The INK Canadian Insider Index holds flat, as oil slides

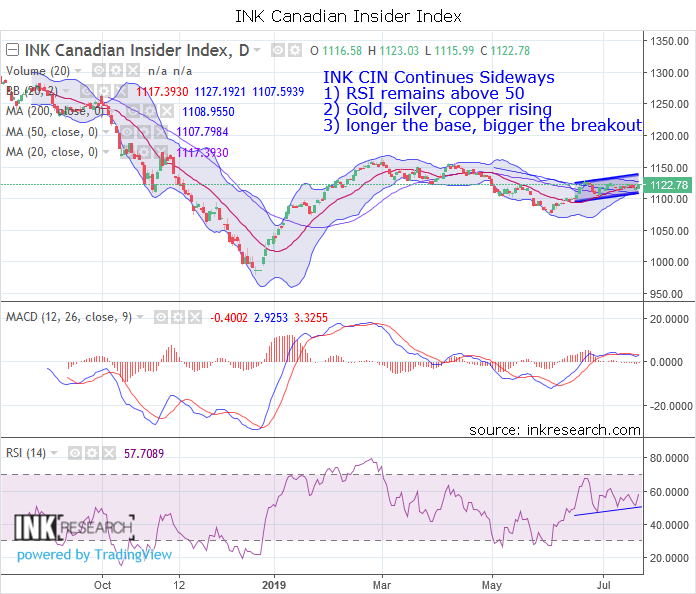

Thank you for joining us in a weekly technical look at the mid-cap-oriented INK Canadian Insider (CIN) Index. Last week, the INK Canadian Insider Index remained in its tight sideways multi-week consolidation, adding 3.11 points to close at 1122.78.

MACD ticked down 0.1 points to -0.4. RSI added 1.73 points to 57.71.

Support is now at 1108.96 (200-day moving average) and 1107.80 (50-day moving average). Resistance is at 1127 (upper Bollinger band) and 1135.

The Index continued sideways but did not break higher in the face of higher gold, silver, and copper which all rose strongly. Notably, oil was down 7.4% and the S&P 500 was down 1.1%. The Index's basing or consolidation looks largely bullish alongside rising metal prices, but we also may need to see oil put an end to its 6-7 week correction before the Index can break higher.

The INK Canadian Insider Index is used by the Horizons Cdn Insider Index ETF (HII).