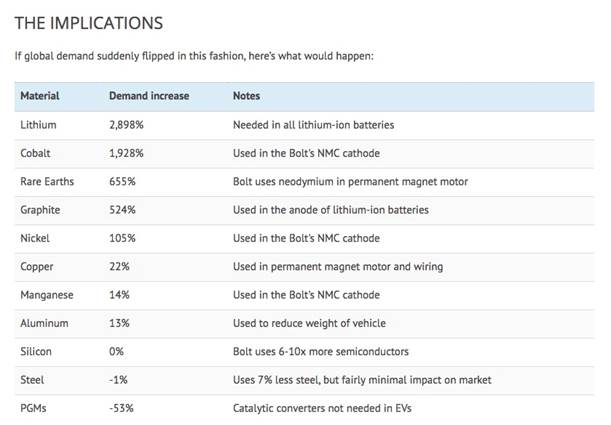

UBSrecently did a “thought experiment” whereby they visualized what would happen to the demand for metals that go intoEVs if consumers suddenly shifted to Chevy Volts from thecurrent auto mix. They found that copper demand would surge 22% - a fairlymodest increase compared to other battery metals which would see leaps of usein the triple digits. (see table below) An average electric vehicle contains 85kilograms of copper compared to 25 kg for regular vehicles.

Thelatest use for copper is in renewable energy technologies, particularly inphotovoltaic cells used for solar power, and wind turbines.

The copper market

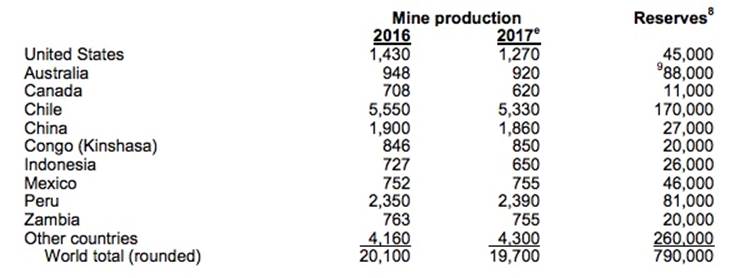

Accordingto the US Geological Survey (USGS) 2.1 billion tonnes of copperresources have been identified throughout the world, with the most common deposit being porphyries,representing 1.8 billion tonnes. By far the country with the most reserves isChile, at 170 million tonnes, while Australia is second at 88 million tonnesand Peru a close third at 81 million tonnes. JORC-compliant reserves forAustralia though are only about 24 million tonnes so really the top two copperdepositories are Chile and Peru. The United States has 45 million tonnes ofreserves, around the same as Mexico.

Interms of production, in 2017 Chile produced the most copper, 5.3 milliontonnes, with Peru second at 2.3 million and the China third, 1.8 million. TheUS cranked out 1.2 million tonnes of copper last year. Total mined productionwas just under 20 million tonnes in 2017.

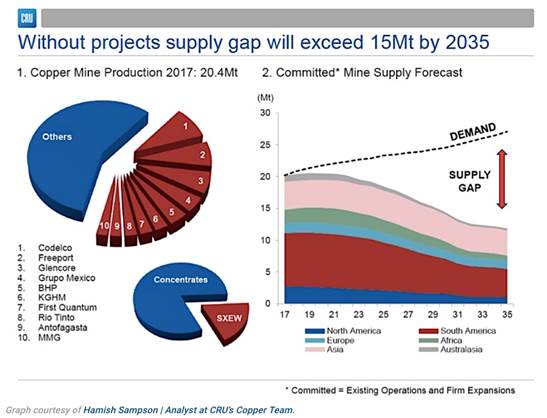

Thetop four copper companies produce around two-thirds of the metal, and the 10biggest firms produced $644 billion worth of copper in 2017 at a price of $3.10a pound, according to stats from Infomine. The top 10 copper companies are, inorder, Codelco, Freeport McMoRan, Glencore, BHP Billiton, Southern Copper, KGHMPolska Miedz, Rio Tinto, First Quantum, Antofagasta and Vale.

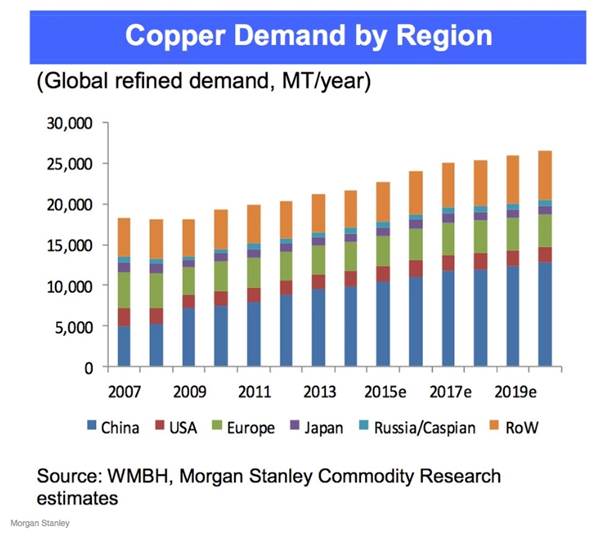

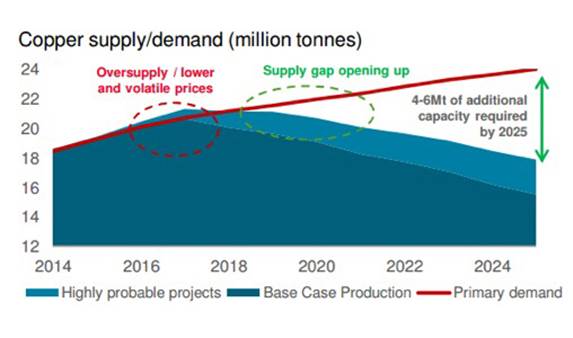

Whobuys the most copper? By far the largest copper consumer is China -representing about 50% of global demand. Due to its large manufacturing sector,the Chinese import roughly 70% of the copper they use. Other big copperconsumers are the manufacturing sectors in Europe and the United States. Globalrefined copper demand has risen steadily from 2005, when it was around 18million tonnes, to the current global consumption of about 24 million tonnes.Immediately we can see that demand is currently outstripping supply by about 4 milliontonnes, annually. More on this when we get into the details of the copperforecast.

Beforethat, let’s take a look at what happened in the copper market in 2017. Asmentioned the copper price had one of its best years, rising 27%. Supply issueswere one of the main factors driving the price up. According to theInternational Copper Study Group (ICSG) copper production declined nearly 3% inthe first five months of 2017 due primarily to a 43-day strike at Escondida,the world’s largest copper mine in Chile. Lower output from Codelco mines plusa 21-day strike at the Cerro Verde mine in Peru also tightened supply.

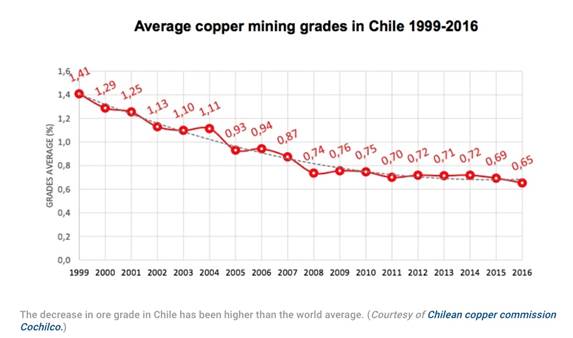

Meanwhilein Indonesia, a dispute between US-based producer Freeport McMoran and theIndonesian government saw the country implement a temporary ban on concentrateexports from the Grasberg mine. The ban was lifted three months later. Violentprotests erupted at Grasberg last August, after workers were fired for takingpart in the strike action. A resolution to the issue was finally reached inOctober, but the strikes and protests are estimated to have cost Grasberg,which produces around 3% of the world’s copper supply, a 5% decline inproduction. Canada and Mongolia each saw production declines in 2017 of about20%, according to JLT Specialty, aLondon-based insurance and risk management firm, due to lower ore grades. Inthe United States copper production also dropped by nearly 11% due to lowergrades, lower mining rates and poor weather.

Onthe demand side, copper consumption last year was driven by Chinese growth andexpectations of US demand for copper based on statements from President-electDonald Trump, who promised $1 trillion to help repair America’s crumblinginfrastructure. Soon after Trump won the election in November 2016 the copperprice rose nearly 2%.

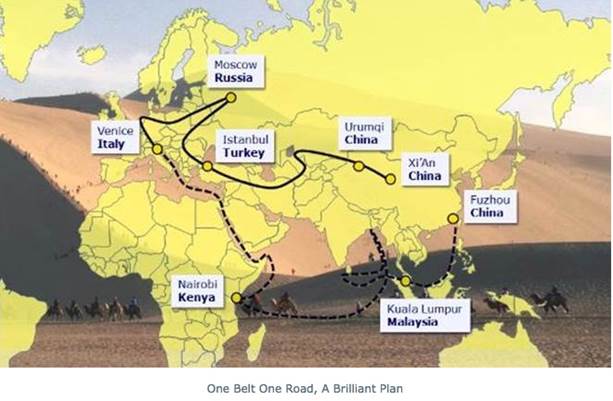

Accordingto JLT Specialty, China’s retail and industrial sectors grew a respective 10.4%and 6.9% in the first half of 2017, spurring demand for more copper. Most ofthat copper went to, and is going to, China’s power grid which accounts foralmost half of the country’s total copper requirements. The $4-trillion One Belt One Road initiative is meant to open channels between China and its neighbors, mostlythrough infrastructure investments that will require large quantities of metalsincluding copper.

Other Chinese initiatives that will help drive copperdemand include:

The Beijing-Tianjin-Hebei integration, a $1.5billion fund that promotes the government’splan to integrate the economies of Beijing and Tianjin with the surroundingHebei province. Made in China 2025initiative, which involves efforts to upgrade Chinese industry throughrobotics and “smart factories”, for example. The plan also envisionshigher-efficiency motor standards, and a more advanced railway network, all ofwhich requires more copper - an additional 232,000 tonnes by 2025. Electric cars. About375,000 EVs were made in China in 2016 according toconsultancy McKinsey & Company - representing 43% of the global market for electric vehicles.China is the leader in the supply of and demand for electric vehicles,overtaking the US in 2016. Six of the 10 biggest EV makers are in China. Asnoted above copper is a necessary component of EVs so as demand for them grows,so will the need for copper.Theforecast calls for (supply) pain

Given that China is growing (while not at doubledigits like in the 2000s, 7% is still not bad), it has grand plans forinfrastructure, and it is motivated to keep building more electric vehicles inorder to cut down on smog that is choking its overpopulated cities, what doesthe copper market have in store for investors over the next few years? Along withdemand calculations the answer should take into account inevitable stoppagesdue to strikes and weather, which happen every year without fail, thus puttingdownward pressure on supply.

Here we get some help from the USGS and theICSG, both of which offer insights into whether we are looking at a deficit ora surplus. The latest numbers fromICSG show a 3.5% increase in world copper production in January, or 60,000 tonnes, owing to: 6% more copper from Chile, arecovery in solvent-extraction-electrowinning (SX-EW) in the DRC and Zambia,and higher production in Indonesia and China.

World refined production (defined as metal containingat least 97.5 % copper by weight) was also up in January, by 5.2%, with Chinacontributing the most (an increase of 8%) due to capacity expansion. Refinedcopper production in Japan, Indonesia, DRC and Zambia also accounted for theincrease.

However on the consumption side, as of January,world apparent refined copper usage increase by around 5.5%, with China againleading the way with usage increasing by 9% due to increases in both refinedproduction and copper imports. The world refined copper balance for Januarytherefore showed a small surplus of about 33,000 tonnes.

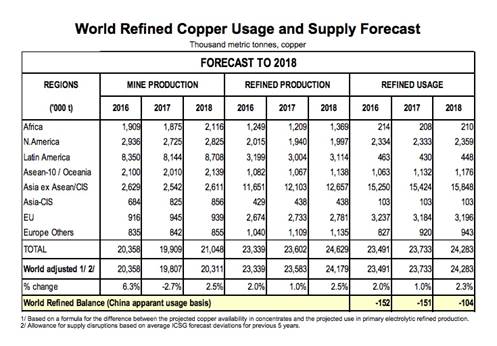

That doesn’t look like a good number for copperbulls to start the year on, but wait, it gets better. According to the ICSG’s copper marketforecast from last fall,while 2018 world mine production is expected to reach 20.3 million tonnes(+2.5%), world apparent refined copper usage will also go up, by 2%.

“Sustained growth in copper demand isexpected to continue because copper is essential to economic activity and evenmore so to the modern technological society. Infrastructural development inmajor countries such as China and India will continue to sustain growth incopper demand,” reads the forecast.

But copperdemand growth in China for all the above-stated reasons is expected to bearound 3% in 2018 for both apparent and real usage, states ICSG, with the rest of the world’s demand at 1.5%, meaning thatthere is expected to be a deficit of world refined copper in 2018 of 105,000tonnes.

ICSGreports that as of the end of March, copper stocks held at major metalsexchanges (LME, COMEX, SHFE) totalled 900,000 tonnes, an increase of 66% fromstocks held at the end of December 2017 - the highest level since 2003.

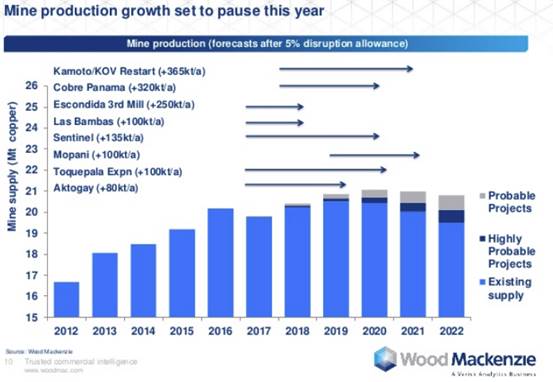

Disruptions in the copper market averaged 900,000tonnes of copper supply per year between 2004 and 2012, 2015 saw a record minedisruption of 1.33mt. Because copper is infamousfor its unpredictable supply, analysts covering copper build a disruptionallowance into their estimates, typically 5% ofglobal mined supply.

Consultancy KPMG is a little more dramatic on both the supply anddemand end, expecting global mine production to increase 5.5% in 2018, to21.3 million tonnes - leading to a surplus of 478,000t. The increases wouldcome from the new Cobre Panama mine, with capacity for 330,000t per annum, theQulong copper mine in China, at 120,000t a year. Codelco’s Radomiro mine inChile and Southern Copper’s Toquepalain mine in Peru would each contribute100,000t in 2018.

Intotal KPMG expects mine production to increase at a CAGR of 3% from 2017 to2020, reaching 22 million tonnes that year. Refined copper production wouldgrow from 23 million tonnes in 2017 to 24.6 million by 2020, driven mostly bynew refining capacity in China.

HoweverKPMG is predicting that by 2020 global copper demand will outstrip mine outputand will pull even with refined copper production. By 2020 the consultancy sayscopper consumption will reach 24.5 million tonnes “driven by growth in globalindustrial production and higher investment in energy infrastructure.” Anacceleration in demand for EVs and renewable energy over the next two years areexpected to be the main copper demand drivers.

Lookingbeyond this decade, the copper deficit widens considerably, according toexperts quoted at the 17th World’s CopperConference in Santiago, Chile in April. While supply and demand will remainrelatively evenly balanced until 2019 or 2020, after that, “the deficit willbecome increasingly evident,” MINING.com quotedArnaud Soirat, chief executive for copperand diamonds at Rio Tinto.

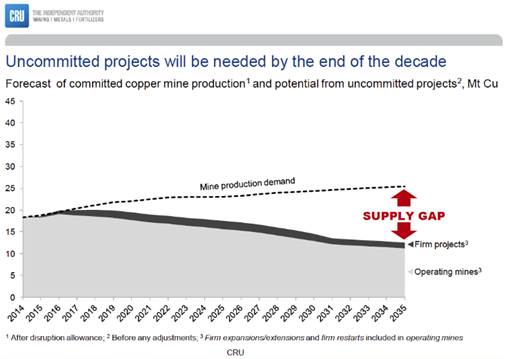

CRU analyst Hamish Sampson said unless newinvestments arise, existing mine production will drop from 20 million tonnes tobelow 12 million tonnes by 2034, leading to a supply shortfall of more than 15million tonnes. (see chart below). That’s because over 200 copper mines areexpected to run out of ore before 2035, with not enough new mines in thepipeline to take their place.

Onlyif every single copper project currently in development or being studied forfeasibility is brought online before then, including most discoveries that havenot yet reached the evaluation stage, the market could meet projected demand,the consultant said. - MINING.com

WhileRio Tinto has an extension in the works for its Mongolian copper mine, OyuTolgoi, there are few major new copper mines (except maybe Cobre Panama) beingdeveloped. The copper pipeline as of April is reportedly the lowest seen this century, althoughaccording to Hamilton, the CRU analyst, the biggest bottleneck to increasingcopper supply is existing operations. For the first 10 months of 2017 copperproduction trailed consumption by 175,000 tonnes, due to the 43-day strike atEscondida and the ban on concentrate shipments from Grasberg. A copper analystat BMO quoted by MINING.com said the world's top copper operations in 2007presently produce 10% to 15% less than they did 11 years ago, and he expectsthat trend to continue. And things aren’t expected to get better on the laborfront. Over 30 labor contracts are up for negotiations this year in Chile andPeru - the two largest copper producers - putting around a fifth of globalcopper supply at risk of disruption. So far this year there is no laboragreement in place at Escondida, the site of last year’s record-long strike andviolence. The current contract expires on July 31.

Lowerore grades are also expected to be painted into the waning supply picture. Asan example, during the first quarter, top 10 copper miner Antofagasta saw itsoutput fall by 10.5% due to lower quality ore. At the World's CopperConference, the managing director of amining-focused private equity firm said copper grades havedeclined about 25% in Chile in the last decade - highlighting the urgent need for grassroots exploration toarrest the trend.

Why everyone can’t use copper like anAmerican

Thepreceding analysis has shown that the copper market will be in relative balancefor next few years, but then demand will gradually, or perhaps dramatically,push past supply. This begs the question, with a growing population, andemerging economies, will there be enough copper to go around?

Atthis moment there are slightly over 7 billion people living on this planet. Anurbanization rate of 53% means there are roughly 3.71 billion city dwellers inthe world today. It has been estimated that by the year 2050 our globalpopulation will reach 10 billion people.

Thedeveloping world’s urban centers are expected to burgeon, drawing 96% of theadditional 1.4 billion people by 2030. Due to the overall growing globalpopulation - but especially an exploding urban population (urban populationsconsume much more food, energy, and durable goods than rural populations) -demand for water, food, housing, heat, energy, clothing, and consumer goods isgoing to increase at an astounding rate.

Wealready have one billion people out of today’s current population slated tobecome significant consumers by 2025.

Another2.8 billion people will be added to the world between now and 2050. Most willnot be Americans but they are going to want a lot of things that we in theWestern developed world take for granted – electricity, plumbing, appliances,AC etc.

Butwhat if all these new one billion consumers were to start consuming, over thenext 10 years, just like an American? What’s going to happen to the world’smineral resources if one billion more ‘Americans’ are added to the consumingclass? Here’s what each of them would need to consume, per year, to live theAmerican lifestyle…

In2010, more than 38,000 pounds (19 tons) of minerals and fuels were needed perperson to maintain the American lifestyle.

Onebillion new consumers by 2025. Can everyone who wants to, live an Americanlifestyle? Can everyone everywhere else have everything we in North Americahave? The answer is a resounding no!

Ifwe mined every last discovered, and undiscovered, pound of land-based copper,the expected 8.2 billion people in the developing world would only get threequarters of the way towards copper use parity per capita with the US.

Ofcourse the rest of us, the other 1.8 billion people expected to be on thisplanet by 2050, aren’t going to be easing up, we’re still going to be usingcopper at prestigious rates while our developing world cousins play catch up.

Copperuse parity isn’t going to happen, it can’t.

“Concern about the extent of mineral resources ariseswhen the stock of metal needed to provide the services enjoyed by the highlydeveloped nations is compared with that needed to provide comparable serviceswith existing technology to a large part of the world’s population. Our stock data demonstrate that currenttechnologies would require the entire copper and zinc ore resource in thelithosphere and perhaps that of platinum as well. Even a lower level ofservices could not be sustained worldwide because a continuing supply of new metal is neededto make up for inevitable losses in the recycling of the metal stock-in-use.

Substitution has the potential to ameliorate thissituation, but one should not automatically assume that technology will producea satisfactory substitute for every service at an affordable price andprecisely when needed.

…anthropogenic and lithospheric stocks of at leastsome metals are becoming equivalent in magnitude, that world-wide demandcontinues to increase, and that the virgin stocks of several metals appearinadequate to sustain the modern ‘‘developed world’’ quality of life for allEarth’s peoples under contemporary technology…Do we really envision a developedworld quality of life for all of the people of the planet…?” R.B. Gordon, M. Bertram, and T. E. Graedel, Metal Stocks and Sustainability

Need for discoveries

Itshould be apparent by now, that in order to improve the supply-demand imbalanceand delay, or maybe even avoid, the coming copper crunch, there needs to be alot of new copper exploration done. All the low hanging copper fruit has beenpicked - either mined, refined or recycled - so where are new economic copperdeposits to be found? Once again we return to the annual industry conference inSantiago, Chile. According to conference organizer CRU, the supply gap requiresthat every copper mining project with a feasibility study is developed, andover 90% of new projects “see the light of day”, Investorintel reports.

Thepublication identifies a few trends as far as copper exploration that couldhelp to build up the development pipeline:

Major mining companies that slashed exploration budgets during thelean years 2012-16 have restored those budgets and have more to spend onjuniors.Copper exploration teams are too focused on getting quick resultsusing computer data and are losing the art of geoscience to find deposits. With capital costs for new copper projects high, mining companiesare teaming up to bring them down. An example is BHP and Rio Tinto’s JV to developthe Resolution Copper project in Arizona.Conclusion

Thedaily movements of the copper price give some idea of short-term globaleconomic fundamentals, since copper is such an important metal for industrialuses. Demand for copper is a good indication of the relative strength of theeconomy in question. However it takes a higher-level, longer-term view to seewhat’s really happening in the copper market. And what’s happening is thatcopper supply is NOT going to be able to keep up with demand in the long-term.

Evenwith expansions at existing mines and the ramp-up of the relatively few newcopper mines like Cobre Panama, Radomiro and Toquepalain, it will not be enoughto meet the onslaught of demand that is coming from China as it continues tomodernize and urbanize, and electric vehicles, which use three times as muchcopper as regular ones. In 2016, Chinese carmakers sold 28 million cars. IfChina follows through on its promise to go 100% electric, that would mean2,380,000,000 kilograms of copper. At the current production rate of 20 milliontonnes a year, that’s 119 years worth of copper! Just to produce enough copperfor electric cars in China.

DoI expect 100% EV penetration? No, I don’t. But the shift to electrification ofour transportation system is real, it’s not going to go away or stop. Becauseit’s as real as the shift from wood to coal to fossil fuels and now to lithium.That means massive new copper supplies are needed just for Chinese EV’s,whatever the EV penetration eventually turns out to be. And remember there’sthe rest of the world to supply for EV’s and all of coppers other uses.

Bottomline? We gotta find more copper. Preferably Tier 1 assets, aka copper“elephants”. I’ve got my eye on junior copper developers (and I’ll be introducingthem very soon in my newsletter) that can help to fill the massive deficit thatis coming the market’s way. Do you?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2018 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.