The Recovery: Next on the Horizon

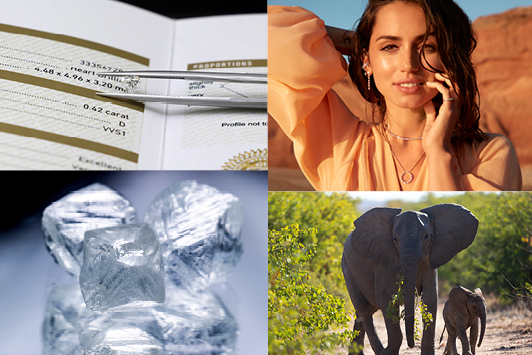

Having adjusted to the major changes that occurred in 2020, the diamond trade is in an unusual position this year. The market has diverged into two streams: those centers where the economy is open again, and those still facing sporadic outbreaks of the coronavirus.Overall, the trade continues to benefit from the Covid-19 dynamic, as consumers are not yet spending on travel and experiences the way they used to. They're saving more, which leaves more dollars to spend on diamonds and other luxury items. But travel will return, and competition for discretionary spending will heat up again. For now, the important consumer markets in the US and China are seeing a robust recovery in jewelry sales. At the same time, there is still a bottleneck of supply in India, the main polished-diamond distribution center. That makes for a complicated and volatile market with supply and demand trends that are difficult to predict. Meanwhile, other dynamics are influencing the trade as well, requiring it to adjust to a new reality.As we pass the halfway point of 2021, we have identified five themes that will characterize the market in the second half of the year and likely exert influence in the long term. 1. The GIA BottleneckAll eyes are on the Gemological Institute of America (GIA) and its progress getting through the backlog of goods lined up for grading at its India labs. As of press time on July 20, there was a turnaround time of over four weeks in Mumbai and Surat, according to the GIA website. The institute attributes the delays to a significant rise in demand for laboratory services."The increased sales in the US and China are driving much of this demand for GIA reports," it told Rapaport Magazine in a recent email. "Online sales are up significantly and are dependent on trusted, independent grading reports."Indeed, the GIA says it's grading more diamonds in India than before the pandemic. The number of stones it has graded in Mumbai and Surat this year, based on a weekly average, is up 37% from 2019 and 31% from 2020. However, the labs' average weekly intake is 71% higher than in 2019, the institute says, and this makes it hard to catch up. "In all locations, we are working six days a week in multiple shifts at the maximum allowable capacity to meet demand for our services as best we can," the GIA states.2. Variations in supplyUncertainty remains as to whether there will be a sudden influx of goods when the GIA backlog diminishes, a scenario that could push prices down. However, Elliot Krischer, president of the New York Diamond Dealers Club (DDC), believes manufacturers will still maintain their polished prices if such an influx occurs, as they want to protect their margins against the current high cost of rough. The release of the GIA goods will also likely coincide with an uptick in demand as jewelers prepare for the holiday season, but even with that recovery, the trade can expect rough supply to stabilize below pre-pandemic levels. The mining companies are leading a drive toward a more efficient supply chain, which means offering their clients fewer but more targeted goods.3. Economic factorsThe US recovery owes much to the government stimulus checks that have boosted consumer sentiment. Add those to the money the average mid- to high-income household was able to save during the pandemic, plus the wealth that resulted from the stock market's rebound, and Americans eager to get back to shopping now have money to spend on discretionary items. Still, this boom will not last. The threat of the pandemic will dissipate - along with the savings - and normality will return to the market. There are growing concerns about inflation and an already weakening dollar. To combat this, the Federal Reserve is slated to raise interest rates in 2023 - a move that typically reduces the amount of money circulating, since loans become more expensive to take out. Higher interest rates also tend to boost investor demand for dollar-based assets, as they can get a higher yield with their money in the bank. For now, the weaker dollar benefits foreign dealers and manufacturers who buy and sell with the greenback, as it leaves them with more of their domestic currency to cover local expenses.4. EnvironmentalfocusSustainability has become a central theme for the diamond and jewelry market. Consumers are demonstrating a growing preference for products and companies that care about the planet. Guided by the United Nations' Sustainable Development Goals (SDGs), the industry has made a concerted effort to ensure it contributes positively to society. It has developed various traceability programs to assure consumers that their diamonds have done no harm on their journey through the supply chain. In the past, these efforts would most often come in response to claims about conflict diamonds or human-rights abuses. Thankfully, the sector is now taking a broader and more proactive approach. Environmental issues have surfaced as a core talking point in public relations. Mining companies are showcasing their contributions to conservation projects, and more entities have set goals to achieve net-zero carbon emissions over the next decade. Negative claims about the environmental impact of mining have also sparked a wider acceptance of lab-grown diamonds - though whether they're actually greener than natural ones remains a bone of contention. Still, the industry is increasingly investing in these issues not simply to refute claims, but because it is the right thing to do.5. Marketing campaignsAfter over a decade of little to no investment in diamond category marketing, the industry launched the Natural Diamond Council (NDC) in June 2020 to replace the Diamond Producers Association (DPA). With former watch-branding expert David Kellie at the helm, the organization changed tracks to focus on content, driving traffic to its Only Natural Diamonds website and upping its engagement on social media channels. Funded by seven leading miners, the NDC is also partnering with retailers to help them attract customers to their stores and increase consumer interest in diamonds. At the same time, it's continuing to release ads via traditional channels like print and TV. The council has already filmed its holiday advertising campaign, which will feature actress Ana de Armas (pictured) as the NDC ambassador for the second consecutive year. The campaign is set to launch in mid-September, coinciding with the October release of the new James Bond movie, No Time to Die, in which de Armas stars.This article first appeared in the July 2021 issue of Rapaport Magazine.

Having adjusted to the major changes that occurred in 2020, the diamond trade is in an unusual position this year. The market has diverged into two streams: those centers where the economy is open again, and those still facing sporadic outbreaks of the coronavirus.Overall, the trade continues to benefit from the Covid-19 dynamic, as consumers are not yet spending on travel and experiences the way they used to. They're saving more, which leaves more dollars to spend on diamonds and other luxury items. But travel will return, and competition for discretionary spending will heat up again. For now, the important consumer markets in the US and China are seeing a robust recovery in jewelry sales. At the same time, there is still a bottleneck of supply in India, the main polished-diamond distribution center. That makes for a complicated and volatile market with supply and demand trends that are difficult to predict. Meanwhile, other dynamics are influencing the trade as well, requiring it to adjust to a new reality.As we pass the halfway point of 2021, we have identified five themes that will characterize the market in the second half of the year and likely exert influence in the long term. 1. The GIA BottleneckAll eyes are on the Gemological Institute of America (GIA) and its progress getting through the backlog of goods lined up for grading at its India labs. As of press time on July 20, there was a turnaround time of over four weeks in Mumbai and Surat, according to the GIA website. The institute attributes the delays to a significant rise in demand for laboratory services."The increased sales in the US and China are driving much of this demand for GIA reports," it told Rapaport Magazine in a recent email. "Online sales are up significantly and are dependent on trusted, independent grading reports."Indeed, the GIA says it's grading more diamonds in India than before the pandemic. The number of stones it has graded in Mumbai and Surat this year, based on a weekly average, is up 37% from 2019 and 31% from 2020. However, the labs' average weekly intake is 71% higher than in 2019, the institute says, and this makes it hard to catch up. "In all locations, we are working six days a week in multiple shifts at the maximum allowable capacity to meet demand for our services as best we can," the GIA states.2. Variations in supplyUncertainty remains as to whether there will be a sudden influx of goods when the GIA backlog diminishes, a scenario that could push prices down. However, Elliot Krischer, president of the New York Diamond Dealers Club (DDC), believes manufacturers will still maintain their polished prices if such an influx occurs, as they want to protect their margins against the current high cost of rough. The release of the GIA goods will also likely coincide with an uptick in demand as jewelers prepare for the holiday season, but even with that recovery, the trade can expect rough supply to stabilize below pre-pandemic levels. The mining companies are leading a drive toward a more efficient supply chain, which means offering their clients fewer but more targeted goods.3. Economic factorsThe US recovery owes much to the government stimulus checks that have boosted consumer sentiment. Add those to the money the average mid- to high-income household was able to save during the pandemic, plus the wealth that resulted from the stock market's rebound, and Americans eager to get back to shopping now have money to spend on discretionary items. Still, this boom will not last. The threat of the pandemic will dissipate - along with the savings - and normality will return to the market. There are growing concerns about inflation and an already weakening dollar. To combat this, the Federal Reserve is slated to raise interest rates in 2023 - a move that typically reduces the amount of money circulating, since loans become more expensive to take out. Higher interest rates also tend to boost investor demand for dollar-based assets, as they can get a higher yield with their money in the bank. For now, the weaker dollar benefits foreign dealers and manufacturers who buy and sell with the greenback, as it leaves them with more of their domestic currency to cover local expenses.4. EnvironmentalfocusSustainability has become a central theme for the diamond and jewelry market. Consumers are demonstrating a growing preference for products and companies that care about the planet. Guided by the United Nations' Sustainable Development Goals (SDGs), the industry has made a concerted effort to ensure it contributes positively to society. It has developed various traceability programs to assure consumers that their diamonds have done no harm on their journey through the supply chain. In the past, these efforts would most often come in response to claims about conflict diamonds or human-rights abuses. Thankfully, the sector is now taking a broader and more proactive approach. Environmental issues have surfaced as a core talking point in public relations. Mining companies are showcasing their contributions to conservation projects, and more entities have set goals to achieve net-zero carbon emissions over the next decade. Negative claims about the environmental impact of mining have also sparked a wider acceptance of lab-grown diamonds - though whether they're actually greener than natural ones remains a bone of contention. Still, the industry is increasingly investing in these issues not simply to refute claims, but because it is the right thing to do.5. Marketing campaignsAfter over a decade of little to no investment in diamond category marketing, the industry launched the Natural Diamond Council (NDC) in June 2020 to replace the Diamond Producers Association (DPA). With former watch-branding expert David Kellie at the helm, the organization changed tracks to focus on content, driving traffic to its Only Natural Diamonds website and upping its engagement on social media channels. Funded by seven leading miners, the NDC is also partnering with retailers to help them attract customers to their stores and increase consumer interest in diamonds. At the same time, it's continuing to release ads via traditional channels like print and TV. The council has already filmed its holiday advertising campaign, which will feature actress Ana de Armas (pictured) as the NDC ambassador for the second consecutive year. The campaign is set to launch in mid-September, coinciding with the October release of the new James Bond movie, No Time to Die, in which de Armas stars.This article first appeared in the July 2021 issue of Rapaport Magazine.