The Dark Cloud Hanging Over the S&P's Monthly Win Streak

The S&P 500 Index (SPX) gained about 2% in October and is now riding a seven-month win streak. Since the March 2009 bottom, there have been two other streaks of that length, neither of which reached eight months. The first streak reached seven months in September of 2009, but then the S&P 500 was down about 2% in October. The last streak happened in May of 2013, only to see the index fall by 1.5% in June. This week, I'm looking at previous streaks to assess the chances of this streak lasting longer.

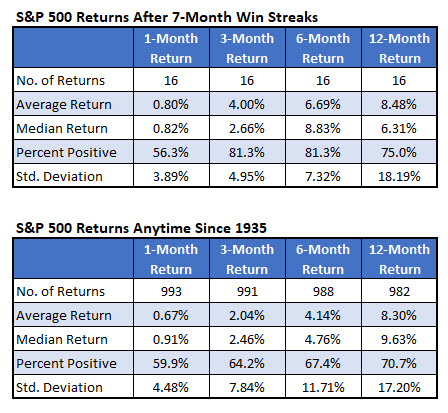

Seven-Month SPX Win Streaks

We have S&P 500 data since 1929. Since then, there have been 16 other seven-month win streaks. The first streak occurred in 1935, so I have typical data since then. Interestingly, the next month doesn't seem much different from any other month. The three- and six-month returns outperform typical returns when looking at average return and percent positive. When you get to 12 months, the returns after these streaks are almost identical to typical market returns.

Below is data on the individual winning streaks. I mentioned that the last two streaks ended at seven months. However, four of the last five streaks saw the S&P 500 gain double-digits over the next six months. The one time it didn't, it was still up 6%.

One thing that stands out is that the S&P 500 has gained just 9% during the current streak. That is the lowest of all the streaks. The two tables below break down the returns going forward based on how much the index gained during the streak. There were six occurrences when the index failed to gain 16%. After these streaks, the index was positive every time six months later, averaging a gain of 9.19%. One year later, the index was up an average of 14.29%, and positive five of six times.

The S&P 500 has done much better when the returns are moderate during the winning streak. The other 10 streaks saw the index gain at least 20%. In these instances, the S&P 500 averaged a return of just 5% over the next year. Based on this data, there might be plenty of gas left in the tank for more gains going forward.

Incorporating Sentiment to SPX Win Streaks

Since 1964, we've been collecting data on the Investors Intelligence (II) sentiment survey. It's a survey of published investor newsletters determining the percentage of them that were bullish or bearish going forward (there's also a third designation of those expecting a correction). The poll is used as a contrarian indicator. That is, when the poll shows a lot of optimism, expect the implications to be bearish and vice versa. The data below supports this interpretation.

There have been 10 streaks since 1964. In five of those, the percentage of bulls, according to the survey, was at least 50%. In those cases, the S&P 500 averaged a return of 5.62% over the next six months and less than 4% over the next year. When the percentage of bulls was not at 50% after seven straight positive months, the index averaged an 8.46% return over six months and almost 14% over the next year. Unfortunately, the most recent poll showed an extreme amount of optimism, with 62% of the newsletters bullish.

In conclusion, on the bright side, the modest gain during the last seven months points to bullish returns going forward from here. Hopefully, this factor trumps the influence of investor sentiment, which is extremely bullish. The bullish sentiment has typically led to underperformance.