The Fed Says Inflation Is Too Low - Diversified Commodity ETFs Agree, But Gold Does Not

The Fed cited low inflation as justification for a rate cut.

The cost of living is rising.

Inflation measures - an art rather than a science look at gold in all currencies.

DBC - commodity prices are low.

Other commodity ETFs agree - the Fed and other central banks could go too far.

In the world of economics, inflation is a general increase in prices and fall in the purchasing value of money.

Economists regularly measure inflation to access the state of the economy. Cost-push inflation occurs when supplies force prices higher. In inflation caused by rising grain prices during a poor harvest is an example of cost-push inflation as harvests are not sufficient to meet demand. Demand-pull inflation happens when demand increases faster than supplies. When too much money chases too few goods, inflationary pressures increase. Double-digit economic growth in China caused the price of copper to rise to $4.6495 per pound in 2011, an all-time high. The demand for the red metal as construction projects to build infrastructure boomed is an example of the impact of demand-pull inflation.

Central banks fear inflation. In the aftermath of WW1 in 1923, French and Belgian troops occupied the industrial region of Germany in the Ruhr valley to ensure reparations payments. When workers in the Ruhr went on a general strike, and the German government began printing more money to continue paying a condition of hyperinflation occurred. The economic situation led to the rise of the Nazi Party in the 1930s and WWII. There are many other examples of how inflation destroyed governments. The latest example is the Venezuelan economy where inflation was at 80,000% in 2018 and is higher this year. Inflation can be an ugly beast, but central banks look for just enough inflation to stimulate the economy.

Even though central banks from the leading economies around the world have been following a mostly accommodative approach to monetary policy, the rate of inflation remains below the 2% target rate. Commodity prices are a significant input when it comes to measuring inflation. The Invesco DB Commodity Index Tracking Fund (DBC) holds a diverse basket of commodities futures contracts that can reflect the impact of inflationary pressures.

The Fed cited low inflation as justification for a rate cut

At its June meeting, the US Federal Reserve said that one of the reasons for its plan to cut the Fed Funds rate before the end of 2019 was that inflation remains below its 2% target rate.

Aside from low inflationary pressures, the Fed also cited "uncertainties" related to "crosscurrents" in the global economy from China and Europe. The Chinese economy continues to experience a slowdown as the trade dispute with the US weighs on China's economy. In Europe, the potential for a hard Brexit on October 31 now that Boris Johnson is the Prime Minister of the UK has increased. The Chinese economy, economic weakness in Europe, and low levels of inflation create an environment where the Fed is likely to reduce the Fed Funds rate by 25 basis points at the July 31 FOMC meeting. The Us central bank could push the short-term rate even lower before the end of this year.

The cost of living is rising

I have a hard time with the Fed's characterization of inflationary pressures. My cost of living, along with the expenses of people all over the US, continues to rise. Health care and educational expenses are rising by far more than 2% on an annual basis. While the prices of many commodities on the futures exchanges are not moving dramatically higher, the price tag for my weekly basket of groceries has done nothing but move higher. At the same time, energy bills have also moved to the upside dispute the price action in the oil, natural gas, and electricity markets. Therefore, from my perspective, I feel the pressure of rising prices and inflation even though the Fed tells us that inflation is below its target level. I would hate to think what my weekly and monthly bills will look like if inflation rises above the central banks desired rate.

Inflation measures - an art rather than a science look at gold in all currencies

The primary inflation gauge for the Federal reserve is the price inflation measure for personal consumption expenditures (PCE) that comes from the Department of Commerce. PCE covers a "wide range of household spending." Meanwhile, the central bank also incorporates other metrics such as CPI and PPI from the Department of Labor in its calculations.

The Fed's measurement of inflation seems to be a bit like a soup where ingredients can vary from period to period. Therefore, the measure lacks a degree of consistency, which makes it more of an art than empirical science.

Meanwhile, when looking at inflation, gold has been a significant historical barometer of the purchasing power of not only the US dollar but other world currencies.

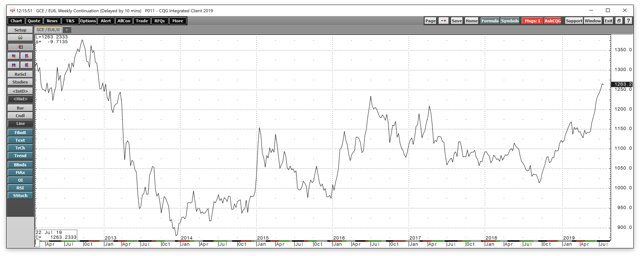

Source: CQG

The weekly chart highlights that the price of gold moved from $1222.20 to $1411.60 or almost 15.5% higher on a year-on-year basis from late July 2018 to the same time of the year in 2019.

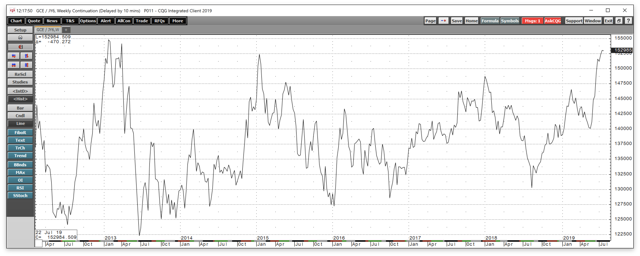

Source: CQG

Gold in euro currency terms moved from 1044.66 to 1263.20 or 20.9% higher over the same period.

Source: CQG

Gold in Japanese yen terms moved from 135,229 to 152,895 or over 13% higher over the same period. Gold has posted double-digit percentage gains in most currencies from last year at this time, which is a sign that the purchasing power of all foreign exchange instruments has declined. A drop in purchasing power is the textbook definition of inflation.

DBC - commodity prices are low

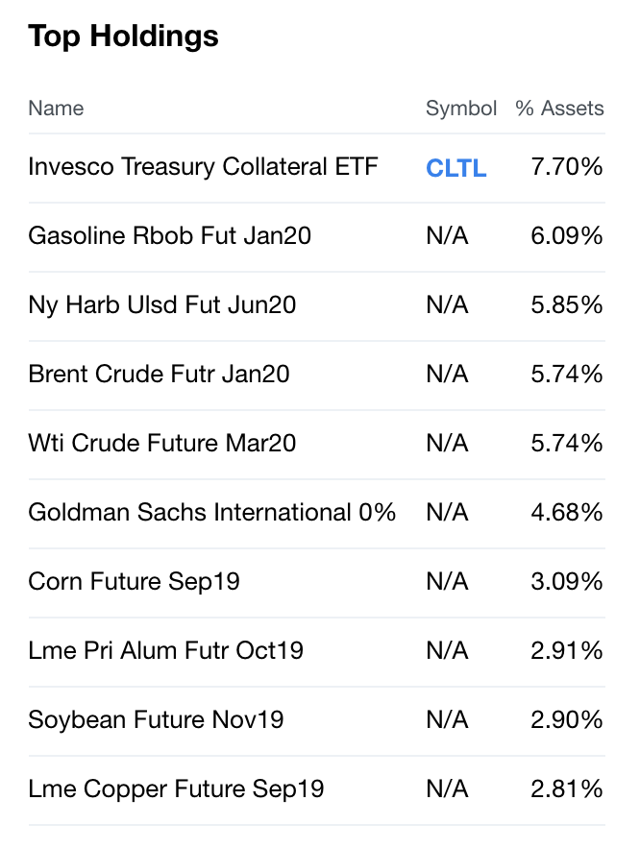

When it comes to one of the leading diversified commodity ETF products, the Invesco DB Commodity Index Tracking Fund that has $1.61 billion in net assets and trades over 925,000 shares each day on average, the ETF is not displaying any inflationary pressures. The top holdings of DBC include:

Source: Yahoo Finance

The price action in DBC on a year-on-year basis shows a low level for commodity inflation.

Source: Barchart

On July 25, 2018, DBC closed at $17.32 per share and was at $15.53 on the same day in 2019, a decline of 10.3%. Meanwhile, one of the factors that weigh on ETF products like DBC that hold futures contracts is that the contango or forward premium weighs on the value of the ETFs as administrations roll positions from one active month to the next.

As an inflationary gauge, DBC is telling us that there is deflationary rather than inflationary pressures when it comes to the current year-on-year performance as of July 25.

Other commodity ETFs agree - the Fed and other central banks could go too far

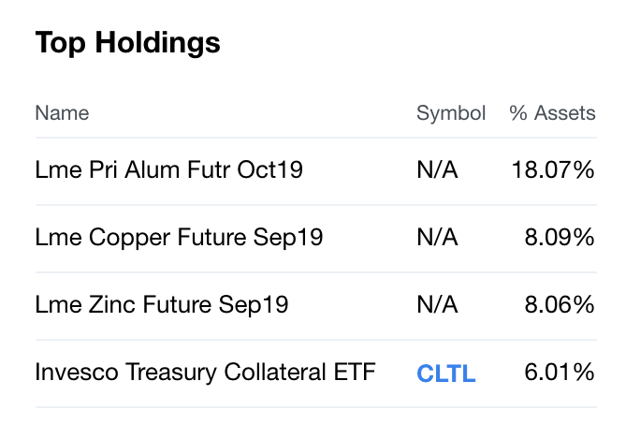

DBC is weighed towards energy commodities which skews results. However, two other commodity ETF products also indicate deflationary rather than inflationary pressures under the same conditions. The Invesco DB Base Metals Fund (DBB) has net assets of $130.23 million and trades over 104,000 shares each day. DBB's top holdings include:

Source: Yahoo Finance

Copper, aluminum, and zinc are the leading industrial nonferrous metals, and the path of least resistance of those prices reflect inflationary pressures.

Source: Barchart

The chart shows that from July 25, 2018, to July 25, 2019, DBB moved from $16.80 to $15.44 per share or 8% lower.

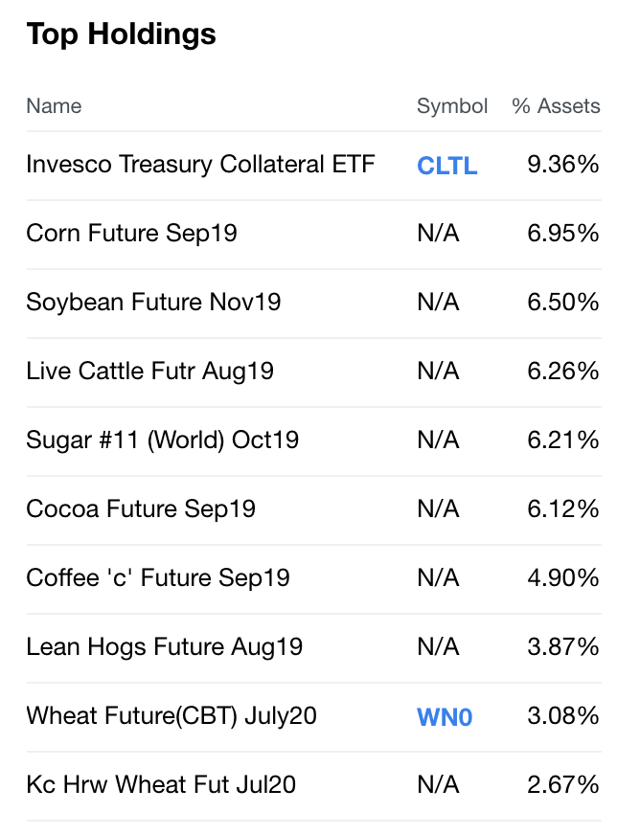

The Invesco DB Agriculture Fund (DBA) has net assets of $420.23 million and trades over 310,000 shares each day. DBA's agricultural portfolio of futures includes:

Source: Yahoo Finance

DBA holds a host of agricultural products including grains, meats, and soft commodities.

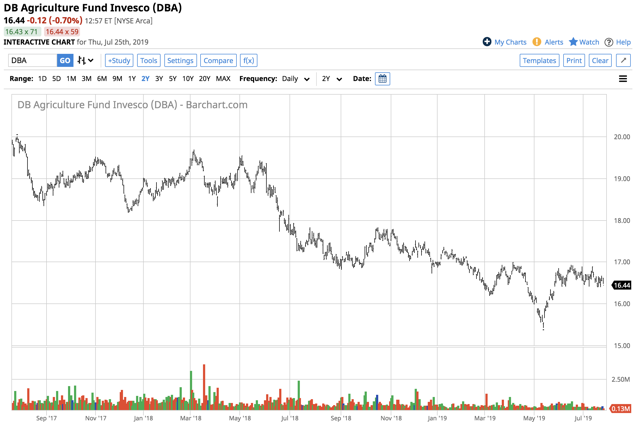

Source: Barchart

On a year-on-year basis from July 25, 2018, to July 25, 2019, DBA moved from $17.67 to $16.44 per share or 6.96% lower over the period.

The trends in the three commodity ETF products reflect a snapshot of deflationary price action in industrial metals, energy, and agricultural raw materials from July 25, 2018, through the same date in 2019. Therefore, the Fed's assessment of inflation based on wholesale commodities prices seems correct. However, the move to the upside in the price of gold is a warning sign for the central bank. As gold has appreciated in all currency terms, lower US interest rates over the coming months and a continuation of historically low rates of interest around the world run the risk of inflating economies dramatically.

Gold is a market that moves higher or lower on the back of the market's sentiment in the form of investment demand. The price action in the gold market could be a harbinger of future inflationary pressures based on the projected policies of central banks. Since the US Fed is the leading monetary authority in the world, gold's response to guidance that the Fed Funds rate will be declining is significant. At the same time, the program of balance sheet normalization in the US will end in September, which will take any upward pressure off of interest rates further out along the yield curve.

The Fed is concerned about the current low level of inflation in the US and global economies. At the same time, the ECB provided guidance that rates in Europe are likely to head lower. Lower interest rates could light a bullish fuse under all commodities prices. We could see a reversal in many sectors of the raw material markets when it comes to prices in the aftermath of a shift to accommodative monetary policy in the US.

The bottom line is that the Fed needs to be careful what it hopes for as commodities are one of the most volatile asset classes. The US central bank runs the risk of much higher raw material prices in the aftermath of a move to address low inflation. Once commodities prices begin to move on the upside, it is often difficult to slow them down. At the same time, inflation is a challenging beast to tame once it gets hold of economies. Gold is the one commodity telling us that extreme caution is in order. Dovish central bank policy has created mountains of debt via cheap and easy money. Gold is a traditional barometer of inflation, but the Fed and other monetary authorities around the globe are ignoring the precious metal, for now.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Follow Andrew Hecht and get email alerts