The Gold-Oil Relationship Has Changed, For Now

When the markets are nervous, investors tend to turn to gold, which is considered one of the safest assets.

Gold prices have risen strongly as investors look for safer assets amid concerns about inflation in the U.S.

At present, the strength of shale supply and concerns about demand are weighing more heavily on the market than concerns about geopolitics.

By Owain Johnson

At a Glance

The world's most-watched commodities typically move in tandem, but global economic concerns and trade tensions have changed the dynamic. Gold prices have risen as investors look for safer assets, while U.S. oil production has made the commodity less sensitive to geopolitical tensions.The traditionally tight relationship between gold and oil prices is disconnecting once more as the gold price soars, while crude oil remains under pressure.

The nearby COMEX gold futures price broke through the $1,400 per troy ounce mark in June, the highest gold price seen since August 2013. Meanwhile, prices for global crude oil benchmark WTI futures have been relatively weak, hovering around the $50-60 per barrel mark for some time.

Moving in Tandem

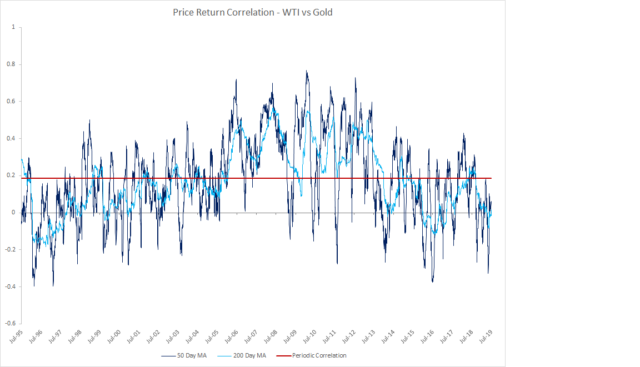

This divergence is quite unusual. Crude oil and gold prices largely move in tandem, although with occasional disconnects.

High oil prices increase the costs of making and transporting goods, driving consumer prices higher. Holding gold is one way of protecting against inflation. So higher oil prices will frequently lead to a similar rise in gold.

Higher oil prices are also often the result of geopolitical instability. A crisis in the Middle East will push oil higher, for example. When the markets are nervous, investors tend to turn to gold, which is considered one of the safest assets. A higher risk environment in the world of energy frequently translates into higher demand for gold.

The Gold-Oil Ratio

Over the past 25 years, the ratio between gold and oil has averaged 15.8. That means that a troy ounce of gold was worth on average the same as 15.8 barrels of U.S. crude oil.

The lowest the gold-oil ratio has been over that period is 6.2 in 2005 when oil went on a demand-driven bull run that outpaced the gains in gold. The highest was a giant 47.6 in 2016 when oil prices were still mired in a slump, while gold prices remained firm.

Since the start of 2019, the ratio has averaged 23.1 - high by historical standards - and July has seen the ratio break through 25.

Gold prices have risen strongly as investors look for safer assets amid concerns about inflation in the U.S. The market is also worried about the potential impact on the global economy of various geopolitical disputes, such as recent events in the Middle East and the U.S.-China trade dispute.

Most observers would previously have expected this tension in the Middle East to be equally bullish for crude oil and to therefore keep the gold-oil ratio steady.

The difference this time is two-fold. First, concerns about the health of the global economy and the impact of trade disputes have led to expectations of lower demand for oil, offsetting the potential effect of heightened Middle East tensions.

Second, the remarkable surge in U.S. oil production since 2013 has created a new global supplier that is not as heavily affected by geopolitical tensions as the traditional oil superpowers. The new role of the U.S. and its growing exports is dampening some of the traditional volatility in crude oil prices and is currently capping some of the market's price upside.

Resetting The Ratio

The impact of shale oil on crude oil prices cannot be overstated in the short term. At present, the strength of shale supply and concerns about demand are weighing more heavily on the market than concerns about geopolitics.

It remains to be seen whether the risk environment will reassert itself as the primary driver of oil, in the way that it has always been for gold. In that case, the two key products are likely to revert to their traditionally tighter relationship, where the ratio is around 15-16 rather than the current 'new normal' above 25. As is often the case with gold and oil, international headlines will tell the story.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Follow CME Group and get email alerts