The most bullish mining chart you'll see all day

After five years of unrelenting declines only punctuated by a couple of false dawns (talking 'bout you nickel) green shoots are appearing in the metals and mining sector.

There's BHP whipping up enough excitement with a "commodity premium" (whatever that is) to amass orders in excess of $13 billion for a bond offering. Unusually, lots of interest for the hybrid offering came from Asia according to the bankers to the world's largest mining company.

The mining and metals contest is being fought there (especially now that Brazil's promise is broken, Africa's is stuttering and India's may well stay just that). So when people on the ground in the East see potential it's worth taking note.

Then there's the closest mining ever came to having a white knight. Mick Davis appears to be close to pulling the trigger on a maiden investment for his $5.6 billion X2 fund. You can't spend that much of other people's money without seeing upside. And if you see upside in seaborne coal, then one would assume you really did your homework.

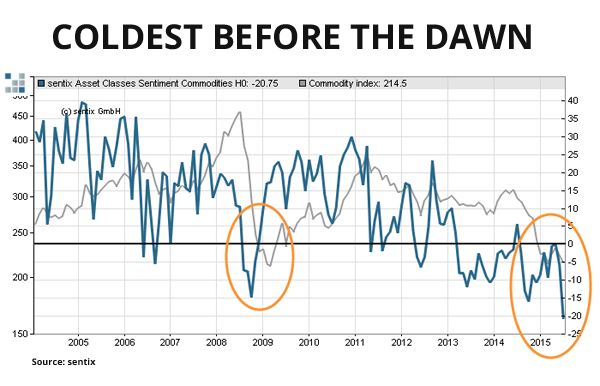

Frankfurt-based sentix, a leader in the emerging field of behavioural finance, has been compiling a commodity sentiment index for more than a decade by surveying more than 4,500 institutional and private investors.

The sentix Asset Class Sentiment for Commodities index dropped precipitously in mid-July to lows not seen even at the height of the global financial crisis or during the stomach-churning fall in the price of crude in the second half of 2014.

The researcher warned with admirable Germanic directness that "when such a strong fall of the indicator occurs it is not wise to buy the market anti-cyclically," but as was the case in late 2009 "the time for contrarians will come when confidence returns" which could take "several months".

From the record low of -20.75 seen on this graph dated July 20, the sentix index has now shot back up to above 0.

At the same time the CRY (Thomson Reuters Core Commodity CRB index) plotted here has continued to decline, trading at 195 points on Thursday.

It's been three months since the lowest ebb of sentiment in the sector; not several months. But it sure seems tempting to jump back in.