The S&P Is Doing This for the First Time in Years

It's no secret the stock market has cooled off recently, as traders fret about tax reform, corporate earnings, and General Electric (GE). In fact, at its session low today, the S&P 500 Index (SPX) was trading south of its 20-day moving average. The last time the SPX ended below this trendline was Aug. 30, meaning it hasn't been breached for 52 trading days -- the longest streak in years. Below, we take a look at what the stock market might expect if the SPX closes beneath its 20-day moving average soon.

The last time the S&P went at least two straight months (42 trading days) above its 20-day moving average was in 2012, according to Schaeffer's Senior Quantitative Analyst Rocky White. In fact, this feat has occurred just four times during the current bull market (since 2009), and 41 times since 1932. The longest streak ever was 101 days and ended in April 1964, and the longest stretch in recent history was during the dot-com boom, at 76 days in 1997. Below are the last 20 times the SPX went at least 42 days above the 20-day, and how the index performed after finally closing below the trendline.

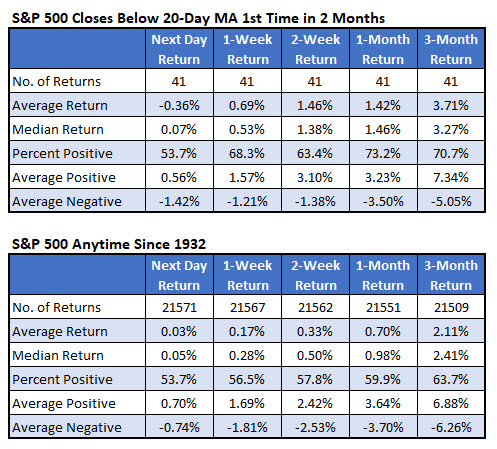

Once the SPX gives up its seat atop the 20-day after at least two months above it, stocks have tended to rebound with a vengeance. The index averages a next-day loss, compared to an average anytime one-day gain since 1932, but was up 0.69% on average a week later. That's more than four times the S&P's average anytime one-week return.

Two weeks later, the SPX was up an impressive 1.46%, on average -- also more than four times its average anytime two-week gain of just 0.33%. A month later, the index was higher 1.42%, on average, and was in the black 73.2% of the time. That's compared to an average anytime one-month gain of 0.7%, with a win rate of less than 60%. And three months later, the S&P was higher by 3.71%, on average, compared to 2.11% anytime.

So, if past is prologue, investors shouldn't fret a breach of the 20-day by the SPX, as it seems Wall Street tends to view these dips as collective buying opportunities. From current levels, another 3.71% rally for the broad-market barometer over the next three months would place the S&P around 2,675 -- deep into uncharted territory.