The Fuel Of The Future That's 9 Times More Efficient Than Lithium / Commodities / Energy Resources

The worldwide shift toward cleaner, greenerenergy sources once again appears to be picking up speed.

While the world’s focus on climate changeunderstandably took a backseat to the Covid-19 pandemic for most of the past 18months, that focus on climate change has started to return in a powerful way.

In fact, our transition into a post-pandemicenvironment is triggering a number of significantopportunities in the green energy space.

Much of the early attention of the cleanenergy movement was focused on lithium thanks to the heavy attention paid tothe electric vehicle markets.

But a stark reality has emerged for lithium inthat it has become increasingly obvious that lithium may not be able to provideenough power to support a full transition of heavier industries to clean andsustainable energy sources.

Many of these “heavy” industries – includingthe maritime and shipping industries – have already begun to search foralternatives that can help power a sustainable future.

One of those alternative energy sources –which appears to have the potential to provide a tremendous amount ofindustrial power – may be something you had never considered: ammonia.

Ammonia Could Be a key “Fuel of the Future”

The experts at Chemical & Engineering News havecalled ammonia a fuel of the future that may be “a perfect commodity for a future hydrogen economy.”

And one company could emerge as a leader in the rapidly-growing Green Ammoniaspace…

Offering early exposure and a possible first-mover advantage for investors.

That company is AmmPower (CSE:AMMP; OTC:AMMPF).

AmmPower is aCanadian company aiming to provide large and medium sized ammonia producingunits for industry, manufacturing, heavy equipment operators, maritime andshipping.

In other words, AmmPower is looking to positioning itself as anearly leader in supplying Green Ammonia to those industries that need it most.

And make no mistake – the global ammoniaindustry is at this very moment in the early stages of a potentially massivegrowth phase thanks to ammonia’s extraordinary potential as a clean energyalternative.

Ammonia May Hold 9 Times the

Energy of Lithium-Ion Batteries

Before diving into what we think are AmmPower’s (CSE:AMMP; OTC:AMMPF) bold steps forward in thisrapidly-growing industry, let’s take a step back to examine ammonia’s potentialas an energy source.

Ammonia, of course, is a compound made ofnitrogen and hydrogen – with a chemical formula of NH3.

It is produced naturally in the human body andin nature – in water, soil and air...even in tiny bacteria molecules.

Of course, ammonia’s main use – at least atthe present time – is in fertilizer.

But it may be rapidly emerging as apotentially game-changing source of clean energy.

Chemical& Engineering News reports that, “ammonia could come tothe (climate change) rescue by capturing, storing, and shipping hydrogen foruse in emission-free fuel cells and turbines. Efforts are also underway tocombust ammonia directly in power plants and ship engines.”

Ammonia offers a number of critical advantagesover other energy sources, such as:

Ammoniais reported to have 9 times the energy density of lithium-ion batteries...Ammoniais less flammable, easier to transport and more cost effective than many otherfuels... Ammoniais reported to have 1.8 times the energy density of hydrogen...Andammonia needs to be stored at -33 Celsius, as compared to the more logisticallycomplex -253 Celsius that is required for hydrogen storage.The potential for ammonia to play asignificant role in the global transition to cleaner energy sources appears tobe gaining recognition on a wider scale.

The industry analysts at Fior Markets projectthat the global ammonia market is expected to continue its growth, reachinga potential USD $81.42 billion by 2025.

In addition, a joint venture in oil-rich SaudiArabia has announced plans to invest $5 billion into a hydrogen-based ammonia facility powered by renewable energy…

And an Oman-India JV has announced plans for a $2.5billion green ammonia project in the DuqmSEZ.

Ammonia’s Potential in the Marine Industry

The global marine industry is a large, readilyavailable market that has already begun turning to ammonia to help meet itsenergy needs.

Ship owners and industry analysts alike saythey expect ammonia may play a pivotal role in the de-carbonization of cargoships, which aim to reduce emissions by 50% from 2008 levels by 2050.

Over120 ports are already equipped with ammonia trading facilities...MANEnergy and Samsung Heavy Industries are part of an initiative to develop thefirst ammonia-fueled oil tanker by 2024...VikingEnergy is poised to become the first vessel propelled by ammonia fuel cells...Andaccording to one consultancy report, ammonia could make up 25 percent of themaritime fuel mix by midcentury, with nearly all newly built ships running onammonia from 2044 onward.The future of energy for the global shippingindustry looks clear – and it could be heavily dependent upon ammonia.

With a commitment to significant reduction incarbon emissions, that means the clock is ticking.

We think ammonia’s potential as both a fuelsource and as a way to transport hydrogen means that investors could see significantopportunities in those companies who establish early leadership positions inthe ammonia space.

And that’s precisely what AmmPower (CSE:AMMP; OTC:AMMPF) isaiming to do.

How AmmPower Plans to Develop Effective, Efficient Production ofGreen Ammonia

So, what steps are they taking that could help establish the company as an early mover in therapidly-growing ammonia market?

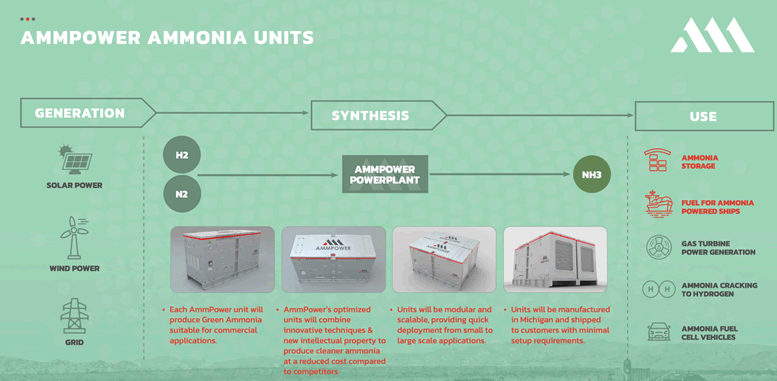

AmmPower isworking on the development of a potentially proprietary technology to produce“green ammonia,” a potential carbon-free energy source.

In fact, the company has publicly identifiedthree clear objectives to that end:

1. It aimsto develop a proprietary process and chemicals for developing green ammoniawith minimal by-products and residual contaminants.

2. Itplans to design and manufacture modular and scalable green ammonia productionunits, capable of delivering green energy onsite. The units are intended to be a disruptorfor the fertilizer industry, by allowing the fertilizer industry to go green,and eliminate CO2 emissions.

3. Ifdevelopment of the units is successful, it intends to scale production toreadily provide industry operations with ammonia manufacturing units.

The company’s research and development teamhas already begun its important work toward the development of a proprietaryproduction process for green ammonia.

AmmPower’s R&D team is led by Dr. V.I. Lucky Lakshmanan Ph.D., FCAE.,MIMM., FCIM and has an experienced track record.

They are aiming to develop intellectualproperty and file patents in the areas of Green Ammonia units,retro-fit technology and an optimized chemical production process for greenammonia.

AmmPower (CSE:AMMP; OTC:AMMPF) isalready making major moves in the space.

In addition to searching for a manufacturing facility in Michigan…

AmmPower is…

AmmPowerPhase I Units (3 Sizes) — 0.1 to 1.0 Tons/Day

Aimingto retro-fit equipment for industryCreatingpotential custom production plants for Maritime & Port applications.This facility could offer large manufacturingcapabilities and large power capacity for onsite ammonia production andexperimentation.

In addition, the facility may be able tophysically expand into larger manufacturing space as required by customerdemand and scientific success.

The company’s research and development wasfurther enhanced by the recent announcement of an R&D agreement withProcess Research Ortech, Inc.

As part of this partnership, AmmPower will work with Ortech to explorepossible techniques to improve the efficiency of ammonia synthesis process byincorporating new additives and catalysts to the production process and testingdifferent methodologies to improve ammonia formation conditions.

In doing so, they hope to develop a cleaner and more economically efficientammonia production process.

With critical research and development workalready starting, we think AmmPower is moving quickly to take advantage of thepotential for Green Ammonia as a significant clean energy source.

Now here are...

7 Reasons Why We Think You Should Consider the Potential for AmmPower (CSE:AMMP; OTC:AMMPF) Right Now

1. The global clean energy movement is movingquickly – and shifting toward more efficient sources of energy at the sametime...with ammonia emerging as a potentially significant energy source.

2. Some reports project the global ammoniamarket will continue growing rapidly, reaching USD $81.42 billion by 2025.

3. We think AmmPower is emerging as an early-mover in the space, working todevelop proprietary technology that may produce cleaner ammonia moreefficiently.

4. The company’s highly accomplished research& development team has an experienced history.

5. AmmPower is actively engaged in the process of securing a manufacturing facility inMichigan that offers capacity for onsite manufacturing of the company’sproposed ammonia producing units.

6. We think by targeting the marine industry –with over 120 global ports currently accepting ammonia – AmmPower could focus initially on the “low hanging fruit” offeredby industries demonstrating the biggest need for cleaner energy sources.

7. The company is aiming to develop its modularprototypes by Q4 2021.

By. Rick Sidthorp

**IMPORTANT! BYREADING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READCAREFULLY**

Forward-LookingStatements

This publicationcontains forward-looking information which is subject to a variety of risks anduncertainties and other factors that could cause actual events or results todiffer from those projected in the forward-looking statements. Forward lookingstatements in this publication include that the global demand for ammonia andhydrogen as commodities will continue to increase; that the research anddevelopment in the energy sector will lead to adoption of hydrogen and ammoniaas commercially viable fuel sources for the automotive, aircraft, marine,industrial or other sectors in the future; that governments will continue toimplement initiatives supporting reduced carbon emissions and that ammonia andhydrogen will gain traction and commercial viability as potential carbon-freeor low carbon fuel alternatives; that AMMP will be able to develop an efficientprocess and proprietary intellectual property for the production of greenammonia and that AMMP’s process, if developed, will be adopted commercially toallow use of green ammonia and/or hydrogen as a viable fuel sources; that AMMPwill meet its proposed development program and funding milestones to developits technology process and produce the proposed AMMP power units; that AMMPwill be able to establish its proposed manufacturing facility and produceammonia power units which will be sold as commercially viable fuelalternatives; that investors will continue to seek opportunities for investmentin green technologies and that hydrogen and ammonia will be considered asviable investment opportunities in the future; and that AMMP can carry out itsbusiness plans. These forward-looking statements are subject to a variety ofrisks and uncertainties and other factors that could cause actual events orresults to differ materially from those projected in the forward-lookinginformation. Risks that could change orprevent these statements from coming to fruition include the global demand forammonia and hydrogen may not actually continue to increase if other energy alternativessuch as solar, wind or hydroelectric are favored over ammonia and hydrogen;that the research and development in the energy sector may lead to rejection ofhydrogen and ammonia as commercially viable fuel sources for the automotive,aircraft, marine, industrial or other sectors in the future, and that researchmay find that other fuels or energy sources provide safer, more cost efficientand/or more viable fuel alternatives; that governments may not implement theanticipated funding and initiatives to support reduced carbon emissionssufficient for ammonia and hydrogen to gain necessary traction or commercialviability as fuel alternatives; that AMMP may be unable to develop an efficientprocess or any unique proprietary intellectual property for the production ofgreen ammonia or, even if developed, may ultimately fail to be adopted ascommercially viable for various reasons; that AMMP may be unable meet itsproposed development timeline and funding milestones to develop its technologyprocess and produce the proposed AMMP power units; that AMMP may be unable toestablish its proposed manufacturing facility and produce ammonia power units,or if such units are developed, that they may not be sold as commerciallyviable fuel alternatives; that investors favour other clean energyopportunities than hydrogen and ammonia or that other fuel alternatives such assolar, wind and hydroelectric may be considered more commercially viable; andthat AMMP may, for any number of reasons, fail to carry out its intendedbusiness plans. The forward-looking information contained herein is given as ofthe date hereof and we assume no responsibility to update or revise suchinformation to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communicationis for entertainment purposes only. Never invest purely based on ourcommunication. Oilprice.com, Advanced Media Solutions Ltd, and their owners,managers, employees, and assigns (collectively, “Oilprice.com”) are being paidninety thousand USD for this article as part of a larger marketing campaign forCSE:AMMP. In addition, AMMP has issued 500,000 restricted stock units toOilprice which will unconditionally convert to common shares after 4 months.The information in this report and on our website has not been independentlyverified and is not guaranteed to be correct.

SHARE OWNERSHIP.The owner and affiliates of Oilprice.com own shares and/or other securities ofAMMP and therefore have an additional incentive to see the featured company’sstock perform well. Oilprice.com is therefore conflicted and is not purportingto present an independent report. The owner and affiliates of Oilprice.com willnot notify the market when it decides to buy more or sell shares of this issuerin the market. The owner of Oilprice.com will be buying and selling shares ofthis issuer for its own profit. This is why we stress that you conductextensive due diligence as well as seek the advice of your financial advisor ora registered broker-dealer before investing in any securities.

NOT AN INVESTMENTADVISOR. Oilprice.com is not registered or licensed by any governing body inany jurisdiction to give investing advice or provide investment recommendation,nor are any of its writers or owners.

ALWAYS DO YOUROWN RESEARCH and consult with a licensed investment professional before makingan investment. This communication should not be used as a basis for making anyinvestment.

RISK OFINVESTING. Investing is inherently risky. Don't trade with money you can'tafford to lose. This is neither a solicitation nor an offer to Buy/Sellsecurities. No representation is being made that any stock acquisition will oris likely to achieve profits.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.