The Dutch Central Bank Explains The Official Sector Opinion Of Gold

Gold went through a dark time at the turn of the century.

Central banks are gold's leading proponents.

A quiet love for the yellow metal.

The Dutch make the case.

GDXJ will outperform gold on the upside.

Gold is money. The yellow metal has been around as a means of exchange long before there were dollars, euros, yen, pounds, yuan, or any of the other currencies of the world today. The role of gold as an instrument of exchange precedes the Bible.

If you have never held a pure gold bar or one-ounce gold bar in your hand and put it up to a light source, I highly recommend doing so. The density and shine are addictive. The metal embodies wealth, stability, and security. The properties of gold are the reasons that central banks all over the world hold the metal as the ultimate reserve asset.

The US dollar may still be the world's reserve currency, but the US government is the leading holder of gold with a horde of over 8,000 metric tons. Approximately 190,000 tons of gold have been extracted from the crust of the earth throughout history. Central banks hold over 30,000 tons of that metal, and many consider it their most significant asset.

Gold's bull market began just after the turn of this century. After reaching a record high in 2011, the price corrected and consolidated. In June, the next leg of the bull market got underway when the price broke out of a five-year trading range. When gold decides to take off to the next new high, gold mining shares are likely to outperform the price action in the futures market. Junior gold miners tend to attract lots of interest when the price of gold is appreciating. The VanEck Vectors Junior gold Miners ETF product (GDXJ) is a diversified instrument that holds shares in many of the leading junior gold mining companies.

Gold went through a dark time at the turn of the century

The turn of this century was far from a golden era for the yellow metal that has captured humans for thousands of years. London is the home of the international bullion market. The Bank of England played the role as the overseer of the gold market for decades. The BOE also holds gold bullion for nations around the world.

In the late 1990s, the leadership of the United Kingdom, together with the Bank of England decided that gold had become a relic of the past. The central bank believed that holding currencies that provide a yield would be a far superior approach to manage the assets of the nation.

In their infinite wisdom, the decision-makers in the UK arranged to sell half of their gold reserves in a series of auctions. In the interest of transparency, they announced their intentions. The price of gold fell to a low at just over $250 per ounce, and the average sales price of over 300 tons of gold was at a sub-$300 level. Gold lost its luster as the nation that was the leader of the bullion market sold off its national treasure. They were alone, and when the sales were completed, the price began to move higher. Eleven short years later, the price of gold rose to a high at $1920.70 per ounce, over seven times higher than the UK's average sales price.

At the time of the sale, the Chancellor of the Exchequer was Gordon Brown. The market dubbed the low in gold, the "Brown Bottom." In 2007, when gold was breaking out to the upside, the British removed him from his duties managing the nation's finances. The British made Gordon Brown the Prime Minister, perhaps to keep him away from the rest of the country's depleted gold supply.

Gold went through a rough time at the turn of the century but entered a golden age of appreciation in the years that followed.

Central banks are gold's leading proponents

The year that Gordon Brown became the Prime Minister of the UK, gold traded to over three times the price as his average sale. Three hundred tons of gold was worth $2.894 billion in 2000. In 2007 at $848, the same amount of the yellow metal had a value of $$8.179 billion. The UK taught central banks around the world a lesson in value at the turn of this century.

These days, central banks are net buyers of gold at a price that is six times higher than in 1999 and 2000.

Source: CQG

The chart highlights the insulting path of the price of the yellow metal for the British since the 2000 low. Almost two decades later, a dozen of the world's central banks bought at least a ton of gold over the eight months of 2019. Two central banks have been increasing their reserves for years, and that continues this year. Russia and China are both significant gold producing nations. In 2018, Chinese gold output was just shy of 400 metric tons, and Russia was third behind Australia with 281.5 tons of production. The Chinese and Russians have been absorbing domestic production like vacuums over the past years. At the same time, both have been buying gold in the international bullion market.

The world's central banks have learned from the Brown Bottom and are proponents of the value of holding gold as a reserve asset. The International Monetary Fund reports gold holding each month and classifies the asset as a foreign exchange reserve. The supranational institution with approval from the world's governments looks at gold as a currency.

A quiet love for the yellow metal

The old saying that "silence is golden" has a long history as does the metal. The proverb dates back to ancient Egypt. In Latin, the saying was silentium est aurum. In 1831, the poet Thomas Carlyle translated it from German into English in his novel Sartor Resartus ("The Tailor Retailored"). In Carlyle's novel, it reads as "Sprecfien ist silbern, Schweigen ist golden" or "Speech is silver, silence is golden."

Central banks have long been silent about gold holdings. While the Fed, ECB, Bank of Japan, and other central banks often speak about monetary policy, economic conditions, and other assets, they are often silent on the topic of gold. However, prominent central bankers have shed light on their opinion of the yellow metal at times. Alan Greenspan, the Chairman of the US Federal Reserve from 1987 through 2006, wrote in a 1966 essay, "In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value."

Commentary on gold by the world's central bankers are few and far between. They typically dodge any questions related to the yellow metal. When I ran an international gold dealing business in the late 1980s and 1990s, I borrowed gold from central banks around the world. The transactions were highly secretive, and the officials demanded the utmost discretion. Recently, a prominent central bank opened a window to its opinion on the value of the yellow metal as a reserve asset.

The Dutch make the case

The Netherlands is the world's ninth leading holder of gold bullion with 612.5 metric tons. The Dutch hold more than India and less than Japan, the eighth leading holder of the precious metal. In a recent article, the Dutch Central Bank, De Nederlandse Bank, said, "If the entire system collapses, the gold stock provide a collateral to start over. Gold gives confidence in the power of the central bank's balance sheet. That give a safe feeling." The Dutch are not alone; the top six holders of gold in the world are the United States, Germany, Italy, France, Russia, and China.

The Bank of England, under Gordon Brown, made a tragic mistake in 1999 and 2000 when they sold have the nation's prized possession. No central bank is likely to follow that lead given the results. If holding gold as part of a portfolio is the right move for nations, it is equally essential for individuals.

GDXJ will outperform gold on the upside

Gold's bull market dates back to the turn of the century when the sale of the precious metal by the UK triggered a blow-off low. The bull market took the price above the 1980 to a peak of $1920.70 in 2011. After a correction to $1046.20 in 2015, gold remained in a consolidation range until June 2019, when it broke out to the upside. The next leg of the bull market got underway over the past months, but markets rarely move in a straight line. At just under the $1500 per ounce level at the end of last week, gold is consolidating once again.

Over the past months, gold moved to new all-time highs in most currencies except for Swiss francs and US dollars. However, the price moved higher in both those currencies, and it may just be a matter of time before the price challenges all-time highs in francs and the greenback. Moreover, the policies of the central banks that hold the gold support its ascent. Interest rates are once again falling around the world. Governments have become addicted to accommodative monetary policy to stimulate economic growth. Dovish monetary policy eats away at the value of fiat currencies, which is highly supportive of gains in the price of gold.

Central banks can push interest rates below zero percent. They can print fiat currency to their heart's content. However, the gold supply can only come from the crust of the earth or above-ground stockpiles. As the Dutch central bank said, "the gold stock provide a collateral to start over" during a crisis in fiat currencies.

Extracting gold from the crust of the earth is the business of gold mining companies around the world. An investment in the shares of these companies amounts to a leveraged long position in the gold market. Gold mining shares typically outperform the price action in the gold market on the upside and underperform on the downside. The junior gold mining companies tend to be more leveraged than the senior and more established producing companies. The VanEck Vectors Junior gold Miners ETF product holds a diversified portfolio of junior gold mining shares. GDXJ mitigates some of the risks of concentration that comes from owning a long position in a single company. The most recent top holdings of GDXJ include:

Source: Yahoo Finance

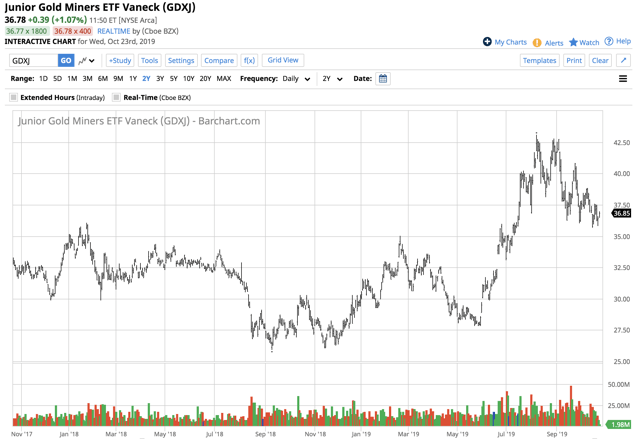

GDXJ is a highly liquid ETF product with $4.18 billion in net assets and an average of over 17.6 million shares changing hands each day. The product charges an expense ratio of 0.54%. The price of gold rose from $1266 in April to a high at $1559.80 in early September, a move of 23.2%.

Source: Yahoo Finance

Over the same period, GDXJ moved from $27.80 to $43.10 per share or 55% higher. GDXJ is likely to outperform the price action in the gold market on a percentage basis if the price is heading to new highs over the coming weeks and months.

The Dutch central bank, in a rare admission, told the world why the yellow metal is an essential reserve asset for governments. If gold is the preferred asset for the governments of the world, it is undoubtedly an asset that should be in all portfolios. GDXJ is a tool that can turbocharge results during periods of price appreciation.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.The author is long gold

Follow Andrew Hecht and get email alerts