The Most Profitable Way To Play The Gold Boom / Commodities / Gold and Silver Stocks 2020

Since the middle of 2019, we have been in a preciousmetals bull market, with gold prices hitting a new all-time high of$2079 on August 3, 2020.

And silverprices have also been climbing steadily since the beginning of 2Q 2020,sending investors on the search for the best way to play this precious metalsbull run for maximum upside potential.

In the search for high upside in this bullmarket, many investors smartly turn to the junior exploration sector, ascompanies in that space tend to offer the biggest potential bang for the buck.

But it’s important to understand that not all junior exploration plays arecreated alike.

Seasoned investors in the space know that thekey to success in the junior market is investing in the right people – and theright properties – at precisely the right time.

In the midst of today’s ongoing preciousmetals bull comes Sentinel ResourcesCorp. (CSE:SNL; OTC:SNLRF) anunder-the-radar exploration company that now seems poised to take advantage ofa significant potential high-grade opportunity in Australia.

Australia is home to the largest andmost cost-effective gold reserves on earth...as wellas a number of outstanding recent junior exploration success stories, including Fosterville South Exploration(TSXV: FSX) and Kirkland Lake Gold (TSX:KL).

Now a similar scenario for significant potentialgrowth could be unfolding again with SentinelResources.

The company combinesa highly experienced exploration team with a proven track record of success inthe region of Victoria. This veteran team now has its sightsset to the North and their impressive collection of fifteen recently acquiredgold & silver projects in New South Wales, Australia.

Here are 5 reasons to look closely at Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) rightnow:

#1: TheAustralian Gold Market is the World’s Largest and Most Cost-Effective

The Australian gold market is an attractiveone for investors thanks to both its ranking as one of the world’s top goldproducers as well as its track record of junior gold exploration success.

Industry expert Resource Monitor recently proclaimed that, “(Australia) willovertake China next year as the world’s largest gold producer.”

Estimates call for Australia to produce anestimated 383 tonnes of gold in 2021, surpassing the production of China, whichhas annually produced the most gold since 2007.

According to Nikkei Asian Review, “today,Australia has the world’s largest economically viable gold resources and someof the world’s biggest mines.”

This is due in large part toAustralia’s cost effectiveness, offering high margins to explorers. All-insustaining costs in Australia are among the lowest in the world...sotoday’s gold bull market means more capital available for development of newmines and expansion of existing operations.

But perhaps more important to investors in thejunior exploration sector than a region’s overall level of production is itsability to produce junior mining success stories – and Australia has deliveredseveral notable recent examples:

FostervilleSouth Exploration (TSXV:FSX) soared from $1.48 in May to a peak of $5.38this summer...RegisResources Limited (ASX:RRL) climbed 72.54% in just five months this past summer ...CapricornMetals (ASX:CMM) soared 136.56% in the six months between March and September 2020 ...MusgraveMinerals Limited (ASX:MGV) – with a high-grade discovery in Western Australia –shot up 560.87% in justthree months earlier this year and remains significantly higher year-to-date. And in south-central Australia, Kirkland Lake Gold (TSX:KL) enjoyedgreat success with its super-high-grade Fosterville gold mine which drove thecompany’s share price 40 times higher in just four years.Now along comes Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) inthe midst of this sustained gold bull market with an impressive collection ofnew acquisitions in Australia that could help the company become the nextjunior mining success story Down Under.

#2: AWorld-Class Caliber Leadership Team Has Been Assembled

Just as world class athletes like to work withthe “best of the best” – and elite actors and musicians tend to collaboratewith each other – the very best executives in the exploration space often preferto work only with the very best in the industry.

That means only the best properties...only thebest geologists...only the best finance executives...all working together tocreate the very best opportunities.

So when you see a smaller company assembling ateam of exploration veterans – each with several decades’ of successfulexperience – chances are good there are projects with significant potential inthe company’s arsenal.

After all, veterans with 20- and 30-year trackrecords can essentially name their own opportunity...and when they assembletogether with an under-the-radar company it is worthy of investor attention.

That’s precisely what has happened with Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF). Led bycompany President & CEO Rob Gamley,Sentinel Resources Corp. boasts a “Hall of Fame” caliber team of miningindustry veterans, including:

* Dr.Peter Pollard, Chief Geologist and Director – Dr.Pollard has more than 30 years of global research and mineral explorationconsulting experience and is a recognized expert in intrusion-relatedmineralized systems. He has presented short courses onore geology to the industry for more than 25 years and has consulted for thetop 20 companies on the biggest projects in the world.

* DannyMarcos, Exploration Manager – With over 25 years as afield-oriented exploration geologist. Mr. Marcos was a key member of the WMCtechnical team behind the discovery of the Tampakan deposit, the large copperand gold orebody located in the south Philippines (15 million tonnes of copperand 17.6 million ounces of gold.)

* GregBronson, Geologist and Director – Possessing more than 29 years ofsenior geologist experience, Mr. Bronson has excellent technical skills and hisexperience covers all aspects of mineral exploration project management andproperty acquisition.

* Dr.Chris Wilson, Senior Advisor – Dr. Wilson is an innovativeexploration geologist with over 30 years in area selection and prospectgeneration experience. Dr. Wilson was previously an Exploration Manager for Robert Freidland’s IvanhoeMines Mongolia, and was responsible for an 11-million-hectare portfolio and hehas worked in over 75 countries on most commodities and deposit styles.

#3 StrategicallyLocated Gold Projects within Historically Prolific Locations in New SouthWales, Australia

SentinelResources Corp.’s world-class leadership team recentlyannounced key acquisitions in Australia that are likely to grab the attentionof investors looking to play this market...and for good reason.

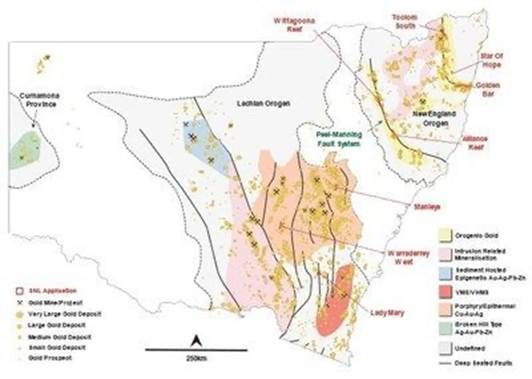

New SouthWales, located in southeast Australia, has significant gold endowment with pastproduction exceeding 40 million ounces and with current in-ground goldresources exceeding 68 million ounces.

Much of New South Wales remains hugelyunder-explored...and the mining-friendly jurisdiction offers a wide range ofopportunities for new discoveries.

The concessions acquired by Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) includeat least 198 historic gold mines and gold exploration prospects andhistoric production records indicate that goldgrades were often multi-ounce.

The concessions acquired are known as Star ofHope, Golden Bar, Alliance Reef, Stanleys, Lady Mary, Waddery West,Wittagoona Reef and Toolom South.

Theseacquisitions offer Sentinel Resources the possibility of drill-ready targets with just a small amount of field work andsampling, and they include numerous high-grade historic gold mines andshowings.

With a high level of focus on acquisition inthe New South Wales area – and the increasing number of companies now movinginto the region – acquiring such an impressive collection of targets is an extremelypositive sign or Sentinel ResourcesCorp. (CSE:SNL; OTC:SNLRF).

These potential high-upside acquisitions – ina mineral-rich region of what could soon be the world’s largest gold producer –could put the company in position to deliver multiple, sizable, low-cost,high-grade gold projects.

Investors looking for the next great story inthe junior resource sector are likely searching for the next Fosterville South / Kirkland Lake Gold-stylesuccess story...and SentinelResources Corp. (CSE:SNL; OTC:SNLRF) offersas strong a potential for that title as any other junior resource play in thespace.

In addition to Sentinel’s gold exploration projects in New South Wales, the company also recently announced that it has acquired,by staking, seven silver-focused exploration concessions totaling approximately38,600 hectares in New South Wales.

These concessions are known as: Wallah Wallah,Stony Creek, Carrington, Dartmoor, Glens Skarn, Broken Hill West andGoongong.

At least 23 historic silver and 3 historicgold mines and exploration prospects are present across the Silver Projects.Historic production records indicate that silver grades were generallyhigh-grade and exceeded 1 kg/t Ag in some instances (see News South Wales Departmentof Planning, Industry and Environment).

This acquisition of seven strategicallylocated silver projects, within the prolifically mineralized Lachlan orogenicterrane and the world famous Broken Hill Block, serves as an excellentcomplement to the Sentinel Resources gold projects in NewSouth Wales. A significant historic database (held by the New South WalesDepartment of Planning, Industry and Environment) provides a robust foundation tohelp the company rapidly advance projects and generate high-value drill-readytargets.

#4: Sentinel’sWaterloo, British Columbia Offers Robust Silver and Gold Potential

While the company’s recent acquisitions inAustralia are the properties grabbing most of the attention, Sentinel Resources’ portfolio alsoincludes attractive opportunities in both Canada and Peru.

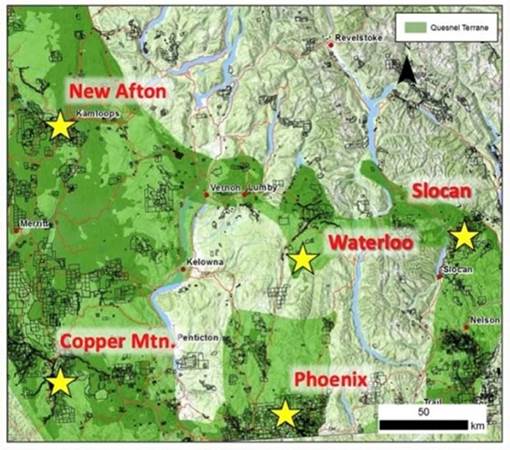

In Canada, the company’s Waterloo SilverProject is located in British Columbia, home of one of the world’s largest,most productive mineral trends.

The 1,000 kilometer belt in north centralBritish Columbia known as the Quesnel Trough has seen significant placer goldproduction.

This production includes very large-scalemining operations such as the Kemess gold-copper mine which produced 303,475ounces of gold as recently as 2004.

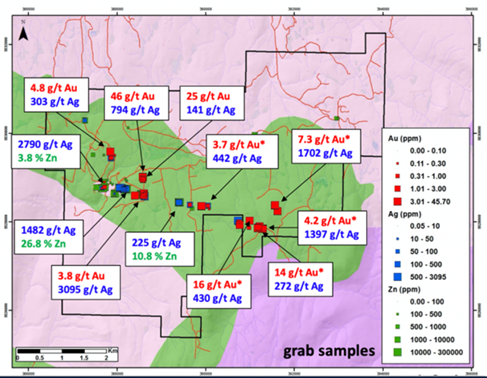

SentinelResources 3,130-hectare Waterloo project includes thehistoric Waterloo Mine, which has seen sporadic production of high-grade silversince 1903 and is road-accessible with developed infrastructure nearby.

Grab samples from historic workings came backat 2,790 g/t silver and 45.70 g/t gold.

Waterloo also hosts even more explorationpotential as the area was never systematically drill-tested with numerousdefined, yet untested, targets.

Historic work on the project – includinggeological mapping and prospecting – has produced compelling results ofhigh-grade silver and gold, according to the company.

#5: SentinelAlso Recently Acquired Mining Concessions in Western Peru

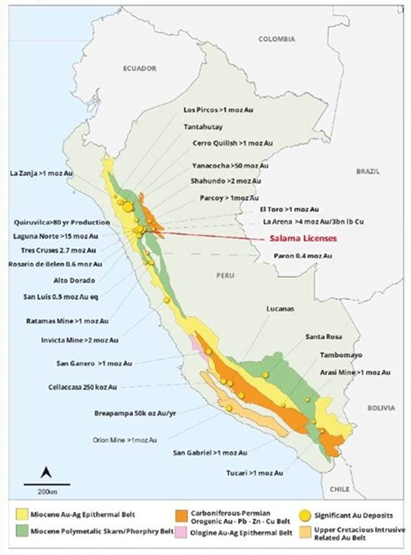

Sentinel’s Salama Gold Project consists of four gold focused mining concessions totalingapproximately 2,700 hectares, located in the Anta province of western Peru.

Preliminary review shows that this regionoffers extensive areas of quartz veins with localized silicified breccias, thathave been the focus of historic production by artisanal and small-scale miners.

These miners targeted high grade areas whereoxidation of bedrock resulted in formation of free gold amenable to gravityrecovery.

Sentinel (CSE:SNL; OTC:SNLRF) projectsthat there is potential on these properties for high and low sulfidationepithermal gold mineralization and breccia pipe stock-work style gold-silverdeposits.

The Salama Gold Project is situated within theprolific gold-polymetallic Miocene skarn and porphyry belt – one of severalcoastal metallogenic belts that host the larger and more significant Peruviandeposits.

These include the Lagunas Norte Gold Mine,Rasario De Belen Gold Mine, La Arena Gold Mine and La Virgen Gold Mine, thattogether host over 20 Moz gold within a 45 km radius of the Salama Concessions.

Sentinel's field team will initially comprisethree in-country geologists, allowing for rapid first pass reconnaissance androck-chip grab sampling.

The fieldteam has robust project review and target generation experience, especiallywith respect to Peruvian low and high sulphidation epithermal deposits, such as Lagunas Norte, La Arena and Rosario DeBelen.

This will allow mineralization at Salama to beplaced within the wider context of an epithermal deposits geological,structural and hydrothermal evolution, and thus allow key controls onmineralization and high value targets to be rapidly established.

Bottom Line

SentinelResources Corp. (CSE:SNL; OTC:SNLRF) isa potential high-upside junior exploration play positioned perfectly to takeadvantage of the ongoing precious metals bull marketEntry into the Australian explorationmarket at precisely the right time, as Australia seems poised to become theworld’s largest gold producer An impressive land package inAustralia – with high-grade showings – in a region that has been overlooked fordecadesA collection of recently acquiredsilver-focused explorations in New South Wales that provide an excellentcomplement to the company’s gold propertiesA “Hall of Fame” caliber leadershipteam that has been assembled to pursue only the highest-upside opportunities...seekingto replicate the success they’ve enjoyed individually over the past 30 years asa new teamRecently acquired potential high-gradegold deposits in western Peru in a region with historic production With such a sizable package of assets– including existing mines and historical data – the company offers outstandingspinout potential for any one of its gold- or silver-focused projectsBy. Stephen Bloom

https://www.kitco.com/news/2020-05-12/Australia-to-be-world-s-top-gold-producer-in-2021-overtaking-China-with-its-expansion-plans-report.html

https://www.sbma.org.sg/media-centre/publication/crucible-issue-14/gold-rush-2-0-australia-to-become-worlds-biggest-gold%20producer/#:~:text=Next%20year%2C%20Australia%20will%20be,spot%20it's%20held%20since%202007.

MGV.AX traded at .115 on 5/11/20 and at .76 on 8/3/20

IMPORTANT NOTICE ANDDISCLAIMER

PAIDADVERTISEMENT. This article is a paidadvertisement. GlobalInvestmentDaily.com and its owners, managers, employees,and assigns (collectively “the Publisher”) is often paid by one or more of theprofiled companies or a third party to disseminate these types of communications.In this case, the Publisher has been compensated by Sentinel Resources Corp. toconduct investor awareness advertising and marketing. Sentinel paid thePublisher to produce and disseminate five similar articles and additionalbanner ads at a rate of seventy thousand US dollars per article. Thiscompensation should be viewed as a major conflict with our ability to beunbiased.

Readers shouldbeware that third parties, profiled companies, and/or their affiliates mayliquidate shares of the profiled companies at any time, including at or nearthe time you receive this communication, which has the potential to hurt shareprices. Frequently companies profiled in our articles experience a largeincrease in volume and share price during the course of investor awarenessmarketing, which often ends as soon as the investor awareness marketing ceases.The investor awareness marketing may be as brief as one day, after which alarge decrease in volume and share price may likely occur.

Thiscommunication is not, and should not be construed to be, an offer to sell or asolicitation of an offer to buy any security. Neither this communication northe Publisher purport to provide a complete analysis of any company or itsfinancial position. The Publisher is not, and does not purport to be, abroker-dealer or registered investment adviser. This communication is not, andshould not be construed to be, personalized investment advice directed to orappropriate for any particular investor. Any investment should be made onlyafter consulting a professional investment advisor and only after reviewing thefinancial statements and other pertinent corporate information about thecompany. Further, readers are advised to read and carefully consider the RiskFactors identified and discussed in the advertised company’s SEC, SEDAR and/orother government filings. Investing in securities, particularly microcapsecurities, is speculative and carries a high degree of risk. Past performancedoes not guarantee future results. This communication is based on informationgenerally available to the public and on interviews with company management,and does not contain any material, non-public information. The information onwhich it is based is believed to be reliable. Nevertheless, the Publishercannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. ThePublisher owns shares and/or stock options of the featured companies andtherefore has an additional incentive to see the featured companies’ stockperform well. The Publisher has no present intention to sell any of theissuer’s securities in the near future but does not undertake any obligation tonotify the market when it decides to buy or sell shares of the issuer in themarket. The Publisher will be buying and selling shares of the featured companyfor its own profit. This is why we stress that you conduct extensive duediligence as well as seek the advice of your financial advisor or a registeredbroker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS.This publication contains forward-looking statements, including statementsregarding expected continual growth of the featured companies and/or industry.The Publisher notes that statements contained herein that look forward in time,which include everything other than historical information, involve risks anduncertainties that may affect the companies’ actual results of operations.Factors that could cause actual results to differ include, but are not limitedto, changing governmental laws and policies impacting the company’s business,the degree of success of identifying mineral-rich areas to explore, the degreeof success of drilling excursions, geopolitical issues in the various parts ofthe world in which the company operates, the size and growth of the market forthe companies’ products and services, the ability of management to execute itsbusiness plan, the companies’ ability to fund its capital requirements in thenear term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have readand understand this disclaimer, and further that to the greatest extentpermitted under law, you release the Publisher, its affiliates, assigns andsuccessors from any and all liability, damages, and injury from thiscommunication. You further warrant that you are solely responsible for anyfinancial outcome that may come from your investment decisions.

TERMS OF USE. By readingthis communication you agree that you have reviewed and fully agree to theTerms of Use found here http://GlobalInvestmentDaily.com/terms-of-use. If youdo not agree to the Terms of Use http://GlobalInvestmentDaily.com/terms-of-use,please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY.GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarksused in this communication are the property of their respective trademarkholders. The Publisher is notaffiliated, connected, or associated with, and is not sponsored, approved, ororiginated by, the trademark holders unless otherwise stated. No claim is madeby the Publisher to any rights in any third-party trademarks.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.