The FOMC Meeting And What It Means For Gold And Silver

The Federal Reserve cut interest rates again by 25 basis points and so the new target range is 1.75% to 2%.

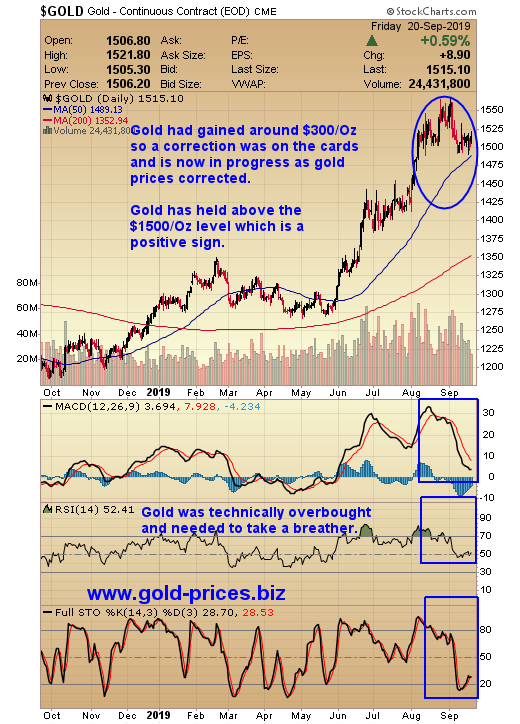

Gold prices fell to around $1485/Oz before recovering some of the losses to close at around $1515/Oz.

The ECB are doing the same thing and have also re-introduced QE and as we know money knows no borders, so more money into the global financial system.

Buy these dips with both hands as this bull market is only just beginning.

Introduction

The FOMC monthly meeting has just concluded and predictably the Federal Reserve cut interest rates again by 25 basis points and so the new target range is 1.75% to 2%. They also guided that there was a possibility of one more rate cut by the end of the year.

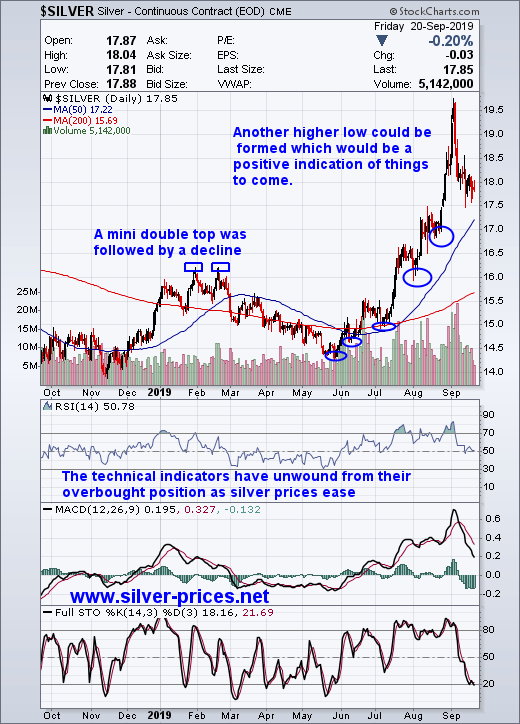

The immediate reaction was that the S&P 500 fell dramatically before recovering to close at 2992. The US Dollar rose 0.32% to close at 98.14. Gold prices fell to around $1485/Oz before recovering some of the losses to close at around $1515/Oz and silver prices followed suit falling to around $17.50/Oz before regaining some of those losses to close at $17.85/Oz

It should be noted that interest rates across the globe are either negative or close to zero as each central banker tries to remain competitive with other nations. This race to the bottom by all concerned has the effect of cancelling or negating what other central banks have done and so the benefit tends to be negated.

As we have previously noted if you live in Denmark and take out a negative rate mortgage you have the benefit of paying off the capital without interest and your lender also pays some of the debt for you. This situation cannot last as sooner or later there will be a spate of bankruptcies in the financial sector.

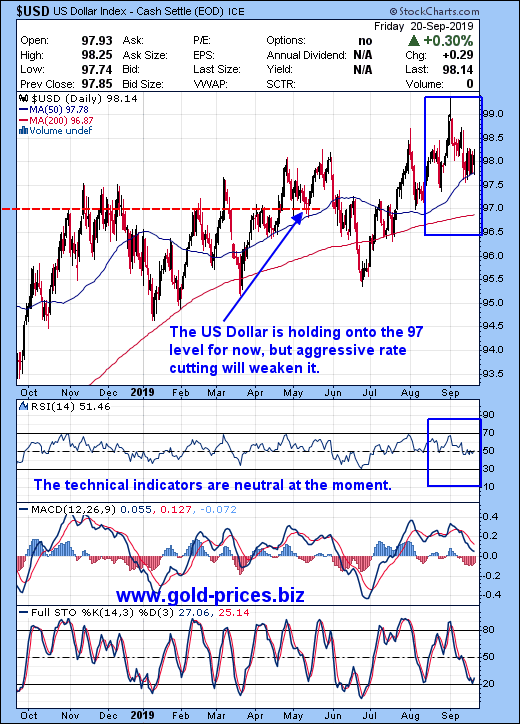

The US Dollar Chart

As the chart shows the US Dollar held its ground and it is managing to remain above the support level of 97, for now.

The Gold Chart

As the chart depicts gold prices had been in an overbought position and was taking a breather. The week during which the FOMC meet is always difficult for gold but as we can see gold recovered very well indeed to close the week on a high note.

The Silver Chart

The technical indicators have unwound from their overbought position as silver prices ease, they were firmly in the oversold zone suggesting that a correction would be on the cards, which is now playing out. It should also be noted that silver rallied a tad higher towards the end of Fridays trading session to close around $17.97/Oz.

Conclusion

We now have cheaper borrowing costs in the US with the possibility of more rate cuts to come in the near term. This is nothing more than printing which eventually devalues the value of the US Dollar.

The Federal Reserve are also under pressure from the President, Donald Trump who has said that the chairman, Jerome Powell, has "no 'guts,' no sense, no vision!" It is difficult not to imagine that the Fed are not influenced a tad by such comments.

The ECB are doing the same thing and have also re-introduced QE and as we know money knows no borders, so this action puts more money into the global financial system.

As this race to the bottom in currencies continues, hard assets including gold and silver will be the beneficiaries. As they increase in price the producers will experience massive improvements to their profit/loss accounts.

Silver in particular is a small market and the gold/silver ratio appears to be out of kilter as it stands at around 84. Should this ratio return to a more normal figure of around 60 then silver prices would appreciate dramatically when compared to gold prices which we also expect will do very well indeed.

Buy these dips with both hands as this bull market is only just beginning.

Got a comment, then please fire it in whether you agree with us or not, as the more diverse comments we get the more balance we will have in this debate and hopefully our trading decisions will be better informed and more profitable.

If you are not already a Follower and wish to see our posts on gold, silver and the associated stocks, then please hit the follow button in order not to miss out.

Take good care

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer:http://www.gold-prices.biz/ makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is neither a guide nor guarantee of future success.

Follow Bob Kirtley and get email alerts