The Gold Market Is Getting Ready for Another Interest Rate Hike / Commodities / Gold and Silver 2022

As predicted, gold stocks aregradually declining. Their situation is unlikely to improve - the Fed isalready planning another interest rate hike.

After yesterday’s huge slide in the PMs(GDXJ declined by over 8%!) and a sizable increase in our short positions injunior miners, gold and silver are moving back and forth, gathering strengthfor the next move. Or waiting for the next trigger.

They are likely to get it tomorrow(Wednesday, June 15), as the Fed is about to make another interest ratedecision. The word got out yesterday that the Fed might hike interest rates by0.75% instead of just 0.5%, and the markets reacted accordingly. Stocks and PMsfell, while the USD Index rallied.

The best part is that you knew about thebigger rate hike before almost everyone else – I wrote about that in the extraanalysis that I posted/sent out on Saturday. Quoting:

Thenext interest rate decision is this Wednesday, and it’s probably going to bevery interesting. I wouldn’t be surprised if we saw a rate hike by more than0.5% - for example by 0.75%. This might be enough to send a message to themarket that they are serious about the inflation and have positive politicalimplications. Whether that happens or not, the following conference will likelyaim to rebuild investors’ confidence in the Fed. It might or might not workwith regard to confidence, but it should be enough to triggerdeclines in the markets (including PMs) – after all that’s how hawkishsurprises work.

Okay, so, the precious metals declinedsignificantly, and now they paused. What’s next?

Well, they might take a breather today,but since the interest rate decision is tomorrow and – in my view – a 0.75%rate hike is indeed likely along with some hawkish rhetoric, the markets mighttumble even more (and the USDX would be likely to rally further).

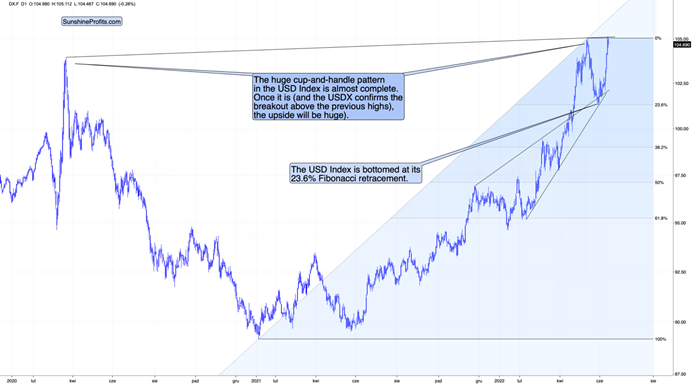

While in case of the USDX it will likelyimply a breakout above the big cup-and-handle pattern, in case of the preciousmetals sector, it would likely open the way to another huge wave down.

In today’s analysis, however, I’d like tostep back from my usual day-to-day comments (my previousthoughts on the market remain up-to-date) and feature a specificlesson from the 2008 decline that might be useful during the current slide.

To clarify, there are no guarantees thathistory will repeat itself, and I don’t guarantee any kind of performance, buthistory does tend to rhyme, so what we’ve seen so far might be a usefulindication of what’s next.

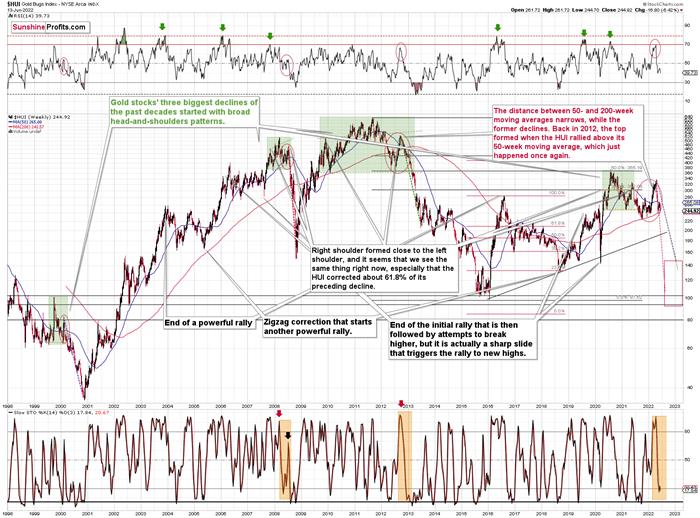

First, let me emphasize that gold stocksare declining similarly to how they did in 2008.

The Russian invasion triggered a rally,which was already erased, and if it wasn’t for it, the self-similarity would bevery clear (note the head-and-shoulders patterns marked with green). Since the latterhappened, it’s not as clear, but it seems that it’s still present. At leastthat’s what the pace of the current decline suggests.

I used a red dashed line to represent the2008 decline, and copied it to the current situation. They are very similar. Weeven saw a corrective upswing from more or less the 200-week moving average(red line), just like what happened in 2008.

All right, let’s zoom in and see howmining stocks declined in 2008.

Back then, the GDXJ ETF was not yettrading, so I’m using the GDX ETF as a short-term proxy here.

The decline took about 3 months, and iterased about 70% of the miners’ value. The biggest part of the decline happenedin the final month, though.

However, the really interesting thingabout that decline – that might also be very useful this time – is that therewere five very short-term declines that all took the GDX about 30% lower.

I marked those declines with redrectangles. After that, a corrective upswing started. During those correctiveupswings, the GDX rallied by 14.8-41.6%. The biggest corrective upswing (whereGDX rallied by 41.6%) was triggered by a huge rally in gold, and since I don’texpect to see anything similar this year, it could be the case that thiscorrection size is an outlier. Not paying attention to the outlier, we getcorrections of between 14.8% and 25.1%.

The interesting thing was that eachcorrective upswing was shorter (faster) than the preceding one.

The first one took 12 trading days. Thesecond one took seven trading days. The third one took 2 trading days, and thefourth and final one took just 1 trading day.

Fast forward to the current situation.Let’s take a look at the GDXJ ETF.

TheGDXJ ETF declined by 32.4% and then corrected – it rallied by about 20.3%. Thecorrective upswing took 14 trading days.

Theabove is in perfect tune with the previous patterns seen in the GDX during the2008 slide.

What does it tell us? It indicates thathistory can be rhymed, and while it will not be identical, we should payattention to the indicators that worked in 2008. The next corrective upswing (anotable one, that is) might start when the GDXJ ETF declines by about 29-35%from its recent top. To clarify, I don’t claim that the above technique wouldbe able to detect all corrective upswings, or that I aim to trade all of them.For instance, in my view, it was a good idea to entera long position on May 12 and switchto a short position on May 26, but I wasn’t aiming to catch theintraday moves.

GDXJ could also decline a bit more than29-35%, as let’s keep in mind that previous statistics are based on the GDX ETFand we are discussing the GDXJ here, and the latter is likely to decline evenmore than GDX as juniors are more correlated with the general stock market (andthe latter is likely to slide).

So, let’s say that the GDXJ might declinebetween 29% and 40% from the recent high before triggering another notablecorrective upswing (one that could take between 5 and 10 trading days based onhow long the last one took and how big those corrections were in 2008).

The recent high was formed with the GDXJETF at $42.19. Applying the above-mentioned percentages to this price providesus with $24.78-29.32.

Now, is there any meaningful supportlevel in this area that could stop the decline?

Yes!

The late-March 2020 low is at $26.62, andit provides significant short-term support within the analogy-based targetarea.

Additionally, the above corresponds – moreor less – to the size of the decline that would match the size of the April-Maydecline. It would be only somewhat bigger.

Let’s keep in mind that gold stocks don’tnecessarily move on their own, but rather move along with gold.

In the case of gold, a repeat of theApril-May decline would imply a move to very strong support – the mid-2020 and2021 lows. Prices below $1,700 stopped gold’s declines several times, and thatwould make at least a rebound likely once it’s reached that level.

Now, since the general stock market isabout to slide, junior miners might be affected even more than gold, so itwould make sense for one to expect them to decline somewhat more than gold(compared to what happened in April and May).

Consequently, the near-term (yes) targetfor the GDXJ at about $27 appears to make sense, and it seems that profits fromthe current short positions in the junior mining stocks will become even biggersoon.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.