The elephants driving US bond yields

In today's INK Research US market comments, we noted that insiders in the American insurance industry were an upbeat bunch, in stark contrast to the Utilities sector insiders who remained on the canvass following the December drop in the Utilities SPDR ETF (XLU). As we wrote, it is probably a reasonable assumption to make that at least part of insider behaviour towards those two groups incorporates expectations of higher bond yields. In Canada, we see a different picture.

The Fed may not be the only elephant in the US bond market room

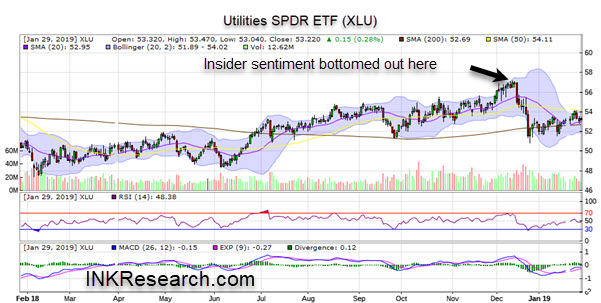

American insiders in the Utilities sector are currently more interested in profit-taking than bargain hunting. As the Utilities SPDR ETF was peaking in early December, our sector indicator bottomed which meant there was peak insider selling. The indicator has recovered only modestly since. Consequently, this morning we downgraded the sector to an overvalued reading.

US Utilities insiders remain downbeat (click for larger)

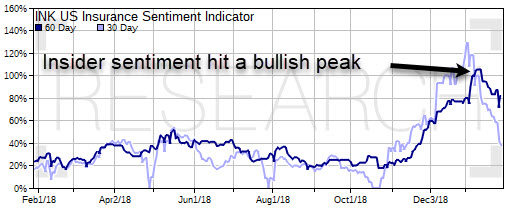

Meanwhile, insider insiders are upbeat about the prospects for the US insurance industry with our sentiment indicator moving to over 100% earlier this month. Seeing American insider sentiment over 100% is not something we see every day and is a high conviction positive signal.

American insurance insiders may be anticipating higher bond yields

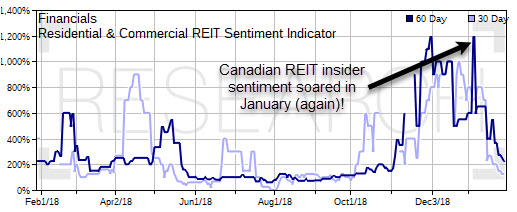

Although the Canadian insurance and utilities groups are too small to get a good handle on insider sentiment in these two interest sensitive areas, the REITs Industry is large enough to track. Everything else being equal, REITs should benefit as mortgage rates fall. As we wrote in our January 21st Canadian market report (Canadian Insider Club link), if credit spreads have peaked along with long-term rates, real estate stocks and REITs should benefit. Canadian REIT insiders appear to be betting on lower-for-longer rate days ahead. Our Canadian Residential and Commercial REIT Indicator started off the New Year with a peak at 1,200%, meaning there were 12 REITs with key insider buying for every one with selling.

Canadian REIT insiders are bullish

With Federal Reserve Chairman Jerome Powell on deck this afternoon to hold a press conference, we may get our first chance to see if such expectations of higher US bond rates are justified. If the Fed's recent backtracking on interest rate hikes is not complemented with a reversal in its desire to reduce its balance sheet, fixed income investors may well lean towards shorter duration securities such as T-bills or 2-year notes at the expense of Treasurys. In contrast, the Canadian central bank does not have a bloated balance sheet to worry about, right now.

Moreover, the Fed's balance sheet is not the only elephant in the American room. There is also the US federal debt which continues to expand at a vigorous pace. In its latest projections Monday, the Congressional Budget Office described it this way,

Deficits remain large by historical standards, and federal debt grows to equal 93 percent of GDP by 2029.

The federal Canadian government debt situation pales in comparison. With neither the US nor Canadian economies expected to shoot the lights out over the next few years, growing US government bond supply could well help drive yield spreads between US and Canadian bonds higher. While several factors will determine bond yields at any given time, we are not in the camp that dismisses the impact of supply. At some point, the looming supply of Treasurys is likely going to matter. In fact, bond yield considerations may already be at play given that US bond yields are the highest in the developed world right now.

If we are right and widening US Treasury bond yields becomes driven by looming bond supply, this will have major implications for cross-border investors. If yield differentials favouring the US reflect repayment or monetarization risk more than relative sustainable economic strength, the US dollar is unlikely to benefit. Canadian investors who are banking on a weaker loonie over the next few years to help boost US-dollar based returns may be in for a disappointment.