The Gold and Silver Markets Have Changed... What About You? / Commodities / Gold & Silver 2020

We tend to spend a lot of timelooking into the rearview mirror, especially when under duress.

Connected to this is somethingpsychologists call "recency bias." This simply means that what hashappened in the near to intermediate past tends to inform and influence us asto how we should behave in the future.

The 2011 to early 2019 precious metals bear saga was broken only by a six-month bullhiatus in early 2016 – which then gave most of the rise back over the next twoyears!

Now, in spite of some verypowerful evidence to the contrary, the general investing public still questionsboth the validity and upside potential of physical precious metals and theshare prices of producing miners.

My premise today is that thephysical gold and silver market has fundamentally changed. And if you intend togear up for and stay on this evolving multiple-year historic run, you had bestdo the same.

Significant increases indemand – especially in the West – tend to begin subtly with large purchase andstorage by high net-worth individuals.

Over the last year or so, goldand silver ETF share inflows (which are supposed to be backed by growingamounts of metal) have been surging, setting monthly records time after time.In just the last two years, silver bullion held in trust by these ETFs hasrisen from a 22-million-ounce loss in 2018, to an 81.7-million-ounce gain lastyear... and ETF holdings are still marching higher.

Ounces vaulted under the SLV,which holds almost one-half of the silver owned by the world's ETFs, ispublished daily and has become a must-follow item for speculators and investorsalike. As such, the Trust's mission of mirroring the metal's price serves as aproxy for silver investment demand.

By the middle of July, asreported by Adam Hamilton, SLV held over 516 million ounces of silver! Adambelieves that this current rise is caused by institutional investors, statingthat this "near-vertical holdings build has been highly consistentand disciplined. It has happened whether silver is rising,falling, or grinding sideways."

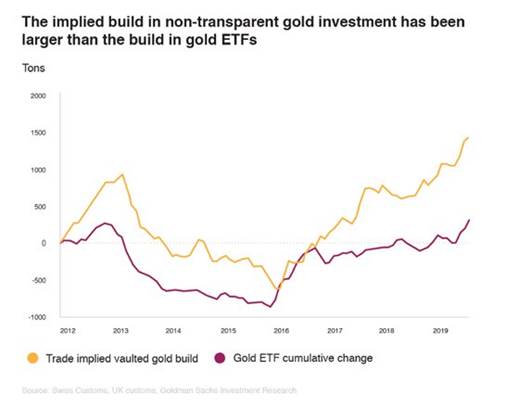

There is an interestingdiscrepancy going on between the amount of gold going into ETFs of record, andthe "implied build" taking place in other venues. These take the formof private purchases held either in non-banking vaults, private storagefacilities, or (quite literally) holes in the ground.

In addition, Central Banks,probably the largest buyers of gold over the last decade (having beennet sellers for a number of years prior to the switch), have becomeunremitting accumulators. For all their public posturing about "gold notpaying interest," gold being "a barbarous relic," or a "petrock," they certainly have been doing just the opposite!

The most profound exceptionsto this have been, when at the start of the (so-far) 20 year bull run, UKbureaucrat Gordon Brown managed to sell fully half of his country's reserves atan average price of $275, which turned out to be the absolute low of theprevious two decades.

Immortalized as "Brown'sBottom," his farcical action cost his countrymen billions of dollars inlost value, as gold rocked up to its current level of over $1,800. No doubtthis will continue to be "the gift that keeps on taking" as gold addsmore thousands of dollars per ounce.

But the top prize for"thinking backward" must go Canada, which although it is the world's8th largest gold producer, holds next to nothing. Their puny"reserves" could probably fit on a sturdy coffee table!

The large buying build in bothgold and silver have reached the stage where individual investors are startingto realize that, far from being a flash in the pan last spring, elevatedpremiums, long delivery delays, and difficulty in finding metal at all arebecoming the norm.

My suggestion: Expect thesetrends to persist and become noticeably worse as we move into the fall months,typically one of the strongest time frames for both metals.

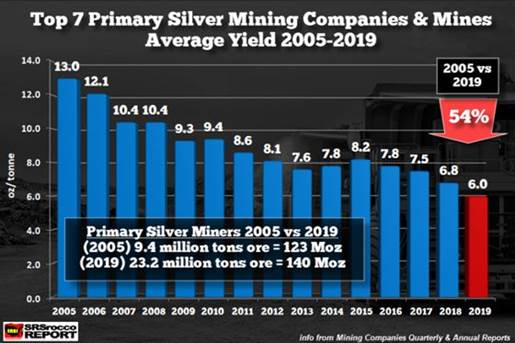

The biggest decrease in silvermine supply in recorded history – going back to the 1940's – has takenplace during the last four years (2017-19, CPM Group)! And this was pre-COVID.

As Jeff Clark notes, in 2019,only a single new primary silver mine came online anywhere on the globe. Not tomention that due to the pandemic this year, we can expect a further 10-20%production decrease.

If you have yet to acquire"enough for your needs," then you'd better get on the stick. Decidewhat your acquisition plan should look like, how much you intend to budget,what you should buy, and how often you plan to do so. Then don't fail to dosomething about it!

Adam Hamilton's latest essayconcludes with the following paragraph.

The resulting enormous SLV-holdings builds areunprecedented, forcing them vertically... unleashing a powerful virtuous circlefor silver, with investment buying driving silver higher attracting in evenmore investors. Silver still has a long runway higher to mean revert back up tohistoric norms relative to gold. And the Fed’s epic monetary inflation shouldkeep demand high.

By just about anymetric, the odds overwhelmingly indicate that the historic silver (and gold)institutional and speculator demand now being witnessed, will lead in due timeto a virtual "gold rush" by individuals like you and me for what'sleft over.

So, don't keep waiting for lowerpaper prices in hopes of getting some cheap metal.

As investors with this mindsetfound out last spring, holding out for $12 silver simply meant they had to pay$22, as opposed to being able just a few months before to get it at $17, whichincluded only a single dollar premium over spot.

So, don't be zinc penny wiseand copper pound foolish!

Real money – gold and silver –unlike the fake stuff in your wallet, holds and builds value as a counterweightto the ongoing depreciation we've all been experiencing in fiat currencypurchasing power.

And oh, did I mention thatjust since 2000, those "paper promises" you've been collecting havedeclined in value by about 44%?

As for gold and silver sincethen? Try working the math on scratch paper with these statistics. Gold in2000: c. $265; Today: c. $1,863. Silver in 2000: $4.75; Today $22.37. On theway for both over the next few years to __?__ (fill in theblank).

David Smith isSenior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com aswell as the LODE Cryptographic Silver Monetary System Project. He hasinvestigated precious metals’ mines and exploration sites in Argentina, Chile,Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sectorobservations withr eaders, the media and North American investment conferenceattendees.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.