The Correlation Between Interest Rates And Gold

Conventional wisdom states the following: When the Fed raises interest rates, the USD will strengthen and demand for dollar-denominated commodities such as gold will decline. This is true (theoretically speaking) because gold is a non-interest-bearing commodity that cannot compete with fixed-interest-bearing securities. Additionally, a strengthening USD means that foreign buyers of gold will be required to spend more of their own currency for the equivalent ounce of gold. As such, demand for gold typically moves in the opposite direction to rising interest rates.

At the start of 2017, US economic sentiment was bullish. This was largely the result of Trump Trade and the renewed confidence that consumers and investors had in the US economy. Positive sentiment was a direct result of calls for decreased taxation, deregulation, fiscal expansion, monetary tightening, a policy of America first, tightening of immigration laws, and protectionism of US trade and industry. Many of these policy agendas will not be fulfilled, but speculators used Trump's campaign promises as cannon fodder to ignite the markets. This is precisely what happened. We saw the Dow Jones Industrial Average surging to 21,000, the NASDAQ composite index rallying to record levels, and the S&P 500 making laudable gains.

Performance of Gold in Recent Days

However, one commodity was paring gains in a big way: Gold. With all the euphoria surrounding the election of Donald Trump, and his first 100 days in office, gold traders were not seeing the 20% + appreciation in the price of gold that they saw in Q1 and Q2 of 2016. In fact, gold was far from the best-performing commodity of all, with 6-month gains of just 3.56% (May 21 2017), and 30 day losses of 2.24%. It's interesting to point out that gold has appreciated in 13 of the last 16 years in USD terms. The strongest annual gains for gold came in 2007 at the inception of the global financial crisis, when gold shot up 30.9%. While gains in 2017 have been modest, growth in gold demand is strong at 12.1% in USD terms (year-on-year).

Failure To Ignite Spurs Gold Rally

All the hullabaloo around Trump's failure to unify the GOP with the new health care bill, immigration shortcomings and dwindling popularity have also affected the financial markets. Now, we are seeing banks and financial stocks falling, and Wall Street indices retreating sharply from their January highs. On Wednesday, 17 May 2017, global bourses retreated by 1.8%. This was fueled in large part by the horrific handling of communications on the Jim Comey affair. President Trump has been hamstrung in his efforts to drain the proverbial swamp, and his firing of the FBI director has thrown his presidency into a tailspin. Calls for impeachment, purported collusion with the Russians, and other ignominious charges are dogging the presidency.

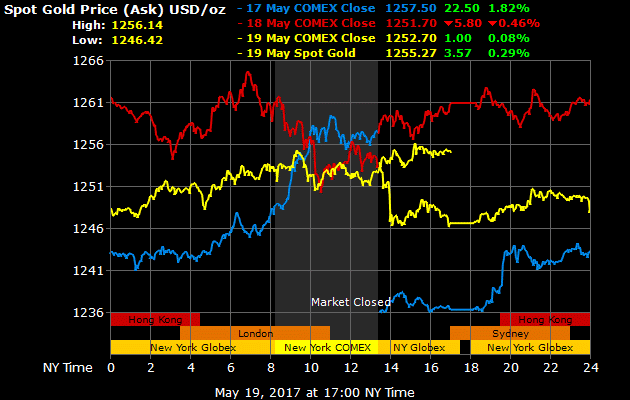

Naturally, the one beneficiary of this risk-off approach to equities is gold. Global bourses have since turned the corner after the midweek crisis, but nobody's quite sure which way gold is going to move. The precious metal is now trading at, $1,255.27 per ounce. It is approaching that critical $1,300 per ounce level, and this bodes well for those involved in gold CFD Trading. As a CFD trader, it's not necessary to buy physical gold stocks or shares to profit off price movements. CFD traders simply speculate on the price by buying or selling gold options accordingly. These are known as derivative trades and they are driven by speculative sentiment.

The correlation between gold and interest rates is an interesting one. Sometimes the relationship holds true. In other words, increased interest rates give rise to lower gold demand and lower gold prices. Gold and interest rates actually have a negative relationship, and it comes in the form of inflation. Inflation and interest rates are positively correlated. In other words when the Fed decides to increase interest rates, inflation rises. When the real interest rate is rising, gold demand will fall, but when the real interest rate is falling, gold demand can rise. What we are seeing now is the Federal Funds Rate increasing, but real interest rates are falling.

Historical charts may point to a causal relationship between rising interest rates and falling gold prices, but many times gold will rise before interest rates rise, indicating that that relationship is not necessarily linear or clear. When rates rise, investors are more likely to transfer money from gold to fixed-interest-bearing securities. This drags down the price of gold. Rising interest rates also make it more expensive for listed companies to pay off their loans. This decreases profitability and should in theory decrease share prices. If this holds true, a risk-off approach should be adopted to equities markets in favour of fixed-income securities or gold as a hedge asset.

********