The one copper price vs China chart you want to see today

It's only 12 January and the copper price is down 8% year to date.

March futures in New York dropped to $1.9525 a pound (just over $4,300 a tonne) early on Tuesday and by the close on the Comex continued to languish at levels last seen March 2009.

For a sustained period below $2 you have to go back a decade at the early days of the China-induced supercycle.

China is responsible for nearly half of global metals demand and its slowing economy is at the heart of not just the commodities sell-off but the rout on global stock markets as well.

Given the extent of fear in the market few are factoring in industry fundamentals, but it's worth remembering just what a different beast China is today versus a decade ago.

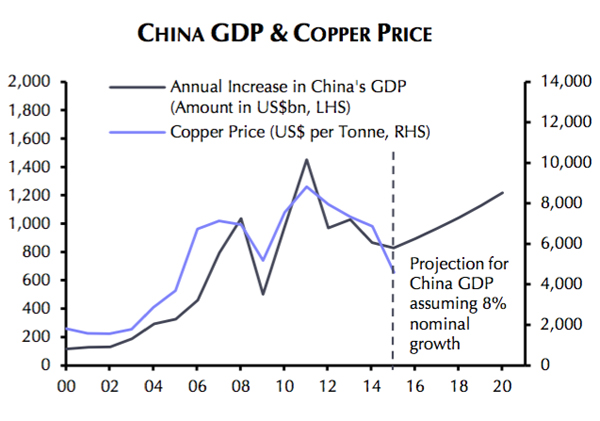

And with copper so closely tied to the country's economy the chart below should give metal bulls some hope.

China's economic expansion is expected to slow to its lowest level since 1990, but measured in billions of dollars Chinese gross domestic product growth paints a totally different picture.

Source: Capital Economics

The country would be adding some $800 billion to GDP (and that's excluding Hong Kong) this year and over $1 trillion by the end of the decade.

That's greater than the size of mainland China's entire economy in 1994, when growth rates peaked at a stunning 30% year-on-year. $800 billion is also bigger than Switzerland's economy and worth almost 2 South Africas and 4 New Zealands.

Caroline Bain of Capital Economics says the chart suggests that a plausible rate of Chinese economic growth from here (8% nominal, or 6% real plus 2% inflation) "would be consistent with some recovery in copper prices, even if growth is less commodity-intensive."

The house view at Capital Economics for the copper price is one of the more bullish predictions: $6,000 a tonne ($2.72 a pound) at the end the year. And as Bain points out this may be an ambitious target, but don't forget the red metal peaked at $4.50 just five short years ago.