The end of the global diversified miner?

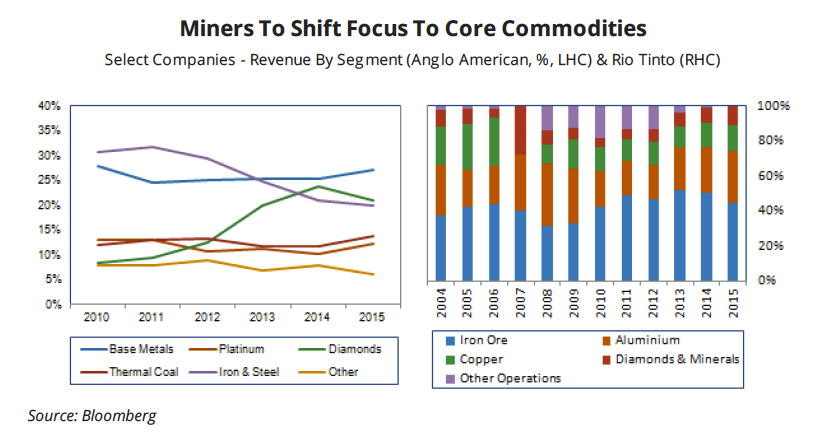

Driven by low commodity prices, large mining companies will shift away from diversification strategies to concentrate on increasing competitiveness in specific sectors, predicts research firm BMI.

The process is already underway at the top diversified firms including at number one miner BHP Billiton which back in 2014 embarked on what it called "portfolio simplification" to focus on iron ore, copper, coal and petroleum and potentially potash.

Severe debt distress has prompted a much more radical overhaul at number five miner Anglo American where only three divisions may survive - copper, diamonds and platinum. Mines will be cut from 55 to just 16.

Miners will "increasingly surrender to a 'lower for longer' price outlook, which would result in further significant divestment of assets, output cuts and bankruptcies"Among its peers Anglo, thanks in part to a history dating back more than 100 years in the world's most well-endowed mining region, was arguably the most diversified. But spreading your risk among many commodities achieves little if prices are falling across the board.

And if Anglo's program to concentrate its focus is successful, ironically another kind of diversification risk will become apparent - it would earn more than half its profits from just one geographical region.

Faced with similar debt pressures Glencore has been shedding billions in assets although founder Ivan Glasenberg is a strong believer in diversification and likes to point out competitors reliance on iron ore compared to the balanced portfolio of the Swiss trader and world number four miner.

Source: BMI

If Vale finds the buyer for its nickel operations it has been seeking, the Rio de Janeiro-based company will become a pure iron ore play like Australia's Fortescue Metals. When prices were higher number two Rio Tinto relied on the steelmaking raw material for three-quarters of earnings. At BHP it was more than half.

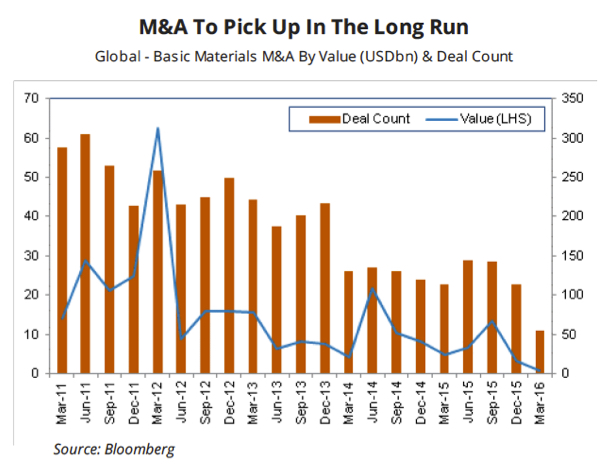

In the report BMI forecasts that merger and acquisition activity will pick up over the next three to five years and miners' divestment programs would continue, but "this would only be a temporary measure to improve the companies' cost structures and increase operational margins in the short term".

Over the longer term miners would increasingly focus on core operations and acquire assets within their field of operations to drive down costs and enhance competitiveness. Capital expenditure will focus on key brownfield projects and expansion of existing higher-margin business rather than building new mines from scratch. - -

BMI says small and mid-tier mining firms will have an even harder time of it and warns of the "increasing potential for an emerging market corporate debt crisis in 2016, given the parlous state of high-yield bonds in the US, rising dollar interest rates, slow growth and elevated emerging market private sector leverage."

While the negative impact on mineral supply of this consolidation trend would be positive for commodity prices, BMI expects that it would take longer for resource equities to come back into favour.

As for the improvement in market sentiment and the rally in metal prices since the start of the year, BMI does not see it lasting and "commodity prices would remain low over the coming quarters on the back of a persistently oversupplied market."

The authors of the report forecast consolidation among large global mining companies and while commodity prices are likely to bottom this year miners will "increasingly surrender to a 'lower for longer' price outlook, which would result in further significant divestment of assets, output cuts and bankruptcies."

Source: BMI