The Gold Surge Has Arrived We Predicted It First

Brian Hicks of Wealth Daily explains the opportunity that gold tokenization offers.

Let's be clear: This is no longer a prediction.

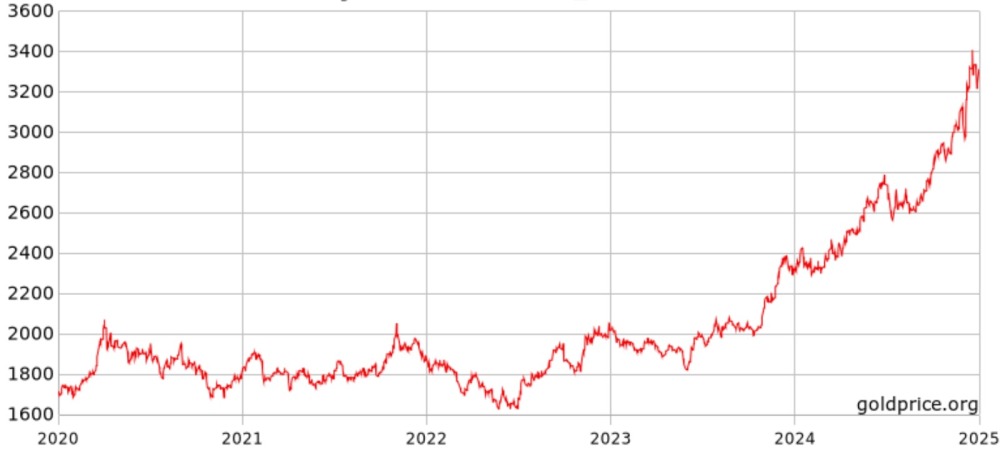

Gold has surged to unprecedented heights in 2025, recently hitting a record $3,509.9 per ounce, marking an impressive 30% gain in the first this year alone.

This rally has been fueled by a confluence of factors, including central bank purchases, geopolitical tensions, and a flight to safety amid economic uncertainties. While the mainstream media and Wall Street firms like Goldman Sachs and UBS are now raising their gold forecasts, we were already miles ahead, signaling this bull market well before it became the consensus view.

According to our Gold White Paper #2, which many of you downloaded last year, we projected gold breaking through $3,100 this year and ultimately moving toward the $3,600-$5,000 range as global trust in fiat systems continues to disintegrate. In fact, my 10-year price target for gold is $16,402! We've said from the start: Gold isn't just making a comeback it's becoming the bedrock of a new financial order.

And now, everyone else is scrambling to catch up.

Wall Street's Late Gold Conversion

Just a few months ago, these firms were still hawking overpriced tech stocks and momentum trades.

Today?

Goldman Sachs and UBS are not only bullish on gold they're boosting their price targets aggressively, citing central bank demand, de-dollarization, and global instability.

In fact, Goldman Sachs has revised its gold outlook for the third time this year, setting a new year-end price target of $4,500 per ounce the most bullish projection yet. The bank cited growing global unease and gold's sharp rebound after the April 2 market sell-off, which was triggered by President Donald Trump's tariff announcement. Gee. Welcome to the party.

To be fair, it's better late than never. But let's not pretend this wasn't predictable.

The signs were everywhere:

Central banks hoarding gold at record paceThe BRICS nations openly plotting a commodity-backed currencyThe U.S. running trillion-dollar deficits as far as the eye can seeGold outpacing bonds, stocks, and even real estate in performanceWe just had the guts to call it early.

Gold Miners: The Leverage Play

While gold itself has been on a tear, gold mining stocks have provided even greater leverage to this rally. The VanEck Gold Miners ETF (GDX), which tracks a diversified portfolio of gold mining companies, has soared approximately 44.5% year to date as of April 30, 2025.

This surge reflects not only rising gold prices, but also improved operational efficiencies and stronger balance sheets among mining companies.

AngloGold Ashanti: A Standout Performer

Among individual mining stocks, AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) has been a standout performer.

The stock has climbed significantly in 2025, reflecting both the broader gold rally and company-specific catalysts.

Anglo has been up as much as 98% just this year alone!

But I think the party in the yellow metal is just starting. And it's about to spread into crypto.

The Digital Gold Revolution Has Begun

Here's where it gets even more interesting and where our readers hold a distinct advantage.

Physical gold?

Still king. But the real revolution is happening in tokenized gold blockchain-backed gold assets that merge the ancient power of precious metals with the speed, transparency, and liquidity of modern fintech.

Recent data confirms what we've been saying all along: Tokenized gold is now outperforming paper gold alternatives like ETFs. Gold-backed tokens are trading on public blockchains with full audit trails and 24/7 liquidity.

The movement is global. But in this digital gold rush, NatGold Digital Ltd. is poised to become the definitive name.

Why NatGold Is Different

While some are rushing to tokenize existing vault gold or ETF contracts, NatGold has done something radically different:

Backed by unmined, proven gold reserves valuated, verified, and sitting untouched beneath the earthNo environmental damage no extraction, no energy burn, no carbon footprint10% pre-launch discount for early participants Exclusively offered through our channel before it goes live to the public This isn't some speculative crypto play or a reheated ETF model. This is a digital asset pegged to the most coveted commodity in human history, backed by real geological surveys and protected from the volatility of mining operations.This is better than mining. This is smarter than ETFs. This is digital gold done right.

What Happens Next

The wave is building. Wall Street just turned bullish. The BRICS alliance is doubling down on gold as a settlement mechanism. U.S. fiscal policy is a bonfire. And average investors from Main Street to Singapore are looking for ways to hold real value, off-grid and out of reach of central bank games.

We've been here before 1971. 2002. 2008. And now. Each time, gold surged not just because of inflation or war but because confidence in traditional systems collapsed.

History's repeating. But this time, there's a twist. Gold isn't just for vaults anymore. It's going digital. And NatGold is your first-class ticket.

Final Word: Get in Before the Floodgates Open

You're not buying a coin. You're securing a claim a stake in the future of monetary value itself. And right now, you can reserve your spot before NatGold goes live.

No money changes hands yet.You'll lock in your allocation at a 10% discount. You'll be part of a movement that merges sound money with smart tech.We're not just riding this bull market. We helped start it. Now the rest of the world is waking up. Are you ready to capitalize on it? To get on the list to reserve your spot in financial history, download a copy of our book on this revolution, The Dawn of NatGold.

You won't regret it.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NatGold Digital Ltd.Brian Hicks: I, or members of my immediate household or family, own securities of: NatGold Digital Ltd. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.