The harvest begins for Village Farms Intl short sellers

High Liner Foods remains the most shorted stock on the TSX based on the latest IIROC report and INK data. Short interest remained relatively steady at 15.54% of its float, down 0.26% from the March 30th report. Since our April 8th INK post warning that based on INK signals the stock appeared at risk of a bearish setup, it has dropped 4.5%. Our bearish signal remains in place based on a combination of relatively large short-selling and average insider commitment.

| Top 10 Canadian Stocks Shorted as of April 15, 2019* | ||||||

| Stock | Shares Short | %Float | Change | INK Signal | ||

| 1 | HLF | High Liner Foods | 3,473,749 | 15.54% | -0.26% | Bearish |

| 2 | CJT | Cargojet | 1,344,935 | 11.41% | 0.06% | Bearish |

| 3 | VFF | Village Farms Intl | 4,129,338 | 11.09% | 3.98% | Bearish |

| 4 | POU | Paramount Resources | 7,598,596 | 10.68% | 0.33% | Squeeze |

| 5 | SSL | Sandstorm Gold | 17,681,658 | 10.21% | 0.01% | Bearish |

| 6 | GWO | Great-West Lifeco | 28,114,999 | 10.12% | 0.23% | Squeeze |

| 7 | L | Loblaw Companies | 11,200,733 | 9.98% | -0.16% | Bearish |

| 8 | ACQ | AutoCanada | 2,707,756 | 9.91% | 0.08% | Bearish |

| 9 | SIS | Savaria | 3,019,775 | 9.84% | 6.05% | Squeeze |

| 10 | CHW | Chesswood Group | 794,730 | 8.91% | -0.01% | Squeeze |

*Stocks trading over $1

Shorts continued to hang on for the ride at Cargojet which remains the second most shorted stock. Although the stock is up slightly since our last report, short-sellers may start to enjoy their ride as our signal has flipped from a potential short-squeeze situation to a bearish setup. On April 16th, the company announced the closing of a $100 million bought deal debenture financing which could encourage some shorts who were hedging the transaction to cover.

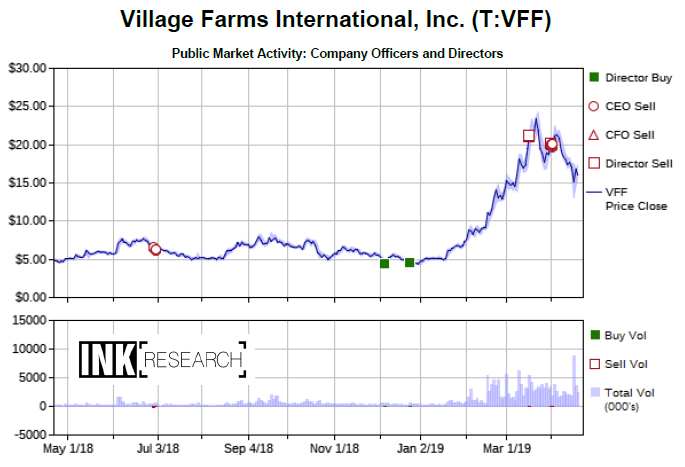

Meanwhile, shorts may start to harvest profits at Village Farms International, a vegetable greenhouse grower that is moving into the cannabis space. The stock has jumped into the top three most-shorted stocks with 11% of its float now shorted.

We highlighted this situation in today's morning report (distributed earlier to Canadian Insider Club members) in a bit more detail, noting in the report that our short signal has gone from a potential short-squeeze to a bearish setup.

Shorts are continuing to press their bets against Paramount Resources, despite our warning on April 8th that the stock was at risk of breaking out on the upside. As it turns out, it is attempting just that, advancing 13.2% since our warning. Although Paramount has dropped a notch to the fourth most shorted stock in Canada, it remains heavily shorted providing plenty of potential rocket fuel for a move significantly higher. All the stock probably needs is for natural gas and liquid prices to show some spark over the next few weeks to ignite liftoff.

Another stock with a notable short-squeeze setup is Savaria which is a newcomer to the list. Shorts may be, in part, hedging a $70.75 million bought deal equity financing priced at $14.15 announced April 1st. The stock closed Monday at $13.15, a dollar below the deal price. Insiders at the elevator maker are willing to bet that its stock price will soon be going back up. According to a company press release, three insiders of the firm, including CEO Marcel Bourassa, have agreed to subscribe for up 7.1% of the offering. The subscription allocations will be at the discretion of the underwriters.

INK signals are for information purposes only and are not investment advice. This post first appeared on INKResearch.com.