The Everything Bubble Will See 6%-10% Inflation Imminently

Tom Beck, editor of Portfolio Wealth Global, discusses why he believes inflation will increase and steps investors can take to protect themselves.

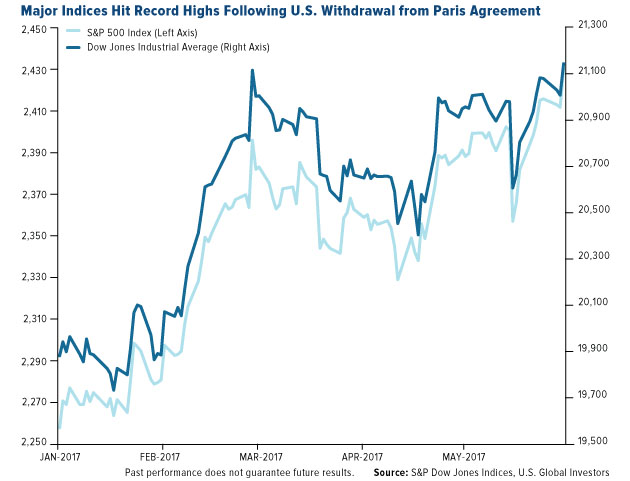

If last week's Paris Agreement taught us anything, it is that when there's a strong trend in place, it takes a bubble bursting to clear it out of the way.

The U.S. withdrew from the agreement, which basically means that instead of being the poster boy for democracy, progress, climate reform, and peace in the world, which they did not help in the past, but at least presented themselves to, Trump's administration is now sending a clear signal: we are protectionists.

Portfolio Wealth Global wants you to fully realize what's at stake here. The U.S. has been the champion of globalism. It has exported government credit to the tune of trillions in exchange for oil, goods, services, manufactured items, and more. Everything except for technology is created outside of the U.S. today.

This same country that enjoyed free trade and ballooned a credit monster the likes of which no other nation has done before is now practically telling the bond holders that the joke is over, and they're not laughing.

But the market doesn't care it is hooked on dividend yield and simply buys more U.S. equities.

For eight years, the game has been to prevent deflation.

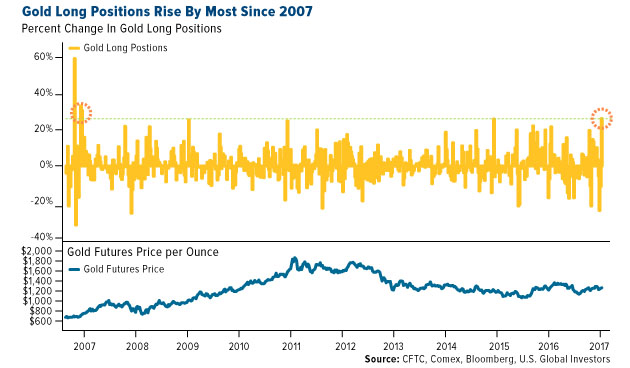

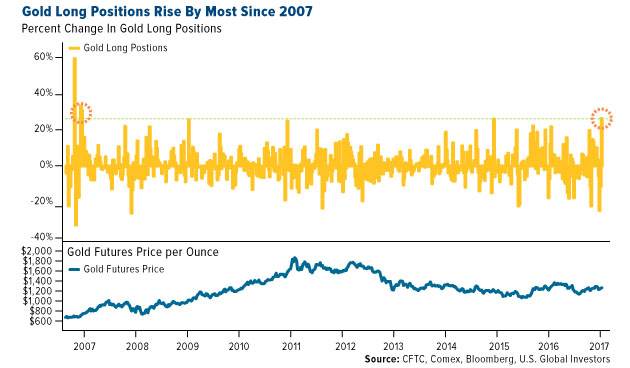

Because of the "wealth effect" of 2008-2011, precious metal stocks went on an unbelievable tear, but then deflation kicked in and we've seen gold contract all the way from $1,900 to lows in the $1,100s. Today, the deflation scare is all but gone.

Though nearly all precious metal investors are discouraged, especially seeing teenagers make $3,000 every month from digital codes called cryptocurrencies, and though we've made huge calls, like our Monero, Steem (1,100% in three months), and others, these gains are unsustainable.

Government taxation, the issuance of national cryptocurrencies, and other risks will put a cap on this trading bubble.

Instead, focus on the red meat: the real economy.

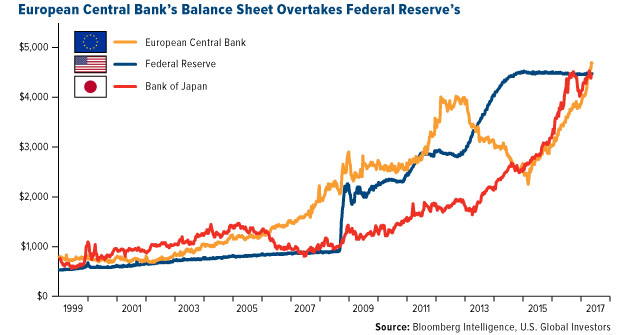

The European Central Bank is increasing its balance sheet, as the deflationary scare in the aging continent isn't over.

What is happening now is that the U.S. is hiking interest rates because they're reaching maximum employment levels and maximum corporate margins both of which are signs of inflation.

Portfolio Wealth Global has shown you how to earn high yields of 8% in deflationary times, but now I want you to realize that yields won't matter.

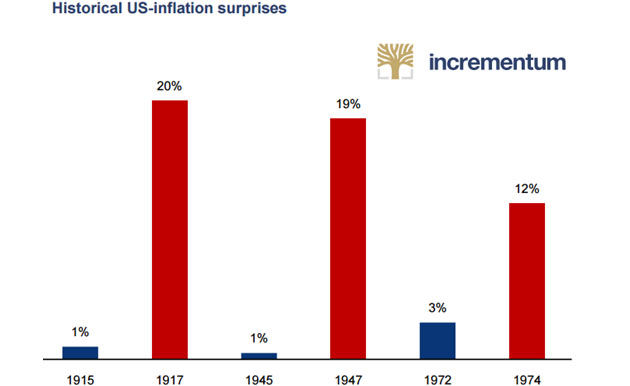

Inflation is an elusive animal and hard to contain, mostly because it's consumer-based and Trump's policies are deterring free trade, thus trillions of dollars will begin to hit the market and find their way into the U.S. banking system.

This is how quickly today's low inflation levels can turn into a nightmare for us.

At Portfolio Wealth Global, we're anticipating gold to break through resistance at $1,300 before we become aggressive with stock suggestions, but the theme is clear: the "everything bubble" is becoming inflationary.

What you should do now, if you haven't already, is consider underweighting deflationary assets and instead own overweight inflationary assets.

If the Fed raises rates in June, the market will see this as a clear signal of the transition in fact, it already has.

Now's the time to educate yourself completely and thoroughly on the timeless investment principles of success and prepare for a breakout in commodities.

Trump's policies, including cutting taxes and creating infrastructure reform, but mostly his protectionist programs, are sealing the fate of global trade and ushering in a new era.

Immerse yourself in detailed research and prosper.

Tom Beck is senior editor of Portfolio Wealth Global. Known as one of the first millennial millionaires in the United States, Beck is a relentless idea machine. After retiring two years ago at age 33, he's officially come out of retirement to head up Portfolio Wealth Global. He brings a vision of setting a new record for millionaires with his seven-year plan to accelerate any subscribers' net worth who will commit to the income lifestyle. Beck delivers new ideas on the marketplace that were once only available to the rich. Traveling the world, he's invested in over a dozen countries, including real estate.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Tom Beck: I, or members of my immediate household or family, own shares of the following companies referred to in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies referred to in this article: None. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts courtesy of the author