The Next Gold Rush Could Be About To Happen Here / Commodities / Gold and Silver Stocks 2019

Gold major Barrick just tripled its profits…

Newmont Goldcorp, also reported a big jump in profits over the last couple of months.

But what most investors don’t know is that mostof the money is made in the discovery of new world-class gold deposits.

And geologists now think they could havehit the motherlode in a new mining frontier…

It all started when miners found a nugget of solid gold weighing 1kilogram…worth $45,400.

Then, they repeated the feat, and dug up asecond nugget weighing 2.7 kilograms, worth $122,500.

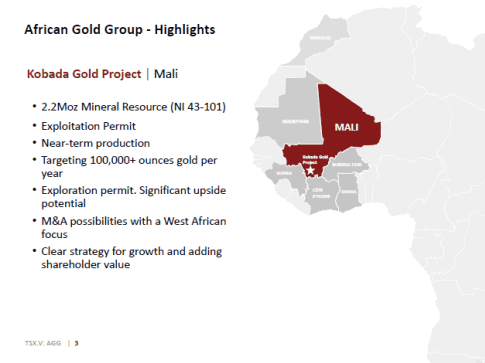

The rocks came outat Kobada, a mine in Mali, owned and operated by African Gold Group Inc. (TSX:AGG.V, OTCMKTS:AGGFF).

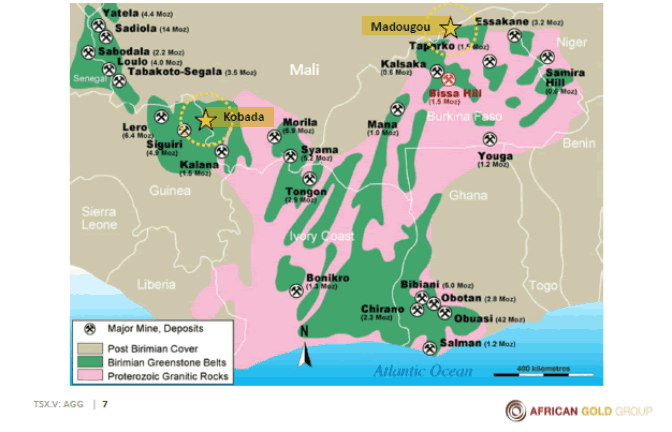

It’s a little mine with a bright future,sitting on top of the biggest mining belt in West Africa and the new centerof the global gold mining industry.

Dozensof firms are droppingmillions on newassets all over the Birmian mining belt.

Dozensof firms are droppingmillions on newassets all over the Birmian mining belt.

And AGG hopes to use Kobada to strike itrich in the next big gold boom.

The company has a lot going for it:

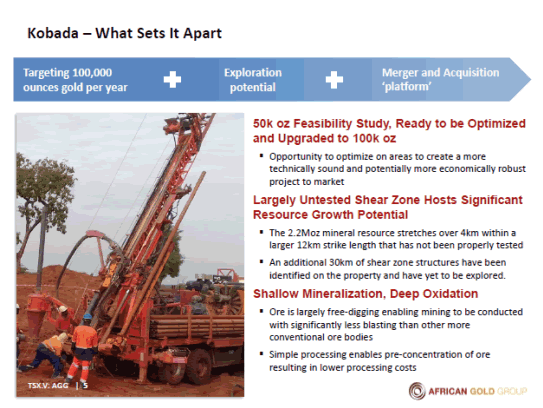

A drilling project that willreach completion on December 12, with a total resource base of an estimated 2.2million ounces of gold, worth $4 billion at current prices.

A management team of dedicated professionals, and their led by Stan Bharti, a titan of the industry who has spun gold out of nothing, turning little companies into firms 20x theiroriginal size.

A management team of dedicated professionals, and their led by Stan Bharti, a titan of the industry who has spun gold out of nothing, turning little companies into firms 20x theiroriginal size.

Gold prices look ready to rise. Interestrates are dropping. Big gold firms scrambling to acquire smaller firms to shoreup their bottom lines.

So this tiny $20 million firm could realizea huge valuation or even potentially get taken over …delivering a massiveupside to investors who get in on the ground floor.

It’s about to get very exciting for AGG (TSX:AGG.V, OTCMKTS:AGGFF).Here are five reasons to take a look:

##1 African Treasure

The Kobada Gold Project is in southernMali—which investors should note.

In fact, Mali isAfrica’s third-largest gold producer. The mining belt running through WestAfrica, known as the Birman Belt, is among the most promising mineral areas inthe world.

The accommodation camp is 95% complete, drillingis well underway with a completion date of December 12. Right now, it’s workingat breakneck speed—drilling a new hole every three days.

That 100,000 ounces could be worth nearly$150 million in revenue each year—for a firm worth just over $23 million.

And recentdiscoveries of two massive solid nuggets mean thatthis is just the beginning. Morenuggets could be unearthed, based on AGG’s findings.

Mineralization isclear at shallow depths with gold very close to surface all the way down to300m. Costs should be low, with less time to market. And the Malian governmenthas proven a reliable partner.

It used to be South Africa was the focus ofmining companies’ attentions. But now, investors are shifting their focusWest... where the geology promises big gains for companies that strike it richearly.

Accordingto Mining Intelligence, 61 new assets are in production orconstruction stages, with 24 assets undergoing economic assessments…and 367assets in exploration, indicating a major boom is under way.

In Mali alone, there are at least twentydifferent mining companies buying up real estate. And the regulatoryenvironment is perfect—the Malian government has embraced mining, Mali’sbiggest GDP contributor, and has made changes to the permit process in order toquicken the rate of exploration.

AGG (TSX:AGG.V, OTCMKTS:AGGFF) has licenses from the Malian government that will be good until2045, covering an area of more than 200km2

In fact, West Africa seems poised to becomea newcenter for global gold mining—thanks to huge deposits, super low costs anda favorable regulatory environment amenable to mining interests.

The local trifecta of Mali, Guinea andBurkina Faso alreadyproduce twice as much gold as South Africa, the previous gold capital ofthe world—and things should only get better from here.

#2 Billion Dollar Birmian

Kobada is part of a massive belt runningacross a huge swath of West Africa—known as the Birmian Belt.

Other companies, including mining giantsBarrick and Resolute, have already hit it big.

And the list of winners doesn’t stop there.

Or takethe Tongon mine in Cote d’Ivoire, alsooperated by Barrick, where the company unearthed 230,000 oz …worth $322million.

Andwhat about the Syama Mine, in Mali, operated byResolute, where production estimates are at 300,000 oz of gold per year—atcurrent prices, a haul worth $420 million.

AGG’s (TSX:AGG.V, OTCMKTS:AGGFF) Kobada Mine is right smackin the middle of this promising new belt, where the mining boom is just takingoff. And that means things could only get better.

Just this year, Ghana overtook South Africaas Africa’s biggestgold producer. And Mali isn’t too far behind, in a close race for secondplace.

There could be hundredsof new assets popping up throughout the Birimian in the next few years—thesooner investors buy into AGG, the sooner they can profit from Kobada’s haul,before other investors beat them to the punch.

#3 Millions? How About Billions

The discovery of 1kg gold nuggets is just ahint of what’s to come at Kobada.

AGG is keeping its expectations small—itonly wants to pull up 50,000 oz a year.

At the current value, that’s nearly $80million. Not too shabby.

The full lode at Kobada is reckoned to be2.2 million oz, a figure a new definitive feasibility study in April might addto. At current prices, that full haul is more than $3 billion—all for a companywith a $23 million valuation.

And even that $3 billion figure should onlyclimb higher and higher.

With China`s goldbuying spree ramping up, industry experts expect the prices to go up to $2000.

That means the estimated gold at the Kobadaproperty could be worth more than $4 billion.

Plus, AGG is in safe hands—it’s got amanagement team that knows how to spin gold from silk, and they’re led by atitan in the field.

#4 Gold Standard in Management

The team at AGG (TSX:AGG.V, OTCMKTS:AGGFF) isan all-star group of mining industry professionals

Two directors, Sir Sam Jonah and BruceHumphrey, have a hundred years of combined experience working the finances formining operations.

Jonah served as CEO of Ashanti GoldfieldsCompany Ltd in the mid-1980s, while Humphrey was CEO and President of DesertSun Mining and COO of Goldcorp.

Taking on matters on the ground is miningengineer Danny Callow. Callow served as the head of Glencore’s Africa Copper division, and he built a copper operation in Africa from greenfields to a 210,000-ton producer while serving at Glencore.

But the big news is AGG’s new CEO,President and Chairman: Stan Bharti.

With thirty years of experience, Bharti isbringing a particular expertise to AGG, promising to take the company into anew golden age.

His accomplishments include:

Started and founded DesertSun in 2002 at $0.40 a share sold 2006 $750 millionor $7.50 a share (TSE: DSM)Started andfounded Consolidated Thompson 2004 at $0.25 a share sold in2011 for $4.9 billion or $17.50 a share (TSE: CLM)Started AvionGold 2008 at $0.40 a share and sold in 2012 for $400million or $0.88 a share (TSE: AVR)Started Sulliden 2009at $0.40 a share and sold in 2014 for merged value of $464million or $ 1.47 (TSE: SUE)Companies under Stan’s leadership haveuncovered 20 million ounces of gold, more than 3 billion ounces of iron ore and1.5 billion ounces of potash.

Bhart’s gathered more than $3 billion ininvestment capital for his companies and released billions to his shareholders.

And he knows his way around a gold mine:Bharti predicted gold prices would bounce back in the mid-1990s and he knewgold would rebound again between 2003 and 2015.

In Mali, he led the company Avion, a $20million firm in 2008, which he turned around and sold for $500 million—all duringthe Great Recession.

That’s a 20x growth rate. And Bharti’sready to repeat the miracle.

“I have always bought or acquiredundervalued assets in emerging markets. This gives our shareholders the bestpotential for HUGE returns. AGG (TSX:AGG.V, OTCMKTS:AGGFF) fitsin that category very well.”

“It feels like we are in 2003 again,” Bhartisaid, “at the cusp of a great run in gold and gold stocks.”

“The team is now complete,” hedeclared, “and we are ready to take this asset to the next level in one ofthe most bullish environments I have seen in my 30 year career in mining “

#5 The Next Gold Rush

Remember those nuggets they found atKobada? That’s only the beginning.

West Africa could be about to become one ofthe world’s biggest gold mining hubs…and AGG hopes to break out of the Birmianand realize gains worth billions.

While some mines are fine digging uppowder, AGG (TSX:AGG.V, OTCMKTS:AGGFF) has turned up huge nuggets worth hundredsof thousands—proof that the company might be under-estimating Kobada’spotential.

And investors are starting to take note.

Gold prices are climbing. Big gold minersare snapping up smaller companies, and AGG could be next.

The VanEck Vectors Junior Gold Miners ETF, one of the most popular small-capmining ETF’s, has gone up 50% in the last 2 months.

FIRST, the price of gold won’t likely stayput for long. It’s been trending upward for months, and could go even higher.

StanBharti, the new chief of AGG, thinks it’ll hit $2000/oz.

SECOND, the company knows the real potentialof the Kobada mine…2.2million ounces, worth as much as $3 billion, or more than $4 billion if theprice goes up.

But that could just be the beginning. Withaccommodations for crew 95% complete and workers drilling around the clock toreach the December 12 completion date, AGG is sprinting towards the finishline.

As Pope & Company noted, "The gold at the Kobada deposit is coarse and nuggety, which means thecontained gold content is often under estimated."

This little $23 million marketcap company with its billion dollar mine in Mali could see a colossal surgeof investor interest…and it could all happen in the next few weeks, beforecompletion on December 12.

Investors who want a piece of this action will have to act fast…

By. Ian Jenkins

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Oilprice.com, AdvancedMedia Solutions Ltd, and their owners, managers, employees, and assigns(collectively “the Publisher”) is often paid by one or more of the profiledcompanies or a third party to disseminate these types of communications. Inthis case, the Publisher has been compensated by 2227929 Ontario Inc. toconduct investor awareness advertising and marketing concerning African GoldGroup. Inc.2227929 Ontario Inc. paid the Publisher fifty thousand US dollars toproduce and disseminate this and other similar articles and certain banner ads.This compensation should be viewed as a major conflict with our ability to beunbiased.

Readers should beware that third parties,profiled companies, and/or their affiliates may liquidate shares of theprofiled companies at any time, including at or near the time you receive thiscommunication, which has the potential to hurt share prices. Frequentlycompanies profiled in our articles experience a large increase in volume andshare price during the course of investor awareness marketing, which often endsas soon as the investor awareness marketing ceases. The investor awarenessmarketing may be as brief as one day, after which a large decrease in volumeand share price may likely occur.

This communication is not, and should notbe construed to be, an offer to sell or a solicitation of an offer to buy anysecurity. Neither this communication nor the Publisher purport to provide acomplete analysis of any company or its financial position. The Publisher isnot, and does not purport to be, a broker-dealer or registered investmentadviser. This communication is not, and should not be construed to be,personalized investment advice directed to or appropriate for any particularinvestor. Any investment should be made only after consulting a professionalinvestment advisor and only after reviewing the financial statements and otherpertinent corporate information about the company. Further, readers are advisedto read and carefully consider the Risk Factors identified and discussed in theadvertised company’s SEC, SEDAR and/or other government filings. Investing insecurities, particularly microcap securities, is speculative and carries a highdegree of risk. Past performance does not guarantee future results. Thiscommunication is based on information generally available to the public, anddoes not contain any material, non-public information. The information on whichit is based is believed to be reliable. Nevertheless, the Publisher cannotguarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.comowns shares and/or stock options of the featured companies and therefore has anadditional incentive to see the featured companies’ stock perform well. Theowner of Oilprice.com has no present intention to sell any of the issuer’ssecurities in the near future but does not undertake any obligation to notifythe market when it decides to buy or sell shares of the issuer in the market.The owner of Oilprice.com will be buying and selling shares of the featuredcompany for its own profit. This is why we stress that you conduct extensivedue diligence as well as seek the advice of your financial advisor or aregistered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. Thispublication contains forward-looking statements, including statements regardingexpected continual growth of the featured companies and/or industry. ThePublisher notes that statements contained herein that look forward in time,which include everything other than historical information, involve risks anduncertainties that may affect the companies’ actual results of operations.Factors that could cause actual results to differ include, but are not limitedto, changing governmental laws and policies, the success of the company’s goldexploration and extraction activities, the size and growth of the market forthe companies’ products and services, the companies’ ability to fund itscapital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. Byreading this communication, you acknowledge that you have read and understandthis disclaimer, and further that to the greatest extent permitted under law,you release the Publisher, its affiliates, assigns and successors from any andall liability, damages, and injury from this communication. You further warrantthat you are solely responsible for any financial outcome that may come fromyour investment decisions.

TERMS OF USE. By reading this communicationyou agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditionsIf you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions,please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is thePublisher’s trademark. All other trademarks used in this communication are theproperty of their respective trademark holders. The Publisher is notaffiliated, connected, or associated with, and is not sponsored, approved, ororiginated by, the trademark holders unless otherwise stated. No claim is madeby the Publisher to any rights in any third-party trademarks

OilPrice.com Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.