The Diamond Trade's Provenance Challenge

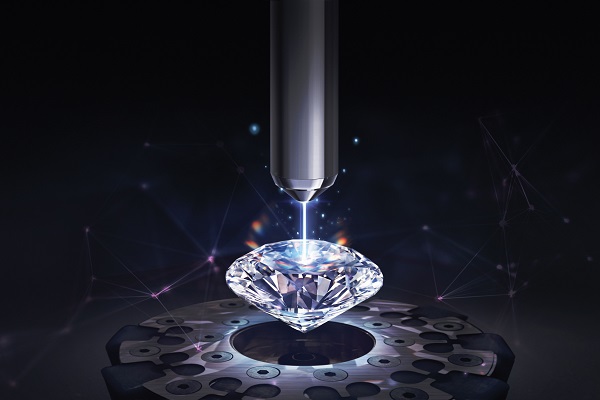

RAPAPORT... Source-verification programs are poised to become a standard feature of diamond sales, with early adopters set to gain market share.The question of whether a diamond could be traced throughout the distribution chain initially met with some skepticism. Back in 2011, as rough production from Zimbabwe's controversial Marange fields was being cleared for export by the Kimberley Process, the goods were still banned in the United States (as they remain today). It was therefore necessary to separate the Marange goods during the production process if manufacturers were to continue supplying both the US market, and jewelers in other centers that were willing to buy the Zimbabwe rough.Back then, manufacturers gave contrasting responses on whether such separation was possible, as factories tended to aggregate their supply from different mines into size and quality categories. Today, we know it is indeed possible, thanks to technology such as radio-frequency identification (RFID).But what happens once the diamond leaves the factory? Or even before it arrives from the mine?With millennials raising the bar when it comes to ethical consumption, these questions need to be answered. In fact, millennials are not so much demanding that the diamonds they buy be responsibly sourced, as assuming it to be the case.That tells us two things: First, the cost of not being able to vouch for your supply is extremely high, and second, consumers value the story of traceable diamonds if it is told to them.That's not to say such diamonds will sell at a premium in the long term. Rather, we expect that source-verification programs, with innovative marketing behind them, will become a standard feature of diamond sales. In that sense, today's early adopters are setting themselves up for success. In the October issue of the Rapaport Research Report, we try to identify the added value these programs provide. We also assess the most effective ways to trace a diamond, focusing on some of the more innovative programs available today.Are blockchain systems, which record the data flow associated with the diamond, enough, or should we focus on programs attempting to track the physical stone? Would it be more productive for retailers to build their own platforms to trace their diamond supply back to the source? Or is it better for miners, manufacturers, and third parties such as the grading labs to provide tracking services that retailers can tap into?The last year or two has brought examples of all of the above, many of which are still in the pilot phase and likely to need some fine-tuning. It's encouraging that the trade is engaged in this conversation. The diamond and jewelry industry needs to satisfy ethically conscious millennials and keep up with consumer trends. And even if it's unclear whether a traceable diamond can sell at a higher price than a non-traceable one, source verification is a necessity moving forward; it's simply the right thing for the industry to do. This article first appeared in the October edition of the Rapaport Research Report. To download a copy of the report, click here and login with your username and password, or learn more and subscribe today.Image: Chow Tai Fook laser-inscribes diamonds for its T Mark program. (Chow Tai Fook)

RAPAPORT... Source-verification programs are poised to become a standard feature of diamond sales, with early adopters set to gain market share.The question of whether a diamond could be traced throughout the distribution chain initially met with some skepticism. Back in 2011, as rough production from Zimbabwe's controversial Marange fields was being cleared for export by the Kimberley Process, the goods were still banned in the United States (as they remain today). It was therefore necessary to separate the Marange goods during the production process if manufacturers were to continue supplying both the US market, and jewelers in other centers that were willing to buy the Zimbabwe rough.Back then, manufacturers gave contrasting responses on whether such separation was possible, as factories tended to aggregate their supply from different mines into size and quality categories. Today, we know it is indeed possible, thanks to technology such as radio-frequency identification (RFID).But what happens once the diamond leaves the factory? Or even before it arrives from the mine?With millennials raising the bar when it comes to ethical consumption, these questions need to be answered. In fact, millennials are not so much demanding that the diamonds they buy be responsibly sourced, as assuming it to be the case.That tells us two things: First, the cost of not being able to vouch for your supply is extremely high, and second, consumers value the story of traceable diamonds if it is told to them.That's not to say such diamonds will sell at a premium in the long term. Rather, we expect that source-verification programs, with innovative marketing behind them, will become a standard feature of diamond sales. In that sense, today's early adopters are setting themselves up for success. In the October issue of the Rapaport Research Report, we try to identify the added value these programs provide. We also assess the most effective ways to trace a diamond, focusing on some of the more innovative programs available today.Are blockchain systems, which record the data flow associated with the diamond, enough, or should we focus on programs attempting to track the physical stone? Would it be more productive for retailers to build their own platforms to trace their diamond supply back to the source? Or is it better for miners, manufacturers, and third parties such as the grading labs to provide tracking services that retailers can tap into?The last year or two has brought examples of all of the above, many of which are still in the pilot phase and likely to need some fine-tuning. It's encouraging that the trade is engaged in this conversation. The diamond and jewelry industry needs to satisfy ethically conscious millennials and keep up with consumer trends. And even if it's unclear whether a traceable diamond can sell at a higher price than a non-traceable one, source verification is a necessity moving forward; it's simply the right thing for the industry to do. This article first appeared in the October edition of the Rapaport Research Report. To download a copy of the report, click here and login with your username and password, or learn more and subscribe today.Image: Chow Tai Fook laser-inscribes diamonds for its T Mark program. (Chow Tai Fook)